Paypal Slashes Forex Fees by 40% For Indian Users; Launches Paypal.me For Faster P2P Payments

Paypal is focussing on Indian operations with renewed zeal and commitment; and the first step has already been taken. Especially for Indian merchants and traders who use Paypal for receiving their payments in international currencies, the forex charge has been reduced by 40%.

This is one huge step for luring Indian users, who have always complained against Paypal’s exorbitant forex fees which are charged once the international currency is converted into Indian currency.

While accepting payments, the user needs to opt for the discounted rate for converting their currencies.

As per Anupam Pahuja, who is the MD & General Manager India at PayPal, one percentage point of forex fees has been reduced. He said, “We have reduced our forex conversion charge by one percentage point. For a small merchant, this will translate to about 30-40 per cent discount,”

Reportedly, India has around 18 million (1.8 crore) freelancers, out of which majority of them use Paypal’s services for accepting payments from all over the world; and around one third of overall India’s export earnings pass via Paypal.

Freelancers, designers, trainers, small scale businessmen, exporters, manufacturers etc from India are relying on Paypal for their export business, and their decision to reduce forex fees can now be a big reason to stay with them.

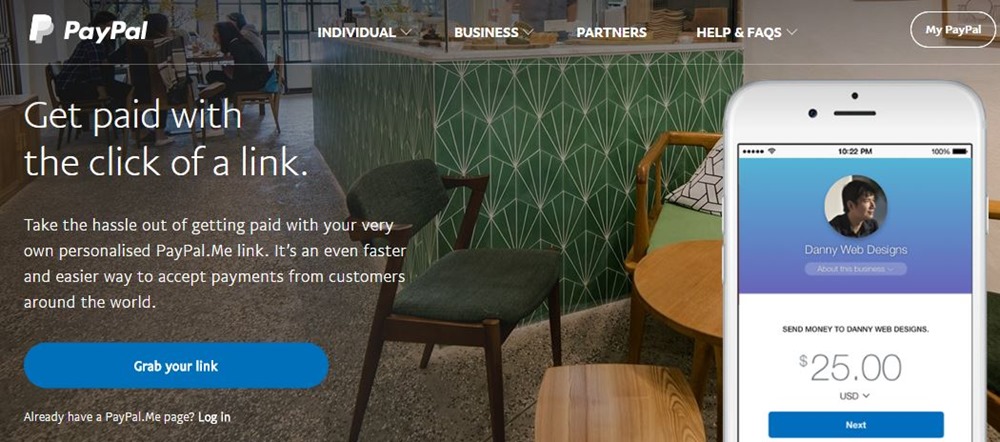

Paypal.me Assures Faster Payments

The decision to reduce forex fees was taken while launching Paypal’s newest offering: Paypal.me which assures faster payments for their users.

Paypal.me basically creates a robust peer to peer digital payment service.

Once a user signup, he can get a personalized URL for accepting payments, which would be easier for the other party to send the payment. Hence, instead of sharing bank account details, IFSC codes or an email address for receiving payment, the merchant needs to share this unique link and get the payment.

This new customized URL is associated with the existing Paypal account of the merchant; and once it is clicked, the associated Paypal account of the buyer is opened, wherein he or she can make the instant payment.

Assume a person named Sultan is selling a product for $100 to international clients. After signing up for Paypal.me, he can create a customized link like this: Paypal.me/Sultan/100.

All he needs to do is, share this unique link wherever he wants to sell his product, and receive instant payments.

As per information available, Paypal.me will allow the user to accept payments from 26 countries from major debit, credit cards and Paypal account holders. The user’s bank account details remain hidden, and protected.

Automatic fraud detection, real time transaction monitoring and Paypal’s signature protection policies would be enforced as usual.

Receiving domestic payments via Paypal remains an unsolved issue; although we had reported late last year that Paypal may soon allow users to receive and send domestic payments as well. As of now, there has been no development in this regard.

If you are using Paypal.me, then do share your experience right here!