[Exclusive Interview] This Community Of Founders, Investors Attracted Rs 160 Crore Funding In 365 Days

Recently we interacted with CA Gaurav VK Singhvi, Co-Founder, We Founder Circle, and asked his vision and mission related to nurturing a community of entrepreneurs, and how they can help the startup ecosystem.

![[Exclusive Interview] This Community Of Founders, Investors Attracted Rs 160 Crore Funding In 365 Days](https://trak.in/wp-content/uploads/2022/11/Untitled-design-11.png)

Highlights from the interview:

Q.1 How many investments have WFC made in the first half of 2022 and how many do they plan to invest in 2022?

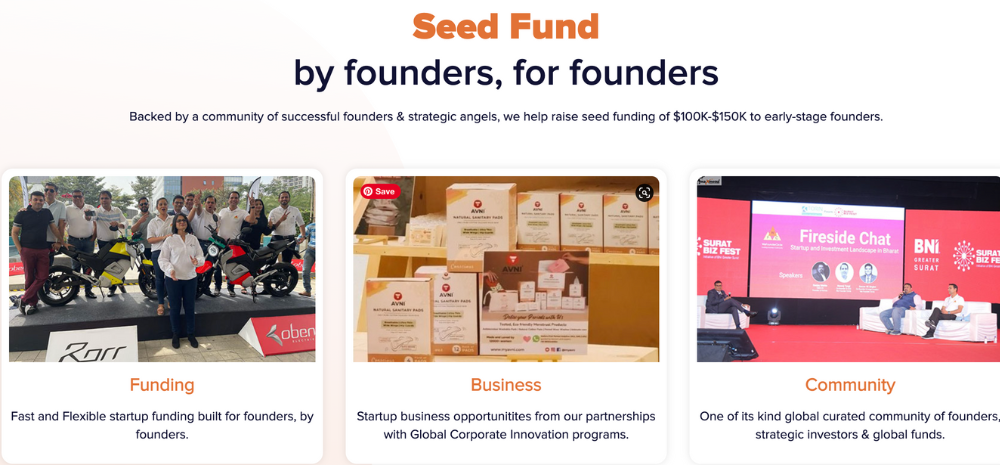

We Founder Circle, founded in 2020 in Mumbai, is a global community of successful founders and strategic angels who share a strong desire to propel the start-up industry forward. The platform successfully enabled USD 20 million in funds across 33 start-up investment deals in its first year of operation. The industry has recognized WFC’s efforts, as it has become India’s second-leading Angel Investor Network. To maximize growth opportunities even further, the brand intends to expand its network to 10,000 angels from India and abroad and desires to invest in 70 or more start-ups by the end of the fiscal year 2022-23.

Q.2 What do you see in a startup before investing?

Our methods for measuring, evaluating, and attempting to minimize market risk vary depending on the industry it invests. WFC conducts an in-depth analysis of the size of market opportunities, and most importantly, we see the motivation and idea behind running the startup. Irrespective of the risk involved in investing in new business, WFC seeks startups that can scale, become meaningful and contribute to society.

Q.3 What would be your advice to the budding entrepreneur who are going to raise their first round?

Even if the budding entrepreneur has the best business idea or the most compelling story, they may fall short of impressing investors if they do not have an elevator pitch ready. Spending time understanding how a narrative is built and presented is the first step to connecting with potential investors. Investors are always curious and want to ask questions, so having the market numbers to defend is important (solid numbers and projections demonstrate the financial value start-ups bring to the table). However, the most important takeaway from watching entrepreneurs pitch their businesses is their sheer belief in their business idea.

Q.4 What is the average ticket size of the investments?

In the inception year, WFC invested between USD 100K – USD500K in early-stage startups driven by ambition, sustainability, and a strategic approach. One year down the line, the marginal investment rate has risen to between USD 100K and USD 2M.

Q.5 How much money has been deployed in the investments made this year and how does WFC plan to spend this year?

We Founder Circle recently launched its 1st Global accelerator program EvolveX and the company applied to the Securities and Exchange Board of India (SEBI) to establish an Angel Fund. The fund’s size was approximately INR 200 crore (USD 26.8 MN as of September 2022).

Q.6 What do you think helped the brand steer to the position of second largest accelerator last year?

While many investors and venture capital firms are fixated just on funding and the desire for a return on investment (ROI). On the other hand, WFC follows the “beyond investment” philosophy, believing that working with an early-stage startup necessitates vigorous assistance in order for the company to grow, become scalable, and be stable. WFC takes a digital-first approach to incubating startups, allowing investors and partners from all over the world to invest in and partner with these startups. In addition, WFC covers all aspects of development, including business strategy, product development, community building, connecting with business mentors, and fundraising. This strategic approach propelled WFC to the position of second largest accelerator last year.

Q.7 What are your thoughts on the slowdown in funding this year?

This year, there is a clear impact of the funding winter across the world, and Indian startups are also feeling the impact of it. There are many factors that are contributing to the slowdown. This is exacerbated by global headwinds such as increasing interest rates, geopolitical tensions arising from the escalating Russia-Ukraine conflict, and rising crude oil prices. Investor caution is not bad, and as businesses and consumers adjust to the new normal, funding for new companies and larger rounds are more likely to emerge.

Q.8 According to you, what are the sectors to watch out for in the next 5 years?

Many WFC investors, motivated by the results of their investments in the fiscal year 2021, are willing to invest a large portion of their savings in India’s growing industries. EV, HealthTech, AutomobileTech, Fintech, EdTech, and Food/AgriTech will be the hottest sectors in 2022 and the next five years. Keeping this in mind, WFC is focusing on investing in start-ups in such sectors to assist them in growing and accelerating their business traction.

Comments are closed, but trackbacks and pingbacks are open.