Yesterday IDC shared a very chilling reality: Indians are not buying tablets. Sales of tablet have dipped 32.8% during the first quarter of 2014, and this is a worrying trend for all manufacturers.

Earlier we had reported that PC sales in India have also started slow this year.

As per the latest research done by IDC, it has been revealed that Indians bought only 0.78 million tablets during the period January-March of 2014, compared to 1.1 million units during the same period in 2013.

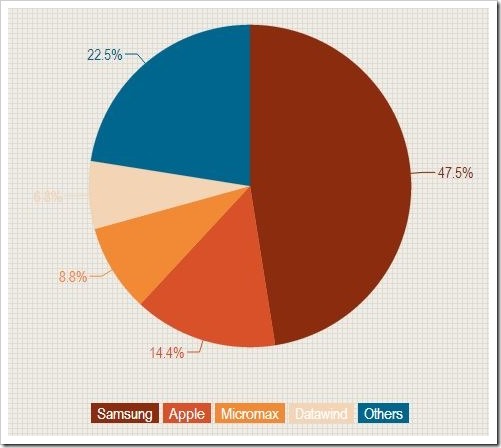

Samsung captured the majority of the market with 47.5% market share whereas Apple was at #2 position with 14.4% market share. iPad Mini is getting good response, as it is attracting the niche buyers of tablets, whereas Samsung is slowly consolidating it’s position after conquering the smartphone market. But besides these two brands, none of the other brands made any impact.

Micromax is at #3 position with 8.8% market share and Datawind is at #4 with 6.8% market share.

Indian Tablet Market Share 1Q2014

Karan Thakkar, senior market analyst of tablets, enterprise client devices and pc monitors at IDC India, said, “However at an overall level, the branded vendors were unable to capitalize on the space left vacant by the erosion from white-box and smaller vendors,”

This trend of tablet sales is in stark contrast to ever burgeoning smartphones sale in India. Last year, more than 44 million smarthphones were shipped in India, and for the first quarter of 2014, almost 4 million smartphones were sold.

What are the reasons that tablet sales is not picking up in India?

2 Reasons For Sales Not Picking Up

The Bureau of Indian Standards (BIS) compliance:

BIS has made it mandatory to screen-print or emboss the quality certification on each tablet (products and packaging material). Additionally, the revised rules of BIS mandates that the font size of this engraving on the product should be of font size 12 or one-fourth of the size of the brand name, whichever is lower.

As per IDC, almost all the vendors import tablet shipments from offshore locations, and in case any external modification to the original design and structure of the product is required (such as this BIS compliance), it needs to be done at the source location itself.

Such large scale enforcement of compliance on each and every product shipped to India will surely disrupt the supply chain, and harm the distribution and sale inside India. This means that demand exists, but due to unnecessary rules and regulations, it is not being possible to market and sell these tablets freely.

Growth in Phablet Sales

Another very crucial factor which is impacting the sale of tablets in India is the huge popularity of Phablets. Typically, a phablet is a combination of tablet and smartphone, and comes in the screen sizes of 5.5 to 6.99 inches. Whereas a typical tablet will start from 7 inches. With such less difference in size and dimensions, the price-savvy Indian consumer is opting for Phablets which can serve both the purposes.

Manufacturers and vendors of tablets certainly need to re-invent themselves and/or induce some striking changes to their marketing campaigns to lure customers in order to push up sales of tablets. Additionally, they should also have a talk with the government and request them to relax BIS compliance to help the industry.

[…] report is also in line with IDC’s report which was released last month showing a 32.8 percent decline in tablet sales. In that we had mentioned 2 reasons, one of them […]