Paytm Introduces ‘Nearby’ Feature to Find Merchants Who Accept Digital Wallet; Processes 5 Mln Transactions a Day

The biggest benefit of demonetization of higher denomination notes in India has been to the digital wallet companies like Paytm and FreeCharge. Snapdeal recently announced ‘Wallet on Delivery’ as a feature in partnership with FreeCharge to offer an alternative to the cash-less people in India.

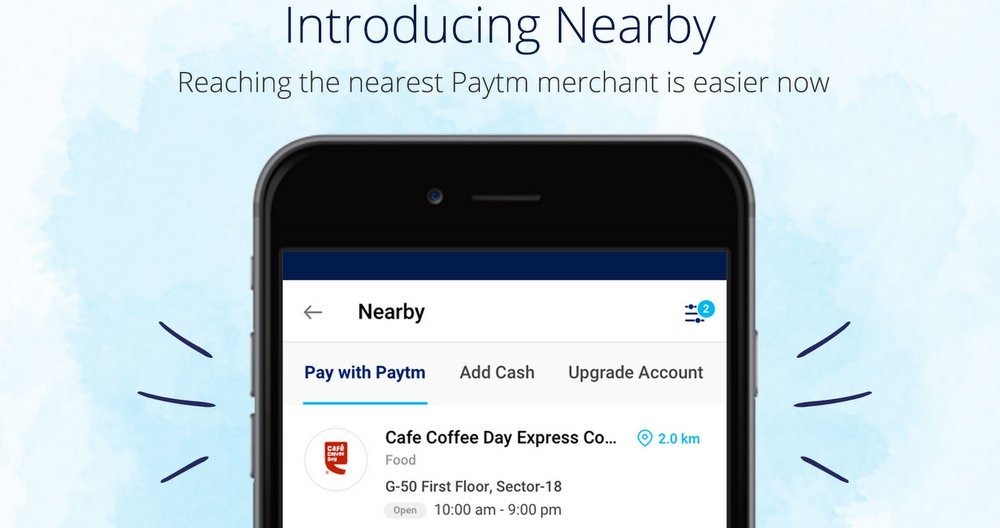

To further provide help to the people using Paytm, the company announced a new feature called ‘Nearby’ in the app. If you have the latest version, you will see a Nearby image at the top right on the front page of the app.

As soon as you click the icon, you will be directed to their new page which will request you to share your location. Upon doing so, it will suggest you all the merchants nearby that accept Paytm, which ultimately means no need of cash for transactions.

Right now, Paytm is being accepted at a lot of kirana stores, even small vegetable and fruit sellers and larger chains like Big Bazaar. This also means that a lot of people who were not using Paytm yet will eventually give in and start using it immediately to purchase the basic materials.

Sonia Dhawan – DGM at Paytm, said, “At Paytm, our approach has always been to build an ecosystem that benefits both merchants & customers. I am confident that while our customers will appreciate the increased convenience of finding Paytm services near them, our merchants & partners will value the exponential increase in visibility and new business ‘Nearby’ feature will bring.”

Paytm has partnered with almost 8 lakh merchants in the country and this offers a lot of options to consumers. It is as simple as sending cash, except you only need the phone number of the seller. In most cases, scanning a QR code has made it even more convenient.

Paytm hits 5 million transactions in a day

The company has seen a surge in the transactions everyday and the number of customer acquisitions. This has been possible only with the recent move by the Prime Minister of our country.

As people are pushed to do cashless transactions, and mostly online, the number of transactions done on Paytm has risen to 5 million per day.

The traffic has increased by 700% in a couple of days, and the amount of money being added to wallet has also increased by 1000%.

The number of transactions per person have already risen from 3 to 18, as more people download the app and use the digital wallet for payments. The company plans to acquire over 5 million merchants by this year end, which means more transactions and more customers.

If you remember, Paytm’s payments bank was also going to be launched in November, and this move from the Government makes it the perfect time to do that. While the Government is still struggling with NFC payments, Paytm has made everything easy with QR code scanning and transfers.

As the Government makes it difficult for consumers to transact with cash in the next couple of months, more people will be convinced to do online transactions and cashless ones at merchants. This will help the Government regulate black money in circulation, and move India into a digital economy.

If you haven’t downloaded Paytm yet, you are missing out on a lot. The transactions are seamless and there will be no hiccups whatsoever. Paytm’s own marketplace also has a lot of products with exciting offers that will convince you to opt for digital payments.