What Will Happen to Your Mobile Wallets if You Don’t Complete Your KYC?

The new move from RBI seeks to prevent any type of online fraud and money laundering.

With the RBI-KYC deadline already passed, users and wallet companies are in a dilemma over what is going to happen in the coming days. Several users are facing issues in transacting through their e-wallets, and Reserve Bank of India (RBI) has straightaway denied any extension to the deadline for completing the ‘KYC’ process.

The mobile wallet users of Paytm, MobiKwik, Freecharge, Amazon Pay, PhonePe, OLA Money and others will not be able to use their e-wallets to transact from now if the KYC is incomplete. As per the new RBI guidelines, the digital wallets need to have the ‘Know Your Customer’ done for their users.

The new RBI-KYC deadline is over and if you haven’t completed your KYC for your digital wallets, you will keep getting error messages and reminders from now on.

Contents

Why The Government Wants KYC For Mobile Wallets?

The new move from RBI seeks to prevent any type of online fraud and money laundering, identity theft and aims to make financial systems safer.

As per the new guidelines, it’s mandatory that all prepaid card providers should have the minimum Know Your Customer (KYC) details for all its users. Without the KYC details, users cannot use the complete functionalities of the digital wallet app.

What Will Happen If You Don’t Do Your KYC?

As per the RBI guidelines, wallets of the non-KYC verified users will be restricted from adding money into their Wallet and won’t be able to send any money to anyone (either from wallets or Bank Accounts). Non-KYC users will not be eligible for any offers applicable to the KYC customers.

But such customers may be able to do other transactions like recharges, utility bill payments, paying for movie tickets, travel bookings and payments at stores or payments at other apps and websites like Swiggy, Uber, Big Basket, BookMyShow and more.

However, only the KYC users will be able to transfer their money to each other using e-wallets and send money from their wallets to bank accounts.

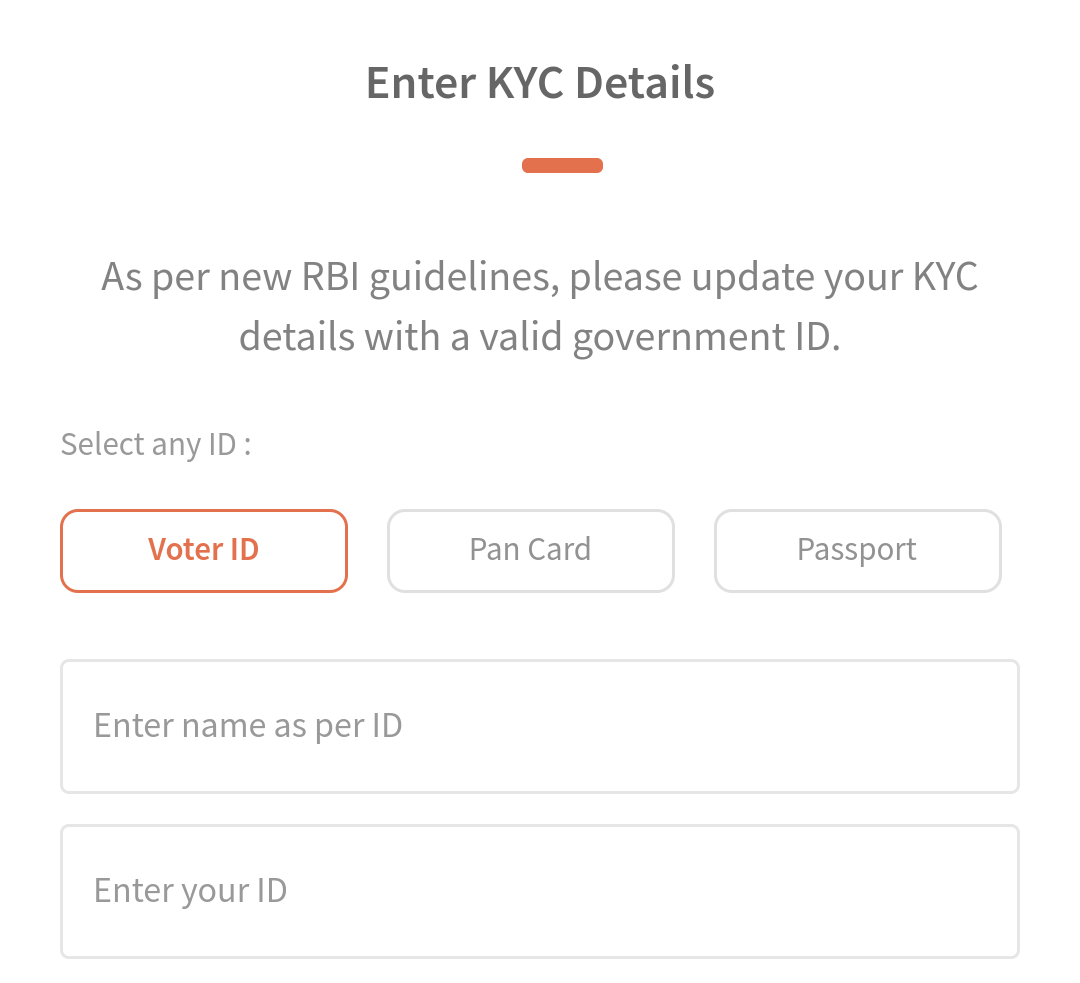

Which Documents Are Valid For KYC?

Among the official valid documents (OVD) approved by RBI, it includes the Passport, Driving Licence, Permanent Account Number (PAN) card, Aadhaar Card and Voter ID Card issued by the Election Commission of India.

Wallets will also accept Job Cards issued by NREGA and duly signed by an officer of the State Government. Customers can submit any one of the six OVDs for proof of their identity and address for their KYC process.

How To Complete Your KYC?

Once you open any e-wallet app, they are showing pop-ups or have a permanent window with an option to update your KYC. The KYC for all the digital wallets can be done instantly with the minimum KYC details.

You can get your KYC done with your Aadhaar details in digital wallet apps, and also schedule a home appointment to verify your documents and complete your KYC.

Users can become a minimum-KYC customer by providing their official valid document ID number (like Aadhaar and PAN). But users will still not be able to send money other wallets or bank account or keep more than Rs. 10,000 in their wallets. Within 12 months of the minimum KYC details, users need to get their full KYC done.

As per the RBI guidelines, users will not be able to receive any cashback if their KYC is not done, but Paytm has said that all Paytm users will continue to get cash back in their accounts, irrespective of their KYC status. Though, non-KYC users will not be able to transfer their money to their bank accounts or to any other Paytm user.

Paytm has also launched Paytm Partner initiative which enables people to earn money by onboarding new and existing Paytm customers by completing their KYC. The Paytm Partners will also get opportunities to sell their products, services and earn commissions in the future!

Do we need to verify only with aadhar??