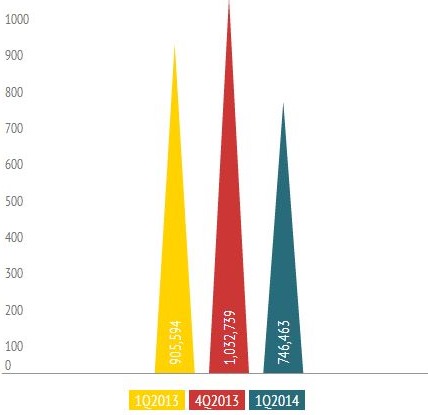

CMR’s quarterly tablet PC market review for the Indian sub-continent is out for Q1 2014 (January – March). In those three months, nearly 0.75 million tablets were shipped across the country. Even so, the number is actually a depreciation as compared to the previous quarter (Oct-Dec 2013).

According to CMR report, Tablet shipments have seen 27.7% QoQ decline, and a 17.5% YoY decline. You would be quick to ask “why?”. After all, why should the tablet market shrink when there are so many budget-priced offerings from as many as 30 domestic and international vendors, flooding online as well brick and mortar stores across the country. It’s simple – Phablets are eating into tablet sales.

CMR report is also in line with IDC’s report which was released last month showing a 32.8 percent decline in tablet sales. In that we had mentioned 2 reasons, one of them being growth in phablet sales.

Phablets are devices that are too large to be considered regular Smartphones, but too small to be considered fully-fledged tablets. They offer a tablet-like large (in many cases, gigantic) displays, added to the functionality offered by a phone.

We aren’t talking about tablets fitted with a cellular SIM slot; Phablets usually have a screen between 5.5″ and 6.5″, and work like a phone when you want it to. In other cases, you can take advantage of the large real estate, i.e. the big screen to watch movies and scribble notes, many a times using a stylus (Galaxy Note, anyone?).

The growth of phablets has diminished the significance of tablets among many potential customers, particularly in the Rs. 15,000-20,000 price range.

Leaving general consumers aside, the Enterprise market for tablets is steadily growing. It accounts for 22.1% of the total tablets shipped in Q1 2014. However, its growth too is coming under question. Such numbers cannot be maintained unless vendors offer market solutions-oriented tablets, that too at compelling prices of course. In some ways, the tablet market in India depends a lot on the growth of the Enterprise market in particular.

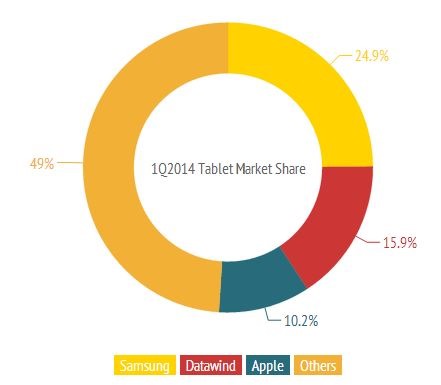

Talking about numbers, Samsung leads the charge by grabbing a 24.9% market share. This is followed by Datawind with a 15.9% market share. Surprised? We are too. Datawind has a lot going for it. Remember the Aakash tablet by IIT? Datawind was awarded the contract to produce those ultra-cheap tablets. although Aakash tablets are nowhere to be seen (atleast not yet), the company’s UbiSlate range of uber-cheap tablets probably sell a lot, mainly due to their aggressive pricing.

Interestingly though, IDC numbers do not match up with CMR research. While CMR gives Datawind 2nd spot with 15.9% market share, IDC reported only 6.8% market share for them. Also, IDC had Apple at 2nd spot with 14.4% market share followed by Micromax (8.8%) and then DataWind.

CMR put Apple at 3rd spot with 10.2% market share. iPad Mini accounted for 60% of all iPad shipments, mind you, in the last quarter.

The top three vendors, cumulatively, account for 51% of the tablet market in India.

[…] dwindling Tablet sales in India, partially due to rise of Phablets, there is some concern regarding the future of expensive tablet […]