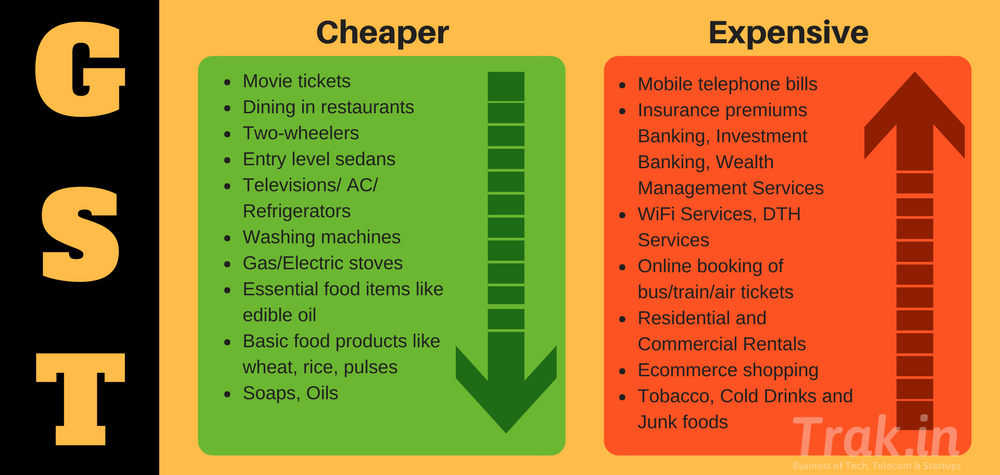

GST Impact: What Will Get Expensive & What Will Get Cheaper!

The rollout of Goods And Services Bill (GST) is now 99% confirmed effective July 2017. After Lok Sabha passed 4 crucial bills related to GST late last month, Rajya Sabha has cleared the bill without any modifications.

Now, only States need to discuss the implications of GST, before nationwide roll out.

Hailed as the biggest, most powerful financial reform bill to have passed since Independence, GST unifies the nation with one tax regime: Either you are selling a product from Assam or Tamil Nadu, it won’t matter henceforth.

The common man is, of course, worried about the actual impact of GST on his pocket, and understanding this need, we bring to you major services which can become expensive after GST rolls out, and 7 of those services, which can become cheaper:

The Expensive List Under GST

- Mobile telephone bills (from existing 15% service tax, telecom bills can now attract 18% tax under GST)

- Insurance premiums

- Banking, Investment Banking, Wealth Management Services

- WiFi Services, DTH Services

- Online booking of bus/train/air tickets

- Residential and Commercial Rentals

- Healthcare/ School Fees

- Courier Services

- Metro fares/ Rail fares/ Airfares

- Ecommerce shopping

- Tobacco, Cold Drinks and Junk foods (Cess of 290% on tobacco products and Sin Tax for cold drinks and junk foods has already been planned under GST)

The Cheap List Under GST

- Movie tickets (Entertainment tax would be absorbed under GST, hence, cheaper tickets)

- Dining in restaurants (Service tax would be reduced)

- Two-wheelers

- Entry level sedans

- Televisions/ AC/ Refrigerators (Currently, televisions and electronic appliances are charged 30% tax, which will come down to 18% for small-screen TV and 28% for AC, refrigerators and others)

- Washing machines

- Gas/Electric stoves

- Essential food items like edible oil (Under GST, tax on these items will fall from 30% to 28% and in some cases, even 18%)

- Basic food products like wheat, rice, pulses

- Soaps, Oils

To be fair, GST changes for essential food products and petrol/diesel hasn’t been announced yet. But going by statements issued by GST Council, it is clear that overall impact on these commodities and products would be positive, and they would become cheap.

Here is the tax slab structure announced under GST regime.

We will keep you updated we receive more updated related to GST changes.

WHAT WILL HAPPEN TO THE MEDICINE RETAILERS. WHAT WILL BE THE EXACT STRUCTURE ON

MEDICINES AND ALLIED PRODUCTS.

What would be its impact on ISP, Web Design and Hosting Services