HDFC Brings Contactless Payments With UltraCash Sound Wave Based Payments!

Sound wave technology for payments is slowly gaining traction and we have already seen Paytm, ToneTag and Tech Mahindra’s MoboMoney adopting it. This technology is extremely useful for phones that do not support near field communication(NFC).

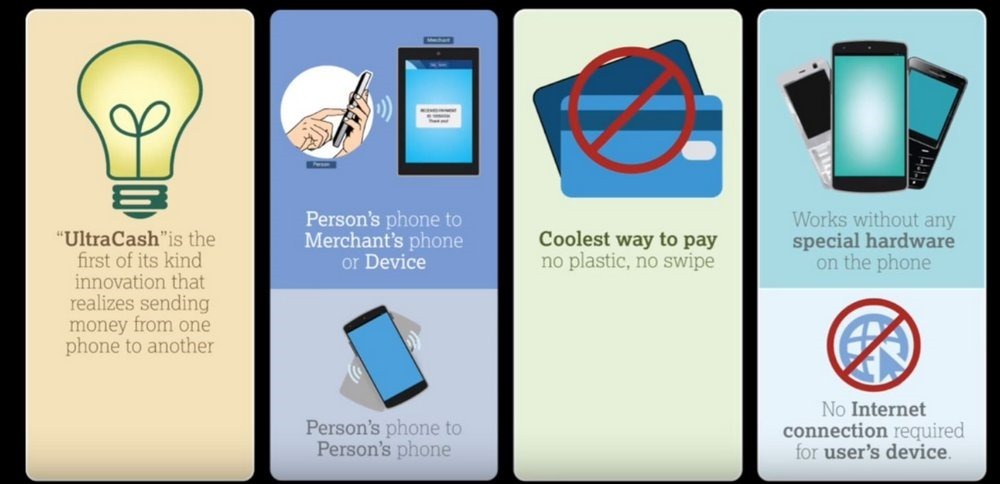

HDFC Bank has launched UltraCash, a high frequency sound wave technology-based payments application that relieves you of your wallet and cards. This means that NFC and internet are not required and all you need is the app for seamless transfer of money.

The company’s note says, “With UltraCash, you can now use your mobile phone to pay at restaurants, retail stores, electronics stores, etc – in a seamless manner, direct from your HDFC Bank account.This mobile-to-mobile transaction takes mere seconds and is redefining the payment ecosystem in India.”

HDFC claims that the technology is completely safe and secure, with an end-to-end encryption and a unique identifier to pair merchant and customer phones. All it takes it 5 seconds to complete the transaction between two parties.

For merchants, the merchant discount rate(MDR) is low which brings down the total cost of ownership. No investment is required apart from a smartphone and the UltraCash app.

How to register for UltraCash?

Before getting started, make sure you fulfill the following needs –

- Setup MMID and M-PIN through HDFC Netbanking or Mobile Banking

- The first 4 digit M-PIN generated needs to be changed to a pin of your choice

- Open the UltraCash app on your smartphone and link your HDFC bank account to it for transactions

- At the merchant location, simply bring your smartphone close to merchant’s phone, enter the 4 digit M-PIN and make payments instantly

Internet is only required during the registration and setup process. Once everything has been setup, transactions can be done without the need of an internet connection. There will be reward offers and UltraCash credits up for grabs periodically.

The payments solution offers a cap of Rs. 10,000 per transaction for security reasons, but there is no limit to the volume of transactions per account. The app is available on Android Google Play Store as of now, and will be available on iOS soon.

This is a very interesting technology from HDFC, currently patent pending, which will allow HDFC bank holders to make payments in a jiffy at any merchant site. To become a success, HDFC will have to spread awareness amongst merchants and HDFC bank users, about the benefits of the application and its future applications.

Source: HDFC