Uber Posts Strongest Growth In Call Volume, But Ola Still #1; More Users Call Amazon Than Flipkart [Truecaller Insights]

For 2016’s last quarter, Truecaller has come up with yet another exciting report, which analyses where their users are calling, and which services they are choosing.

For 2016 Q4 analysis, Truecaller has focussed on two industries: App based Cab hailing services and e-commerce users.

And in both of these industries, Truecaller has discovered pretty interesting trends.

Uber Vs Ola

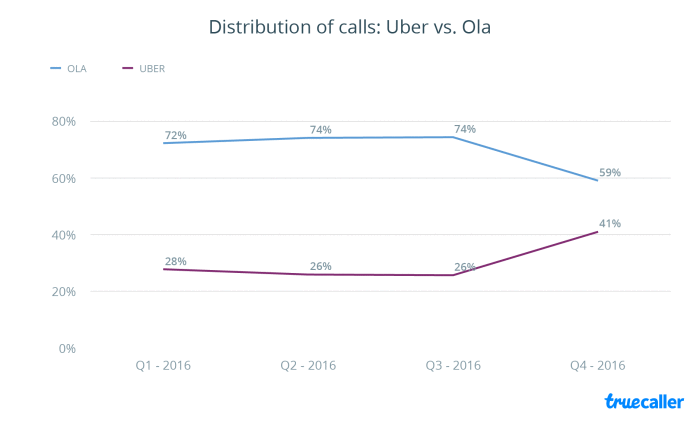

As per Truecaller insights, Ola is still #1 when it comes to a total number of calls made or received. This means compared to Uber, more users are calling Ola cabs or receiving calls from Ola drivers.

Having said that, Uber is catching up fast, and the margin is now very thin. For Q4 2016, Uber posted the fastest growth in call volumes, compared to Ola or any other cab hailing services.

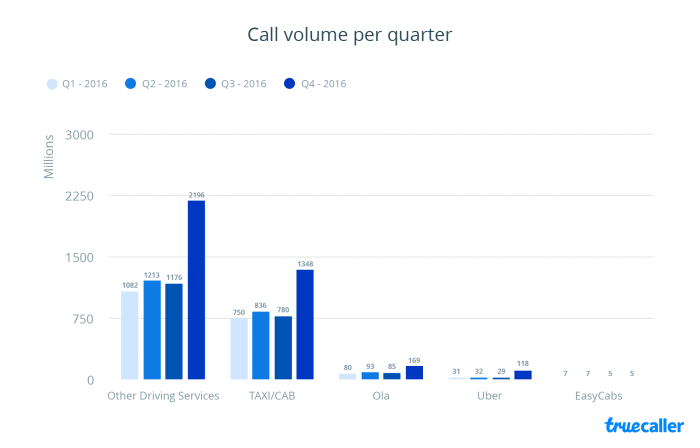

Overall, 42.6 million users made 3.83 billion calls to cab services, which includes Ola, Uber and other platforms as well. In Delhi, 4.3 million users made or received 577 million calls in three months, which means per user made 1.5 calls per day.

If we talk only about Uber vs Ola, then 59% of calls made or received by users belonged to Ola, while 41% belonged to Uber. 169 million calls were made or received by Ola users while 118 million calls were made or received by Uber users.

While Ola is #1 in Karnataka and Delhi, Uber is #1 in Mumbai.

Amazon Vs Flipkart

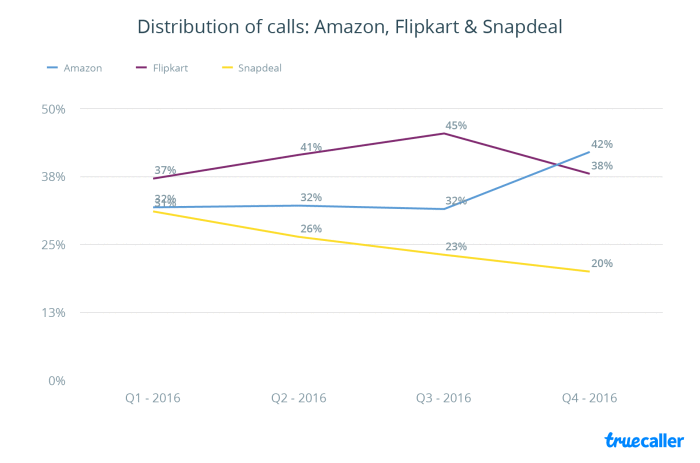

Overall, the e-commerce industry posted a robust growth in terms of call volume. Compared to 700 million calls in Q3 2016, 1.4 billion calls were made in Q4 of 2016, especially within e-commerce industry. A total of 36.4 million users made or received calls to e-commerce sector in Q4 of 2016.

While Snapdeal and Flipkart, both experienced reduction in calls volume, Amazon India continued to surge ahead, with excellent results.

Calls volume to Snapdeal decreased to 20%, and Flipkart’s reduced to 38% from 45% in Q3 2016.

At the same time, Amazon’s call volume increased to 42% from 32% in Q3, thereby indicating maximum growth.

Delhi has emerged as the region which uses e-commerce services the most in India. 3.9 million Delhi residents made or received massive 210 million calls to various e-commerce firms – which is 53 calls per user, in 3 months, which is highest in India.

But Andhra Pradesh is the #1 market for both Amazon and Flipkart.

Andhra Pradesh, Delhi and Karnataka are Flipkart’s top markets, while Andhra Pradesh, Karnataka and Delhi are Amazon’s top market.

You can find the entire report here.

Here is Truecaller’ Q3 2016 Insight report.