IIM-A Emerges As The Top Investor For Accelerator Programs Within Asia; IoT Beats Ecommerce In Attracting Investments

Fundacity, which connects investors with startups have released one of its kind report for accelerator programs active in Asia and Oceania which includes Australia, New Zealand and smaller islands in Pacific Ocean. Several interesting facts and trends have emerged from this report, which was basically created for tracking startup activities in Asian and Oceania countries for the year 2014.

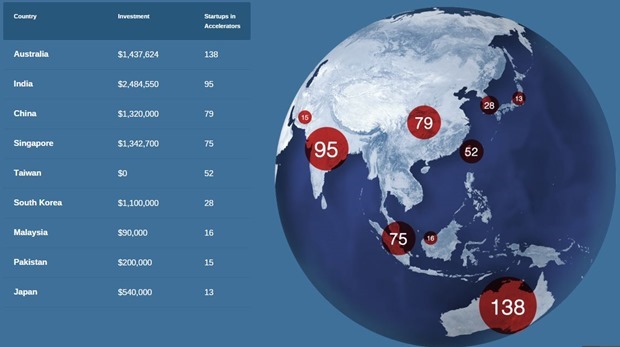

First, some figures related with India, which has emerged as #1 destination for startups in attracting investments indulged in accelerator programs. With total of $2.4 million in investments for 94 startups, India has beaten Australia in this race for receiving accelerator funds.

However, with total of 138 startups, Australia is #1 destination for startups in terms of absolute numbers. These 138 startups in Australia attracted $1.4 million in accelerator funds for expanding their ideas.

China is at #4 position with $1.32 million in investments, while Singapore is at #3 position with $1.34 million. Interestingly, Pakistan second last in this list, with total of $200,000 investment, just above Malaysia with $90,000.

If we talk about individual accelerators active in Asia and Oceania region, then IIM Ahmedabad’s Centre for Innovation Incubation and Entrepreneurship (CIIE) has emerged as the single largest accelerator which has provided maximum funding to young startups. With total of $1.19 million of funding, IIM is the #1 accelerator in this region.

GSF India has also found themselves mentioned in this exclusive list, as total of $500,000 was provided by them for startups, meanwhile Venture Nursery (which claims to be India’s first angel based accelerator) has provided $400,000 as total investments.

Some other prominent accelerators which have been mentioned in this report are:

- Hax from China (World’s 1st and largest hardware accelerator): $1 million

- BlueChilli from Australia: $800,000

- Primer Ventures from South Korea: $700,000

- Mistletoe from Japan: $540,000

- Joyful Frog Digital Incubator from Singapore: $500,000

- HaxAsia from Singapore: $500,000

- SparkLabs Global Venture from South Korea: $400,000

In the report, Fundacity has made a unique distinction between incubators and accelerators; which makes the report more interesting. As per them, there are 5 basic characteristics of an accelerator program, which is not found in an incubator: Application process is open and competitive; Pre-seed investment is given in exchange of equity; focus is on small teams and not individual founders; time limited support and classes or cohorts of startups, instead of individual companies.

Hence, as per this definition, accelerators in Asia and Oceania region provided total of $9.2 million as investments for new startups, which also include seed investment and angel funding.

Note here, that these numbers are for 2014, and by the time 2016 begins (in 36 hours from now..), this number would be exponentially increased.

Some other interesting highlights from this report:

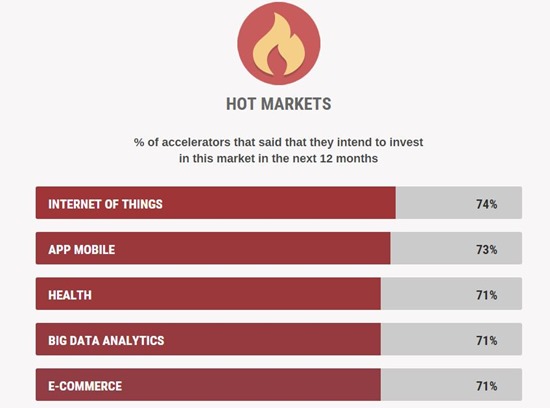

– Startups which are active in Internet of Things and Mobile apps are attracting maximum investments from accelerators. Among all the startups backed by accelerators in Asia and Oceania, 74% belong to Internet of Things (IoT) niche, while 73% are in the Apps niche. Health (71%); Big Data Analytics (71%); E-Commerce (71%) and Fintech (71%) are other hot niches.

– Traditional businesses such as Real Estate only attracted 18% of investments from accelerators, while Biotech was only able to lure 21% of investments.

– The report mentions that as the usage of gadgets and smartphones are increasing, the startups active in these niches are attracting maximum attention and funds

– AppWorks from Taiwan, which claims to be the largest accelerator program in Asia has funded in most number of startups (52); while Microsoft Ventures comes 2nd with 39 investments. IAccelerate from Australia is ranked #2 with 39 investments.

You can access the whole report here.