Updated: New US Immigration Bill Threatens To Disrupt Indian IT Business Model [Analysis]

[box type=”shadow” ]Updated: The much awaited Immigration Bill has been passed by the Senate on Thursday by a vote of 68-32, with 14 of the Senate’s 46 Republicans joining all 52 Democrats and two independents in support of the bill. However, there are some procedural hurdles that need to be cleared yet.

Here is the article we wrote few days back, that analyses how new Immigration bill threatens to disrupt Indian IT Business Model.[/box]

Earlier…

——

All eyes will be on America’s highest ranking diplomat John Kerry when he lands in India on the 24th of June. He plans to conduct the 4th Indo-US Strategic Dialog, which is aimed at working out ways for greater cooperation in wide ranging fields that concern both countries – civilian nuclear cooperation, education, science and technology.

Indian IT service providers will be closely watching the outcome of Mr Kerry’s visit, given the fact that they depend on the US for a large chunk of their revenues.

Mr Kerry’s visit is scheduled soon after a new bill for immigration reform was introduced in the US Senate. When the Immigration bill turns into law, before it brings about its primary aim of improving the American job scene and raising the bar for talent there, it is likely to present serious challenges for Indian IT companies.

Gartner has recently presented insights to help decision makers know what to expect.

Contents

The Background to the Legislation

The full title of the proposed bill is “Border Security, Economic Opportunity, and Immigration Modernization Act”.

The bill was introduced by Senator Charles Schumer in the US Senate during mid-April in 2013.

Sandra Notardonato, Research VP and Invest Analyst at Gartner cautions that the bill in its present form still has to go through several iterations until it is finally passed, with the result that current assumptions may significantly change.

However, both buyers and vendors are strongly recommended by Gartner to consider the current language of the bill in preparing themselves well in advance before the new law comes into effect.

This bill has several provisions to reform legislation on temporary visas.

Thanks to a bi-partisan support and a Democratic majority in the Senate that favors the bill, experts think there is a 50% chance of the bill making it through the Senate.

Republicans have a majority in the House of Representatives, and are expected to concentrate on individual components of the bill which may garner them enough support and ultimately passage of the bill.

The dismal state of the US economy is on the minds of many Americans; some might think this is their chance to witness a job-creation boost in the IT sector, even if it will be manifest over a long term.

But what about the effects of the bill on the Indian IT companies, which have reason to be immediately concerned?

Ms Notardonato points out that the aspects of the bill that are most disruptive to Indian firms are the outplacement restrictions, increased visa fees, limits of the number of new visa applications and government-mandated salary-increases based on a more condensed wage system.

Any company with more than 15% of its workforce in the US on temporary visas would be considered visa-dependent. The bill proposes that an H1-B dependent employer “may not place, outsource, lease or otherwise contract for services or placement of an H1-B non-immigrant employee”.

This provision suggests that employees in the US on H1-B’s cannot work at a client’s site, but it does not restrict work from global delivery centers.

It is not clear how much the first key aspect affecting Indian firms would hit ongoing projects.

Most India-centric IT service providers in the US are likely to be deemed visa-dependent. If this bill in its current state turns into a law, it could turn out to be a significant hindrance for them if they cannot comply within the set deadlines.

Even though the change in the on-site client engagement scene would result in displacement of many professionals, the bill is silent about the shortage of available talent in the US that is supposed to compensate for this.

Employers are mandated to have at least 25% of their staff as US hires by 2014, and up to 50% in the two years that follow. The challenge here, again, is the shortage of US talent in IT.

With increased demand for local US talent and no change in the shortage of IT skill supply, this imbalance would result in an increase in bill rates to the buyer community – this is one of the unintended consequences of the bill.

Furthermore, the cost per petition for H1-B’s would increase by $5,000. A portion of the greater fees for visas would ultimately have to be shouldered by the buyers.

Timeline of the Bill

- 21st May, 2013: Senate Judiciary Committee clears bill for discussion

- 10th June, 2013: Debate begins in Senate, with one member of the Gang of Eight pulling out of the discussion.

- 24th June, 2013: US Secretary of State John Kerry is scheduled to travel to India. We can hope for some compromise in the bill’s current wordings, following this visit.

- 30th June, 2013: Senate vote is expected on the bill

- July/August 2013: Subject to passing of the bill in the Senate, the bill will proceed to the House of Representatives.

- October to December 2013: The bill could be on its way to become law during the early part of 2014.

Revenue of Top India-centric Providers

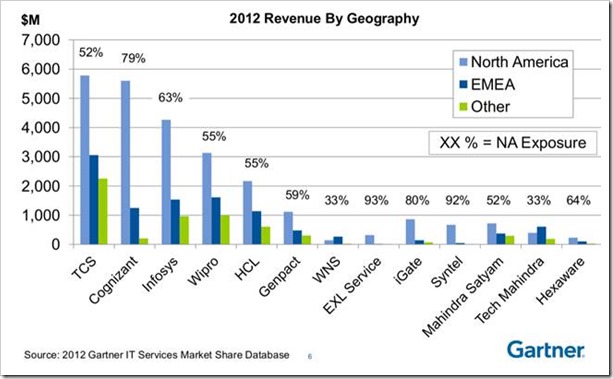

As you can see in the chart below, majority of the revenue of top Indian IT service providers comes from North America. The United States faces the highest risk exposure since most of North America’s revenue emerges from there.

