Indian Media & Entertainment Industry Crosses Rs 1 Lakh Crore; Growing at 13.9% – KPMG

Internet, fueled by social media and adaption of Internet is the driving force behind India’s Media & Entertainment Industry, as the overall market has now crossed Rs 1 lakh crore, growing at a breakneck speed of 13.9% annually.

By the time 2019 ends, the market would be worth Rs 1.9 Lakh crore (Rs 1964 billion or Rs 1.9 trillion). These facts were revealed in the KPMG-FICCI Indian Media and Entertainment Industry Report 2015: #ShootingForTheStars

This comprehensive study was conducted to understand and gauge the market of media and entertainment which includes Digital Media, TV, Films, Gaming, Music, Print, Radio & Out-Door Media, thereby covering the entire spectrum of media industry in India.

The report mentions that all these sectors are experiencing tremendous growth. And Internet and Digital Media is the backbone on which the growth is happening.

Major Highlights from the report:

– Media and Entertainment industry in India is worth Rs 1.02 lakh crore, which will swell to Rs 1.9 lakh crore by 2018, growing at a rate of 13.9% CAGR

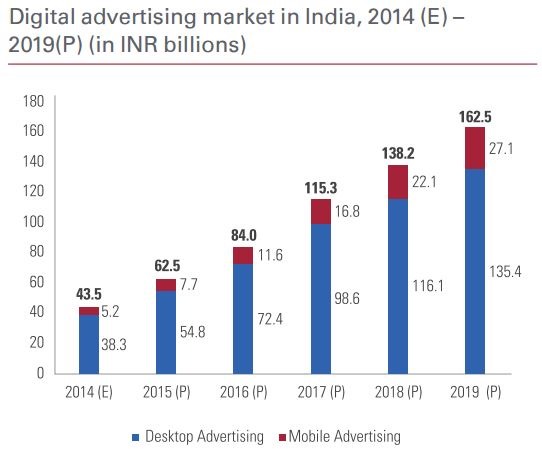

– Digital Advertisements experienced maximum growth of 44.5%, to reach Rs 4350 crore in 2014; by 2019, it is expected to reach Rs 16,000 crore

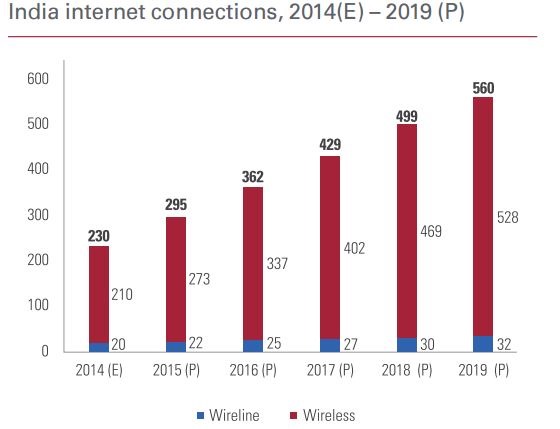

– There are 2 crore Internet users in India who are using wired broadband connection, which will rise to 3.2 crore by 2019

– 50% of all revenues from music was generated via digital channels; and non-digital music market reduced 35-40%.

– Ecommerce portals spent Rs 750-1000 crore on traditional media for promoting their services/products

– Star Movies with 3.8 million Facebook fans and 96k Twitter followers was the #1 social media platform among entertainment companies

– Traditional Media, which includes Print and TV also saw robust growth of 14.2%, owning to general elections which inspired lots of spending. Interestingly, Print constituted 43% of the share while TV had 27% share. Overall traditional advertisement market reached Rs 41,400 crore in 2014

– Government initiated auctions for Phase 3 of Radio channels, as 135 channels across 69 cities would be auctioned in 2015 end

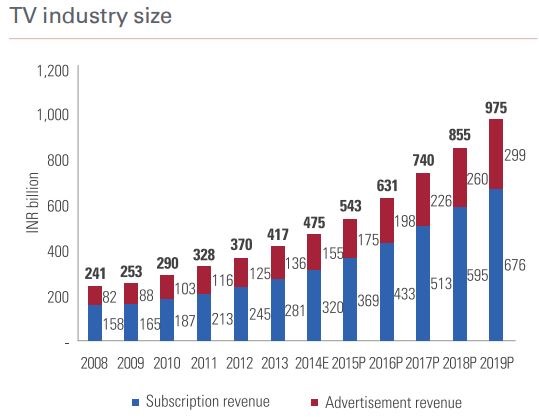

– TV Industry in India is worth Rs 47,500 crore, which grew at a rate of 15.5%. By 2019, it is expected to cross Rs 97,5000 crore

– TV Advertisement industry is valued at Rs 15,500 crore in 2014, which increased 12% compared to last year. By 2019, it is expected to breach Rs 30k crore mark

– Rs 400 crore worth of TV advertisements were paid by political parties in 2014. But overall, FMCG sector was the highest spender in TV ads (The industry suffered due to a rule of only 12 minutes of advertisement / hour on TV. Court has stayed that order, and it is expected that Broadcasting Ministry will reverse this order)

