UPI Without Internet? RBI’s New Payment Feature For Feature Phones Can Be Gamechanger

Among the announcements made by RBI Governor Shaktikanta Das in the Monetary Policy Statement on Wednesday, was the central bank’s initiatives to make the process of small-value transactions simpler and seamless, and to launch a UPI-based payment product for feature phone users.

Learn more about the two initiatives proposed by the RBI Guv on the Dec 8 Monetary Policy Committee meet.

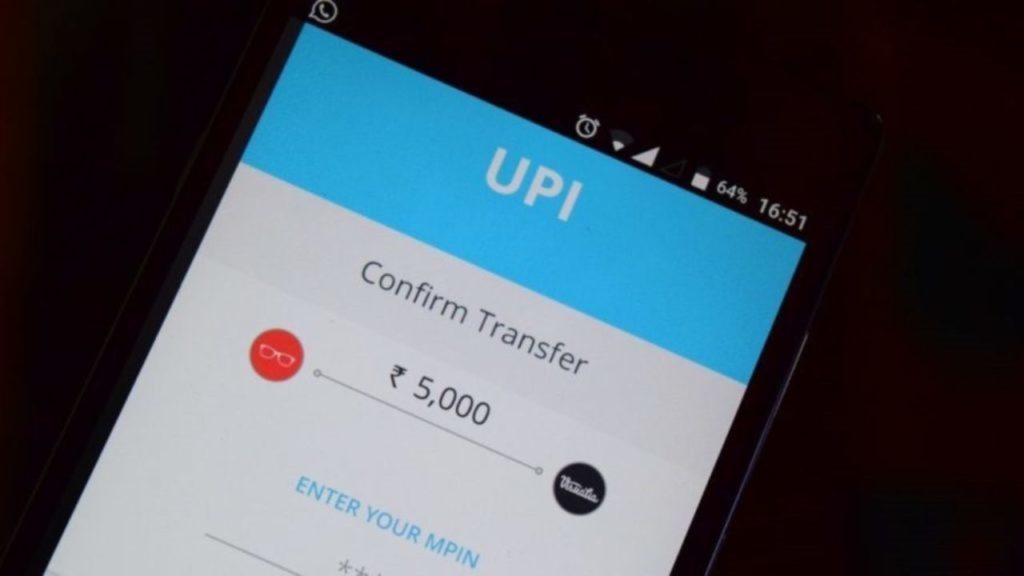

UPI Payment to be Introduced on Feature Phones

In his announcements made on Dec 8, RBI Governor Shaktikanta Das stated that the present mobile phone consumer base of India is at an approximate of 118 crore users, of which about 74 crores have smartphones.

As per the ‘Statement on Developmental and Regulatory Policies’ released yesterday, Das announced to propose launching a UPI-based payment product for feature phone users in India, which would propel the adoption of UPI payment through feature phones in the country.

At present, feature phones can make use of the National Unified USSD Platform or NUUP to avail basic payment services. All they need to do is use the shorthand code *99#.

However, the feature hasn’t gained much popularity, following which the RBI has proposed to launch a UPI-based payment product for feature phone users.

On-Device Wallet for Smaller Value Transactions

The main concept of UPI payment was to move towards a cashless transaction mode, and boost digital adoption, especially for making low valued payments.

According to RBI data analysis, about 50% of the transactions made through UPI platforms are under Rs 200, meaning one of the prime objectives of introducing UPI has been fulfilled.

However, due to large dependence on the usage of UPI to make small-valued transactions, often times significant system capacity and resources are used up, which at times cause customer inconvenience, as a result of transaction failures due to connectivity related issues.

“It is, therefore, proposed to offer a simpler process flow by enabling small value transactions through an “On-device” wallet in UPI app which will conserve banks’ system resources, without any change in the transaction experience for the user,” stated the RBI report.

Additionally, RBI has also announced to increase the UPI limit for investing in IPOs and purchasing government bonds through the RBI Retail Direct Scheme from Rs 2 lakh to Rs 5 lakh now.

Comments are closed, but trackbacks and pingbacks are open.