GST Rate Card Then & Now – What’s Cheap, What’s Costlier

The final meeting of the GST Council happened on Friday, and they came out with a 213 page draft which had the complete list of the products with the slabs of tax rates. It provides a complete laydown of the different rate of taxes on the different category of products.

For some of the products it is a waiver on the existing tax, but for the most of the goods, the prices will see a sharp rise. The committee has fixed on a four slab rate of taxation, upon which all the products are going to get classified. A total of 1,211 items were slabbed according to their category and and rates were fixed. Among these, even included services industry, transport, finance, insurance and hospitality.

The taxes are set on a four slab rate – 5%, 12%, 18% and 28%.

Contents

Exempted from GST

| Goods | Services |

|

|

5% Slab Rate

| Goods | Services |

|

|

12% Slab Rate

| Goods | Services |

|

|

18% Slab Rate

| Goods | Services |

|

|

28% Slab Rate

| Goods | Services |

|

|

Majority of the products come under the first three slabs i.e 81% and the rest come under the last slab (28%).

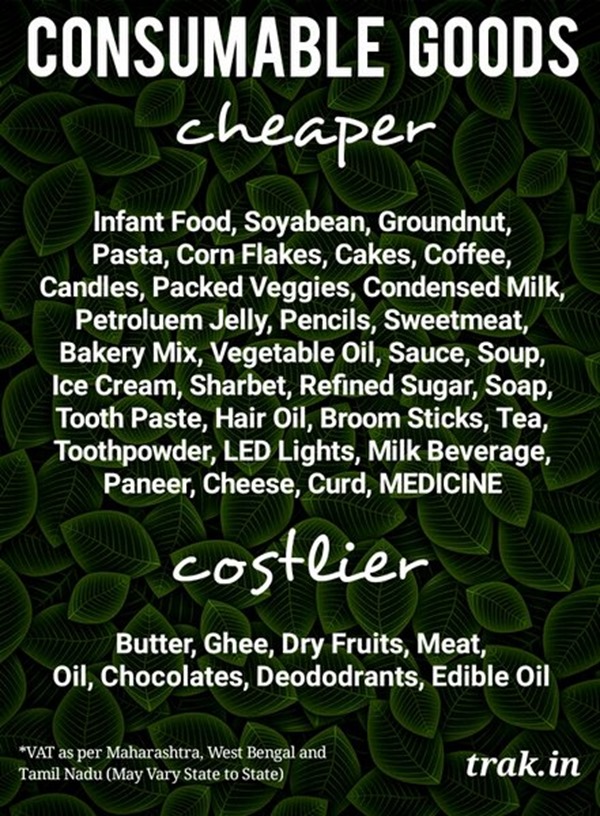

What’s Cheap & What’s Costlier (in Images)

Do let us know if you have any questions in the comments section.