– Expansion of Direct to Home (DTH) service is also growing at a healthy rate with 16% subscription revenues in urban + rural areas. Advertisements revenue in TV, on the other hand, is growing at a rate of 14% annually

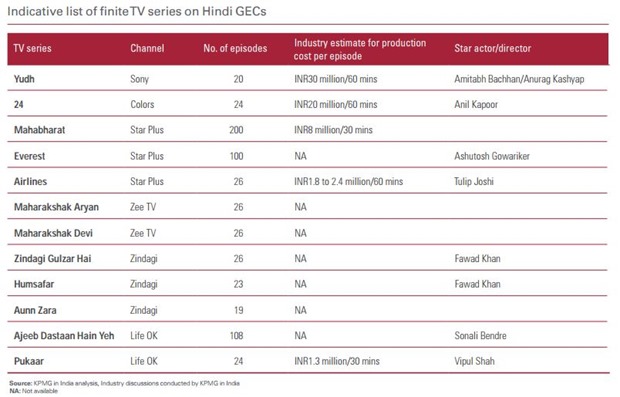

– Amitabh Bachchan starrer Yudh was the most expensive TV show with a production cost of Rs 3 crore for every 60 minutes; Diya Bati aur Hum with a TVT (TV Viewership / 1000) of 10,651 was the most watched fiction series meanwhile Comedy Nights With Kapil with a TVT of 7090 was the most watched non-fiction series on TV

– Subscription revenue from DTH services amounted to Rs 7500 crore, which will grow 22% CAGR to reach Rs 20k crore by 2019. But yes, the current growth is less than expected

– 61% of all households in India is now equipped with a television, as 16.8 crore Indians view TV atleast once a week. This makes us world’s second largest TV viewership market, first being China

– Number of Cable and Satellite (C&S) subscribers grew to 14.9 crore, which increased 10 million last year (excluding DD Direct, its 13.9 million or 82% of all TV viewers!) It expected that C&S subscribers will swell to 17.5 crore by 2019, which would be 90% of all TV households

– Category-A movies in Bollywood continue to hold dominance over the film industry, but overall the growth was less than expected. Tier 2 and Tier 3 cities now hold the key to expansion

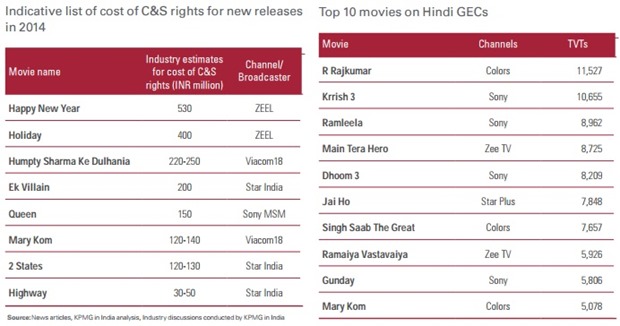

– Happy New Year, the biggest blockbuster of 2014 had the highest cost of cable rights at Rs 53 crores, followed by Holiday, which was sold at Rs 40 crore for TV viewers. R. Rajkumar with a TVT of 11,527 was the most widely watched movie on TV.

– On an average, the upper limit for a single film deal with cable rights increased from Rs 20 crore to Rs 75 crore in 2014

– Media and Entertainment industry witnessed 61 transactions pertaining to mergers, joint ventures and acquisitions, worth Rs 14,280 crore in 2014 (Reliance’s acquisition of Network 18 Media & Jagran Group’s acquisition of Radio City were the biggest such transactions)

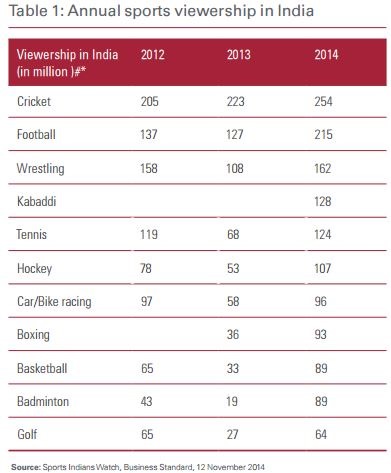

– Although Cricket ruled the charts for Sports related media consumption, alternative sports are slowly but gradually increasing their share. Pro Kabaddi League, for instance, resulted in viewership of 6.6 crore for the first game of the season last year

– As of 2014, there were total of 99,360 print publications in the country, out of which there are 13,350 dailies and 86,310 periodicals. Out of them, over 40% are in Hindi and 47% are in other regional languages

– Overall, the total market for Print in India is Rs 26,300 crore, out of which Rs 17,600 crores is generating from Advertisement revenues, and Rs 8700 crore from circulation based revenues. Rs 24,900 crore of this figure originate from newspapers, and only Rs 1400 crore is being generated from magazines,

You can view the full report here.

What happens these days is there is no more want for story line. Action and drama are selling like hot cakes, that is what the entertainment industry is providing. Hence, the growth in the sector.