What should Visa Dependent Vendors do?

It is evident from Gartner’s research that the companies facing the highest risks will need to carry out these actions:

- Invest in hiring and training more locals in the US.

- Increase the volumes of offshoring.

- Make acquisitions of US based companies to meet visa requirements.

- Use a more diversified global delivery model.

- Introduce more technology-based solutions, including those for remote work.

One of Gartner’s conclusions is that if the bill is passed, a major recalibration is expected to offshore providers’ staffing models and how IT services are delivered.

Additionally, not all companies are going to be able to execute through this major change to the operating models due to investment constraints and management awareness issues.

Implications of the bill

The cost to buyers is likely to rise; about 15 vendors who were interviewed by Gartner agreed with this belief.

Gartner reminds listeners about how the burden of foreign exchange fluctuations between the US dollar and Indian rupee was borne by vendors several years ago, and budget adjustments made midway through projects. A similar situation could arise with the introduction of this new law. Some vendors may not be as quick as others to adjust to the new environment.

Gartner warns about a “crisis of confidence” all along, as vendors attempt to adapt to the legislation. The analytics firm calls for gearing up for better change management.

“In the past, cascading certain communications, or more importantly setting expectations with constituencies, hasn’t always been the hallmark of Indian IT providers”, says Frances Karamouzis, Vice President and Distinguished Analyst at Gartner’s Research Advisory Group.

The Macro Changes from the Bill

The 15% litmus test on outplacement restrictions is expected to prove unsustainable.

“It is very, very difficult to see how some of this work will get done and how this will implemented, so the big question is what is the phasing period”, says Ms Karamouzis.

Ms Karamouzis also talks about a “talent famine” resulting from the new law. At present, the unemployment rate for science, technology, engineering and math (STEM) in the US stands at 3.3%. Since unemployment rates of 3% are considered “full employment” by economists, constraints for talent are expected to be witnessed in the US.

Even for American companies like IBM and Accenture that have a greater proportion of US employees and are non visa-dependent, there is a possibility of a talent war being set off to absorb US residents or green-card holders.

Currently, the average ratio of offshore to onsite work stands at 70-30. The law may result in pushing this ratio to 80% or higher, causing companies to come up with innovative approaches like remote work or automation to deal with the situation.

If that indeed happens, in the US, some of the work that is done remotely or automated may not result in jobs ever coming back to the US. One of the key purposes of the bill, that of creating more jobs in the US, would therefore be defeated.

There is also a possible reverse scenario, in which the US may have to figure out how to boost the local talent pool of knowledge workers by addressing education-related issues.

“These two scenarios juxtapose the difference between what Microsoft and Facebook are saying versus what some of the Indian vendors are saying. Both of those companies use H1-B visas, but they use them in very different ways”, explains Ms Karamouzis.

Those into R & D are bringing in highly-skilled workers on H1-B visas, while companies into enterprise work that Indian vendors carry out, typically involve bringing in lesser skilled people on H1-B visas to do on-site work and then having them go back to India.

So, how global are India-centric vendors?

Most such vendors have 80-90% of their employees of Indian heritage. Now, they will have to employ more US-based employees for operations in the US. Ultimately, it is going to force them to become more global in their workforce.

Gartner was refused precise statistics by companies about how many of their employees were on H1-B’s and how many were local hires. If the law has to be enforced, it will change the scene, bringing about more transparency in HR practices and wage raises linked to the situation.

Ms Karamouzis predicts that a more higher-end set of workers will be imported through the H1-B visas as a consequence of this bill turning into a law.

Gartner’s Suggested Action Items for Buyers

Ms Karamouzis advises buyers to initiate serious conversations with service providers to assess what is going to happen.

Prior to these conversations, buyers should call for clear indications of vendors’ exposure level and how they plan to pass the 15% litmus test, with focus on data from the last 3 years.

Furthermore, vendors should be able to prove that have been preparing themselves in the run up to the introduction of the bill, for which talks have been building up over the last several years.

Another important point is that of contract clauses for ongoing negotiations or new contracts. Gartner advises against actions that may disrupt business, like rushing to sign contracts, but repeatedly stresses on the need for transparency to ascertain risk exposure.

“If vendors aren’t willing to disclose, then you really should proceed with caution”, says Ms Karamouzis.

A poignant example is given to highlight the importance of transparency – the Satyam scandal that broke out in 2009. When Ms Karamouzis contacted the clients of Satyam to talk about the subject, over 20 of the top 34 clients were unable to tell the number of H1-B professionals on their account, and were therefore unable to ascertain their risk exposure.

The US banks accounts of Satyam were frozen in the aftermath of the scandal, and most of these professionals were on a corporate credit card, complicating the situation triggered by the massive fraud.

Going by the current terms, if the bill turns into a law, how do you think will the Indian IT industry change? Are you optimistic about the impending visit of US Secretary of State John Kerry?

Your views are welcome.