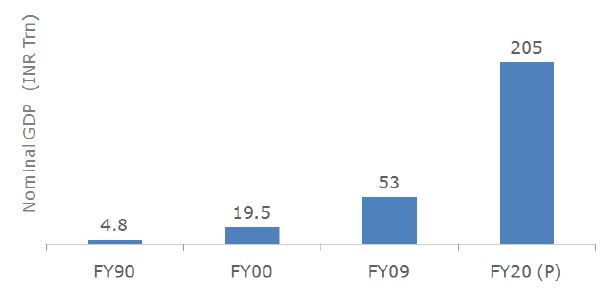

On March 17, Edelweiss Capital has released a research report “India 2020, Seeing Beyond’ which says that India’s Gross Domestic Product (GDP) is likely to quadruple over a period of 10 years. It further states that India is likely to be a US $ 4.5 trillion economy over the next decade.

The Edelweiss Capital report states, “

Driven by a nominal annual growth rate of 13 per cent, GDP is set to quadruple over the next ten years and the country is likely to be a Rs.205-trillion (USD 4.5 trillion) economy by 2020.”

Contents

Infrastructure Investments

The report says that the investment in infrastructure is set to witness a three fold increase from Rs. 21 lakh crore in the Eleventh Plan to Rs. 62 lakh crore until next 10 years.

Service-orientation as Economy Grows

The report says that as the economy develops, the share of the services as part of GDP goes up. As the economy develops on the back of growth in real sectors like manufacturing, industrial production, agriculture, etc., it needs to be supported by ancillary services like Banking and insurance from financial services sector.

The report estimates a big leap in the banking and insurance sector by 5.3 times and 4.7 times respectively, during the decade.

Other critical services which should grow along with the forward march of the economy are education, healthcare, recreation and IT services. Education and healthcare form a critical part in long term fundamental sustenance of the economy on the growth path.

Proper education ensures higher literacy standard which in turn leads to declining unemployment within the economy. The report also estimates a jump of 6 times in domestic pharmaceutical and healthcare industry.

Income Distribution Pattern

According to the report, the gross domestic savings would grow by 3.8 times from Rs.19 trillion in FY09 to Rs.72 trillion in by the end of the next decade. This increased savings could lead to a huge surge in domestic consumption expenditure which is set to triple from Rs. 30 trillion in FY09 to Rs.113 trillion in FY20.

The report points out that a percentage of the deprived population category, in terms of allocation of income distribution pattern within the country, is likely to come down substantially from 51% in the year 2010 to 34% in the year 2020. As per the report, the deprived category of population is likely to be reduced from 133 million households to 100 million households. This would reduce the inequality among various population classes

This shift in category for deprived population would tantamount to increasing growth in consumption-oriented middle and higher-middle class population from 47% in 2010 to 60% in 2020.

The actual numbers of population under this category are estimated to grow from 120 million households to 180 million households. A substantial growth in consuming class population could serve as a self-igniting phenomenon for the Indian economy.

Growing Working Population Age Group

The India 2020 report states that the working age (20-59 years) population is likely to increase by 20%, which will ensure higher per capita income and lesser percentage of idle population with no contribution to productive output of the economy.

The report also states that the population to be categorized under the Aged group (above 60 years) is also likely to increase manifold to the extent of a whooping 45%. This age group could herald an increasing need for medical and healthcare facilities apart from strong financial products like retirement and pension funds.

Trickle down effects of Rising Income

Riding on the back of some of these supportive income distribution patterns and working population strength, the report says the organized retail is set to grow from Rs.1000 billion in FY09 to Rs. 6260 crore in FY20.

With the growing culture of mall mania and increased discretionary spending in the hand of exploding working age population, the organized retail is set to receive a substantial boost of a whooping 6.3 times.

With rising income, the report further states that the demand for Urban Premium housing is set to grow big time from Rs.116 billion in FY09 to Rs.757 billion in FY20. This posh niche of the real estate industry is set to receive the biggest boost as against any other industry over the next decade. The demand for Urban Premium Housing is set to rise a whooping 6.5 times with in next 10 years.

The India 2020 report of Edelweiss Capital seems to be betting on India’s population demographics and its income distribution pattern which is estimated to go a long way in stimulating domestic consumption and investments into rising needs of infrastructure support.

Do you feel it is a Realistic Target for India to quadruple from here?

“The report says the organized retail is set to grow from Rs.1000 billion in FY09 to Rs. 6260 crore in FY20.”

What is 1,000 billion? Isn’t it equal to 100,000 crores??? Are you trying to say that retail will see a “de-growth” from RS. 1,00,000 crore to RS. 6,000 crores?

We have 3 different terms being used in this write-up, which are “lakh crores”, “Rs. billion/trillion”, and “USD billion/trillion”. Is the reader supposed to sitting with a calculator while reading this?

Its happening …. India is new word for economic power. These are small numbers now… big numbers will be seen in upcoming years.

VERY BIG NO….

THIS CAN’T HAPPEN.

THIS IS A BIG JOKE..

HAHAHHAHAHAHHA