UPI Now Live In UAE: Transfer Money To Dubai, Make Payments To Merchants & More!

The international arm of National Payments Corporation of India, NPCI International Payments (NIPL) has partnered with a leading financial institution in the UAE, which means that Indians visiting UAE for business or leisure can now use the Unified Payments Interface (UPI) platform for payments.

Trak.in had last month informed its readers of NPCI discussing the idea of expanding India’s self-developed digital payment platforms like Rupay and UPI to international markets like the United States, West Asia and Europe.

Moreover, NIPL had launched the QR-code based UPI services in Bhutan on July 13, 2021, while partnering with the central bank of the country, Royal Monetary Authority. COnsequently, Bhutan became the first country to accept UPI transactions handled through the BHIM app.

In a major accomplishment, UPI services are now available in the UAE.

UPI Transactions Live in UAE

As mentioned earlier, NPCI, the developer of UPI, has been in discussions with many global agencies for expanding its services in locations like the US, Europe and West Asia.

Now, its international arm, NPCI International Payments (NIPL) has partnered with a leading financial institution in the UAE, Mashreq Bank, to extend UPI services in the country.

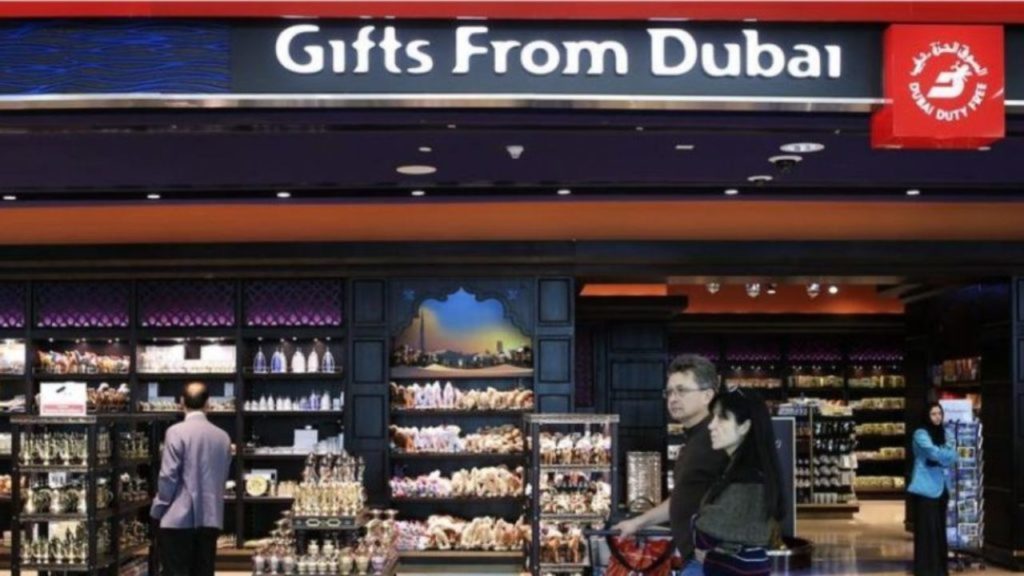

According to NPCI, the partnership between the two organisations will enable over 2 million Indians who travel to UAE for business or leisure purposes every year to pay for their purchases using UPI-based mobile applications across shops and merchant stores in the UAE.

This will facilitate both the entities, as the tie up will boost the digital payment ecosystem in the UAE, whilst working as a stepping stone for UPI to seep deeper in wide areas of international markets.

The CEO of NIPL, Ritesh Shukla, while speaking on the tie-up states that the payments organisations (NIPL) is excited about the partnership with Mashreq Bank, which will enable consumers from India to transact seamlessly using NPCI’s UPI platform and deliver a seamless user experience.

The executive vice president and Head of Payments at Mashreq Bank, Kartik Taneja commented that given the position of UAE as an international commerce and tourism hub, retail merchants in the Emirates always enable the latest payment methods that are expected by our international clients.

“Innovation has been at the core of what Mashreq does, and we have a proud history of introducing omnichannel solutions that benefit our customers and the UAE’s economy. We are the first in this market to partner with NIPL and offer cutting-edge mobile-based digital payments to our clients”, stated Taneja.

UPI Transactions Skyrocket by 400%

Over the past four years, from FY17-21, UPI has grown at a CAGR of 400%. In 2021, UPI transactions form 10% of the overall retail payments (excluding RTGS) unit, which was only 2% until a couple of years back.

The value of payments amounts to the range of Rs 41 lakh crore at point-of-sale (POS) terminals, about 2.8 times more than credit or debit card transactions.

In June 2021, the UPI transaction value amounted to Rs 5,04,886.44 crore, which increased to a total of Rs 6.06 lakh crore in July 2021.

PhonePe dominated the UPI ecosystem in May, with 45.27% market share, followed by Google Pay with 34.67% and Paytm with 11.44% market share.

July 2021 too, witnesses the same trend, however with increasing magnitudes and numbers.

PhonePe now makes up 86% of the market share, while Google Pay climbs up to a close second, making up 80% of the share. Paytm is a distant third 8% market share by value and 12% by volume.

Comments are closed, but trackbacks and pingbacks are open.