20% Of All Phones Sold Are Made In India; Ecommerce Accounts for 30% Of All Smartphone Sales In India

PM Modi’s Make in India campaign is giving rich dividends within 10 months of it’s launch. After creating 2.75 lakh new jobs, Make in India vision is driving mobile phones sales as well.

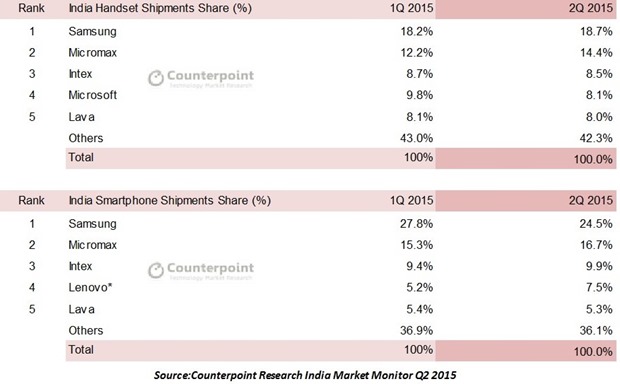

As per CounterPoint Research’s latest report for Q2 2015, 20% of all phones sold inside India were ‘Made in India’. With Micromax commanding 14.4% share and Lava 8% share in the overall handset market, this figure is poised to go up from here.

Overall, Samsung maintained it’s lead over other handset makers, with 18.7% market share in the overall phone market in India for Q2 2015, which is an increase of 0.5% compared to Q1 2015. Interestingly, Samsung’s best selling smartphone in India was Z1, which is not Android based but runs Samsung’s own Tizen OS.

Are we witnessing emergence of a new best selling OS here?

If we talk about smartphones, then ecommerce easily beats offline commerce in India.

30% of overall smartphone sales in India originated from ecommerce channels, with exclusive ‘online only’ strategy commanding 20% of all smartphones sold. Within this 20% share of ‘online only’ campaigns, Flipkart grabbed whooping 56% market share (the recently launched Moto G3 is available only on Flipkart)

Overall, smartphones resulted in 45% of all phones sold, with 4G LTE capable dominating the landscape. One of out of four smartphones sold in India are now 4G capable. This must be happy news for both Reliance Jio and Airtel who are aggressively pushing their 4G services in India right now.

Samsung remains the #1 smartphone vendor in India, with 24.5% share, which is 3.3% less compared to last quarter. Infact, Samsung’s S6 model was a bumper hit in India; as it outsold iPhone 6 by a ratio of 2:1.

Lenovo registered maximum growth in this segment, as it captured 7.5% share, compared to 5.2% last quarter. If we talk about only 4G enabled phones, then Lenovo was the 2nd biggest vendor, after Samsung. In 4G segment, Xiaomi was at #3 position.

Apple maintained their good run in India, as it achieved 1 million sales mark within 7 months (during this fiscal year), compared to 12 months it took last fiscal year.

As expected, feature phones registered the strongest downfall as sales reduced 19% year on year and 9% compared to Q1. Meanwhile smartphone sales increased 34% compared to last year and 25% compared to last quarter.

You can find more data pertaining to Indian phone market for Q2 2015 here.

Major Reshuffle In Chinese Phone Market

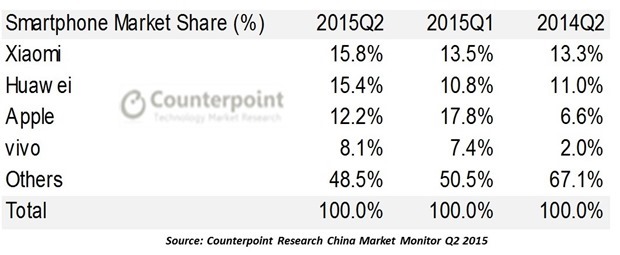

Meanwhile in China, the market received some major shock, as Xiaomi catapulted to #1 position with 15.8% share during Q2 of 2015. Huawei witnessed strong sales numbers, as it rose to #2 position with 15.4% market share. Apple had to be content with #3 rank as it managed to grab on 12.2% market share.

However, revenues of Apple in China continued to grow, as more and more Chinese middle class are adapting their devices. Compared to 2014 fiscal year, revenues of Apple in China increased by 112%, to reach $60 billion.

Another major reshuffling was observed as Vivo, an upcoming brand, replaced Samsung to snatch #4 position with 8.1% market share. This is for the first time that Samsung has slipped to #5 position. Vivo is causing a tsunami of sorts in China with incredible 250% growth compared to Q2 of 2014.

You can find more data about Chinese phone market for Q2 2015 here.

Most of the people are using smartphones since they are featured with latest apps and now recently every smart phones are 4G enabled that increases the sales in India.Brand matters the significance of a smartphone to buy/sell.