6 Important Metrics You Must Track To Grow Your SaaS Startup

For startup founders, there are hundreds of metrics that one needs to track to see how their business is growing. But are all of these important? No. One should pick the most important metrics, which, according to the business owners means the most to them.

These are usually referred to as KPIs (Key Performance Indicators). For entrepreneurs who already have a lot to monitor on their plate, a gazillion metrics to track is not a likely thing. Let us see the must-concentrate metrics for a SaaS startup.

For a SaaS business, there are a few core metrics that you need to give your undivided attention to make your business flourish.

Contents

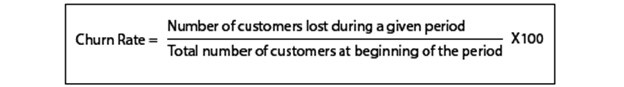

1. Churn rate:

Churn rate is the percentage of “total customers lost in period” divided by “Total customers at beginning of period”.

The number of clients who continue using your product, especially in a SaaS offering is what determines the success of the company. You need to analyze the main reason of your churn rate and the axes through which you and your team can fulfill customers’ needs and decrease churn rate. You will witness a high churn rate if there is something wrong with your product offering, improper marketing, and poor services. At this stage, growth team should implement new strategies in marketing to acquire new customers (Learn these 9 strategies to get new customers).

One should ask their customers the reason they stopped using your services. Was it poor customer service? Inherent problems with the product? What would make them come back to you? Also, talk to customers to understand their perspectives and ideas.

2. MRR

MRR = monthly recurring revenue

It is a measure of your predictable revenue stream. MRR is the key metric for any SaaS Startup to know how much better the company is doing than last month.

So how to calculate MRR?

Calculating your MRR may appear like a zigzag, however, I’ve simplified it with an example.

Take the sum of all of the subscription values from a given month and you will get MRR.

example: If you have 20 customers in your regular plan at $10 per month, and 10 customers in your Pro plan at $30 per month, your total MRR would be (20 x $10) + (10 x $30) = $500.

Reduction in MRR essentially means that you need to be on a war footing in adding new customers and reducing the inevitable churn rate.

You might have an amazing number to show for a month, but the question is, would it repeat itself in the coming months too? If you have a SaaS business, then this is the primary benchmark you should be targeting.

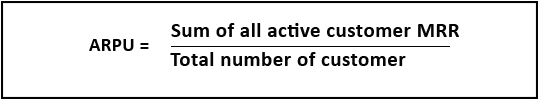

3. ARPU

To sum up ARPU in one sentence: it’s the “Average amount of monthly revenue per user”.

Abbreviated as Average Monthly Revenue per User, it is also sometimes referred to as ARPA (Average Revenue per Account). Measuring ARPU is a key factor to know how well your SaaS Company is actually doing, especially when breaking down the information by segment. The higher the ARPU for SaaS product, the better the chance of generating more money in the future. You cannot use the stock price usually offered when calculating this metric, discounts offered on a case by case basis, free trials offered, etc. will come into picture here.

How do you increase your ARPU? Provide more services, a service bundle or more features added to the existing service that adds value to your customers would be the best way to go about it. Indulging in up-sells and cross-sells will increase the revenue. An up-selling is persuading the customer to buy a higher priced product of yours while cross-selling is selling a different product of the company.

4. LTV

LTV = Lifetime Value of a customer

Lifetime Value (LTV) of a user is one of the most important metrics to evaluate, so that founders can know the direction of growth. LTV is the assumption that a typical customer pays you a similar amount every month over the course of a lifetime of his/her subscription. A SaaS business should take the average subscription length and multiply it with your average monthly revenue per customer along with mindful calculation of the support and acquisition costs.

An Increasing LTV means your company is doing well and has happy customers who will stick with you over a long time and as a result, you will get more money. But decreasing LTV means that your customers are not satisfied and there is a higher chances of losing them, as a result money will decrease.

5. CAC

CAC = Customer Acquisition Cost

Simply, It is the total cost to acquire a single customer. Divide all the expenses made including your sales and marketing expenses by the number of customers added for that month to arrive at the Customer Acquisition Cost.

It is very important to calculate CAC correctly for your SaaS product to optimize their sales & marketing funnel. Understanding and mastering the balanced relationship that CAC has with LTV. It is not surprising to see a high CAC when starting out on your business. But over time, it is desirable to see a comparatively lower CAC because you expect that by referrals and various other sources you would be able to reduce your marketing expenses.

Also, aim for a CAC that is lower than LTV because you need to make sure that the amount spent to acquire a customer is less than the value they provide. One-third should be the ratio of CAC over LTV. The sooner you can recover CAC, the better it is for your business. CAC divided by ARPU will give you the number of months it will take to get back the money put in to acquire a particular customer.

6. Retention

The health of any SaaS company is directly related to its retention strategies to prevent churn. It costs 6 to 7 times more to acquire a new customer than it does to keep a current client. That’s why retention cost is always lower than new customer acquisition.

Existing customers are where the big spending happens. According to Groove, there’s a 5-20% chance of selling to a new prospect. What about your existing customers? You have a 60-70% chance of a successful sale! [source]

Here are some customer retention strategies:

- Follow up on every interaction with the customer.

- Upsell

- Reassert your value proposition.

- Send targeted tips.

- Create a retention team.

- Don’t do unnecessary surveys.

- Follow your customers on social media.

Conclusion:

A close observation on the points mentioned will introduce you to the fact that all these metrics are closely connected. As referred to at the beginning of the article, hundreds of parameters could be closely monitored, but the above six are pivotal to the success of your SaaS-based startup. Once you are well versed with calculating metrics and have made sure that your business would be successful even if it were on auto-pilot, you should pay attention to metrics like retention, activation, product metabolism, viral coefficient, Funnel Conversion rates, etc. since it will provide a detailed report. If there are other metrics that you use to track your progress, let us know in the comments section. Remember, at the end of the day, data alone has no value. Only after proper analysis it will become useful for you to implement in business and make it better.

Author bio – Dhruv Patel is the Co-Founder at SalesHandy– A Data analytics and Communication tool. He likes tweeting about growth hacking, marketing tips, sales tips & SEO.