Mobile phones are increasingly playing an important role in imparting Banking services to Indians. Given the penetration of mobile phones in rural areas, mobile banking is playing an important role in bringing financial inclusion to millions of Indians in rural areas, which was not possible previously.

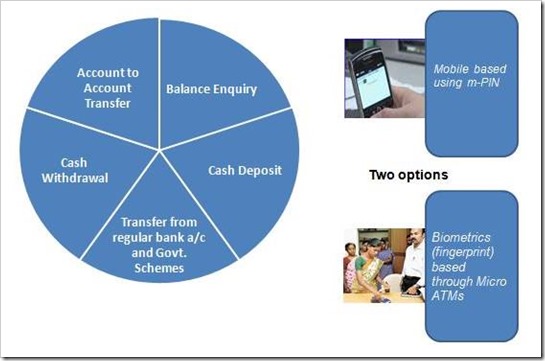

In April of 2010, Government of India approved a framework for “Delivery of basic financial services using mobile phones”, which put forth opening of a no-frills banking accounts that performed 5 basic transactions – cash deposit, cash withdrawal, balance enquiry, money transfer from one mobile linked account to another and money transfer from mobile linked account to a regular bank account.

One of the mandate of this process was to ensure that these banking services be provided at reasonable charges to customers, for which TRAI has initiated comprehensive consultation process last year.

Based on the comments from stakeholder and analysis of inputs, TRAI came up with the following:

1) The telecom service providers can collect charges from subscribers for delivering USSD based mobile banking services.

2) For each outgoing USSD session initiated by the subscriber, the tariff should be limited to Rs. 1.50 per USSD session.

3) Every telecom service provider should facilitate note only the banks but also the authorized agents for the banks to use SMS, USSD and IVR to provide mobile banking services to banks’ customers.

4) Maximum number of stages for completion of USSD based mobile banking transaction has been increased to five, from previous 2 stages.

According to the TRAI press release, these amendments have now been made in Mobile Banking regulations 2013 and these tariffs will come in to force from 1st January 2014.

[Source: TRAI press release]