UPI Into Massive Expansion Mode – IRCTC, eBay, MMT, Idea To Soon Join The Platform

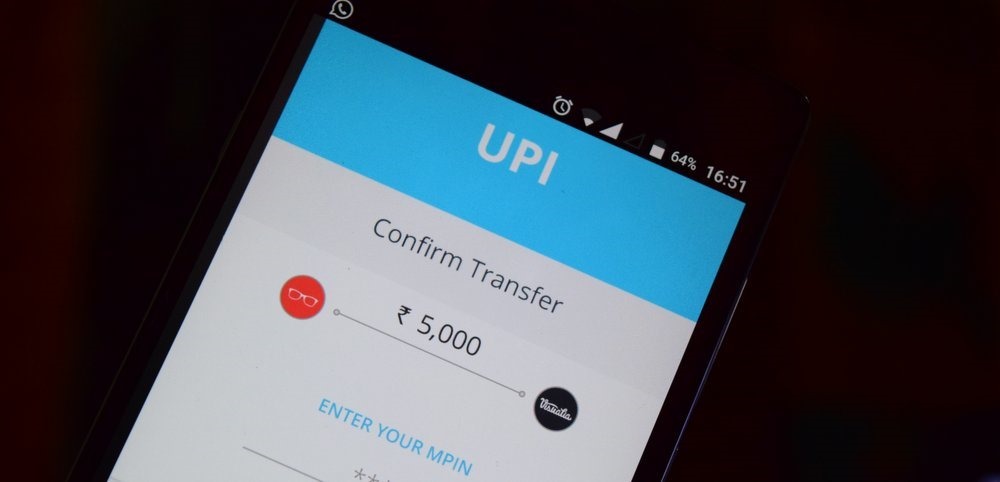

Flipkart was no doubt fast in adapting to UPI, as they launched their app PhonePe within days of UPI’s official launch.

However, other e-tailers are not falling behind either, and the race is on to be on the platform as fast as possible.

National Payment Corporation of India (NPCI), the parent organization behind UPI is leaving no stone unturned to convince ecommerce portals and service providers to join the bandwagon. As per reports coming in, 10-15 major e-tailers are likely to join UPI’s payment system in the next few weeks.

Some of the prominent names which have come up include: MakeMyTrip, IRCTC, PepperFry, eBay; besides telecom service providers Idea and BSNL. As of now, only peer to peer funds transfer is working on UPI’s platform, which is being aided by participation of 21 odd banks, as they have either launched a new UPI based app or upgraded their existing apps to accommodate UPI.

As of now, Flipkart is the only e-tailer which has launched a separate mobile app for using the power of UPI.

The sign that these major ecommerce platforms are joining UPI signifies a broader picture: UPI will become huge in terms of digital payments and transactions in the next 4-6 months.

Dilip Asbe, Chief Operating Officer NPCI confirmed the development, as he said, “In the next one or two months, a sizeable number of ecommerce merchants will go live on UPI. That’s what our effort is. At least 10-15 merchants will be going live so that we can get good traffic,”

Will Mobile Wallets Becomes Redundant After UPI?

Earlier, we had speculated that mobile wallets can die a slow but gradual death, after the emergence of UPI. After all, Paytm is also using IMPS method to carry peer-to-peer transfer of funds; and if UPI, which is backed by Govt. of India also does the same, then on whose side should the bet be on?

However, NPCI COO has denied that mobile wallets can die, because of UPI. As per Asbe, the market is too big to accommodate various stakeholders vying for the same market share. Ultimately, according to Asbe, the customer is the best decision maker.

He said, “The market is too big… I don’t see a reason why both (UPI and wallets) cannot survive. The ecosystem is large enough. As a country, we need multiple payment options. Finally, the consumer is king and will use the option most convenient,”

One other point mentioned by Asbe, regarding the difference between mobile wallets such as Paytm and UPI based apps is the very purpose of usage.

For instance, mobile wallets can be used without a bank account as well; and it’s primary users are those who are inclined to use discount offers and special sales, using the mobile wallet. On the other hand, UPI needs bank accounts to be added, and is mainly an easy interface to transact between several bank accounts, and do some serious banking related operations, using a smartphone.

Describing the various usages of mobile wallets and UPI, Asbe said, “One segment wants to do fund transfer from bank account to bank account – that segment will rely on UPI. There will be people who want to use wallets for cash-back and attractive offers from merchants – they will use wallets,”

Officially speaking, NPCI has listed 26 major tasks which can be performed using UPI, which includes: paying for cash of delivery for ecommerce purchases, paying money to the local vegetable vendor, departmental stores, paying for toll plaza charges, paying utility bills such as electricity, phone bill etc, making donations, paying school/college fees etc.

Once more e-tailers join UPI, it would be interesting to observe how it can dent the market of mobile wallets in the coming days.

“listed 26 major tasks”??!!! WTF?? It’s not UP TO them to list anything – just let us TRANSFER THE MONEY!! I can use it to pay for ANYTHING I WANT!! (from bus fares to a paan shop!)