Ather Raises Rs 991 Crore From Hero MotoCorp & Other Investors; New E-Scooters Will Be Launched Across 100 Cities!

For the April, Ather Energy reported its highest ever monthly sales of 3,779 units.

Ather Energy is high on octane, as the bookings for Ather 450X have been growing 25 percent quarter-on-quarter.

The retail sales network of the company spans 32 cities with 38 Experience Centres as of today.

By 2023, the same will be expanded to 150 Experience Centres in 100 cities.

But not just this, there is another noteworthy accomplishment by the electric vehicle manufacturer, that it has bagged the first direct investment in the electric mobility manufacturing sector by the country’s sovereign wealth fund.

Series E Funding : NIIFL, Hero MotoCorp

A amount of $128 million or Rs 991 crores. Investment agreements were signed with National Investment and Infrastructure Fund Limited’s (NIIFL) Strategic Opportunities Fund (SOF), Hero MotoCorp, a leading shareholder of Ather, and additional investors in the Series E funding of the company.

Ather Energy has raised over $230 million financing from investors like Tiger Global and Flipkart cofounder, Sachin Bansal. Around $56 mil, or Rs 420 crore have been invested by Hero Motocorp. The remaining and major amount is invested by NIIFL.

Further boosting the round with minor investments are the other existing investors, including angel founders.

To date Hero MotoCorp is the largest investor. Ather Energy plans to remain independent with investor goals aligned towards an Initial Public Offering (IPO).

Ather Funding Earmarking & Capacity Enhancement

This funding, as per the company, is earmarked to attain certain time-bound goals which includes expansion of its manufacturing facilities, research and development, charging infrastructure, and retail network growth.

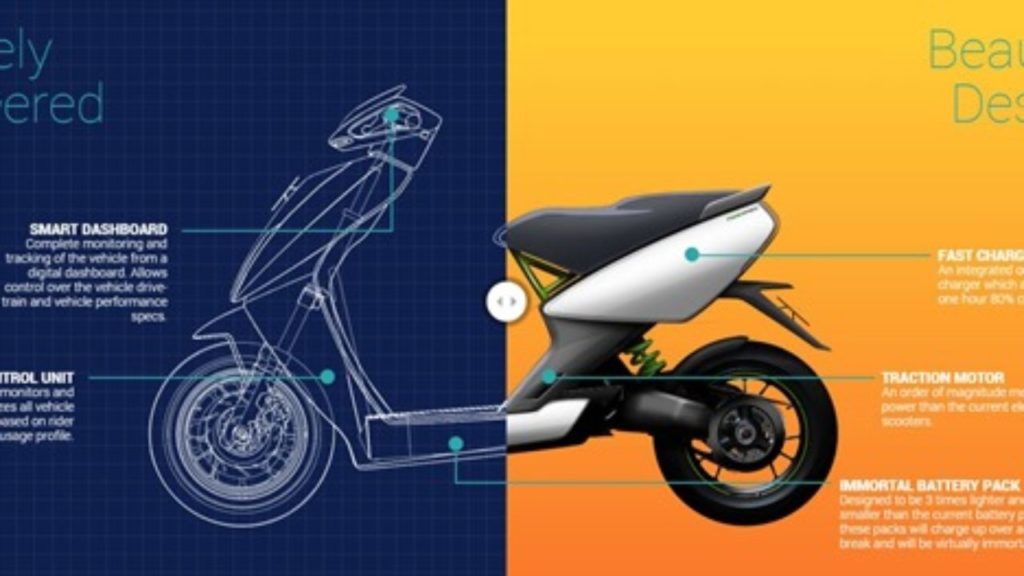

Based on the current 450 series, the company also plans to launch new electric scooters.

Being NIIFL’s first direct investment in the manufacturing sector and in electric mobility bodes well. Both avenues have often been discussed and are key to ‘India’s green mission and decarbonisation goals’.

This investment by NIIFL is a boost to the electric 2-wheeler sector in India. This sector, though is in early stage but its serious growth goals are towards the end of the decade.

Built with a high level of indigenisation, Ather has already proven its mettle with the limited line of new products and the funding in turn directly supports 1st-gen local entrepreneur-manufacturers.

The Previously invested in Aseem Infrastructure Finance, NIIF IFL, and Manipal Hospitals

Strategic Opportunities Fund (SOF) has previously invested in Aseem Infrastructure Finance, NIIF IFL, and Manipal Hospitals.

Tarun Mehta, CEO, Ather Energy, said “The switch to electric is inevitable and FY 21-22 was the turning point for electric two-wheeler adoption in India. We are super excited to have NIIF come on board as an investor. They have been at the forefront of the country’s green transition through their investments and initiatives, and we look forward to our association. We would also like to thank Hero MotoCorp, our long-term investor and strategic partner who continues to support our growth. The current round of investment will help us enhance capacities across the board, bring additional focus on new platforms, expand into new geographies, expand our fast-charging network and double down on the reputation we’ve built for making a product that’s high on quality.”

Comments are closed, but trackbacks and pingbacks are open.