This Bollywood Actress Will Be Jailed For A Bounced Cheque: What Are The Rules If A Check Bounces?

In an interesting development, a famous Bollywood actress has been sentenced to 3 months of jail, because her cheque of Rs 3 lakh bounced.

What made the Judge pronounce a 3-month jail for just a bounced cheque?

What does the Indian constitution say about bounced cheques?

Actress Koena Mitra Will Be Jailed For Bounced Cheque

Bollywood actress Koena Mitra, who is famous for song Saaki Saaki from movie Musafir, will be jailed for 3 months, because her cheque bounced.

The said cheque was given by Koena Mitra in 2013, to a model Poonam Sethi, for repayment of a loan. Koena Mitra had taken a loan of Rs 22 lakh from model Poonam Sethi, which she promised to repay in a short time.

As part of the first installment, she gave Poonam a cheque of Rs 3 lakh in 2013, which bounced. Koena Mitra was served a legal notice regarding the bounced cheque on July 19th, 2013.

On October 2013, the matter reached Judiciary, and the verdict was announced last week, by Andheri Metropolitan Court Magistrate Ketaki Chavan.

The Court has also ordered Koena Mitra to pay Rs 4.64 lakh as compensation to Poonam Sethi, as part of the verdict against bounced cheque.

Interestingly, when Koena Mitra was summoned regarding this case, she had pleaded not-guilty, and asked for a trial.

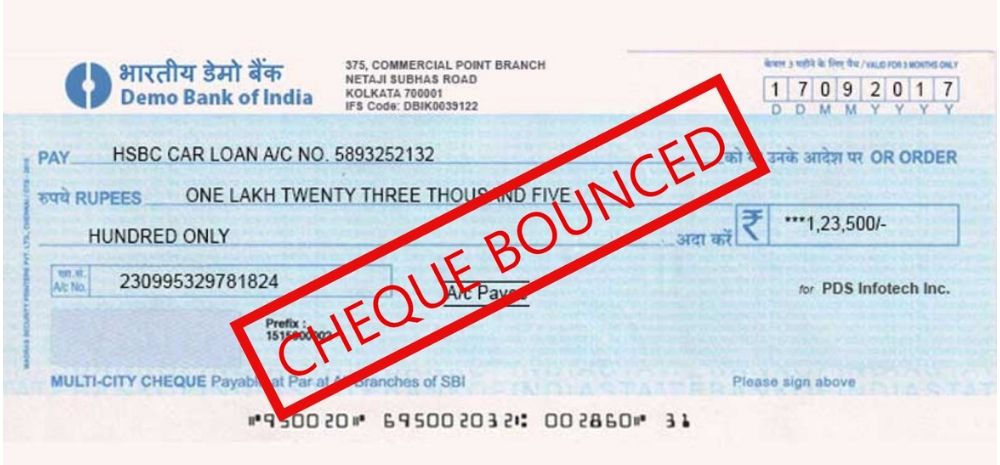

Bounced Cheque: Rules You Should Be Aware

Cheques come under The Negotiable Instruments Act, 1881, which has been amended a number of times since then.

As per the current provisions of the law, a bounced cheque is a criminal offense, and this is punishable under law: the cheque issuer can be jailed for 2 years and/or can be asked to pay the penalty as well.

Under Section 138 of the Act, a bounced cheque or a dishonored cheque is a cheque which is refused by the bank due to any reason, prominent being insufficient funds.

The same provisions under the Negotiable Instruments Act, 1881 has been implicated against Koena Mitra as her cheque of Rs 3 lakh bounced.

Note here, that once the notice has been issued against the issuer of the cheque, there is a grace period of 15 days, within which the repayment can be made. In case there is no repayment, then the recipient of the cheque can approach a Court or Magistrate, and file criminal offense report against the issuer of the cheque.

We will keep you updated, as more details come in.

Comments are closed, but trackbacks and pingbacks are open.