Are too many Tech Startups focusing on frivolities rather than Life-changing Technologies?

In an interview at the TechCrunch Disrupt conference on Monday, VC and Founder of investment firm The Social+Capital Partnership, Chamath Palihapitiya riled up a few souls with his sweeping statement, saying that entrepreneurs and VCs should be “utterly ashamed” of themselves for focusing on frivolities rather than on life-changing technologies.

Without naming the company, but being more than obvious, Chamath referred to SnapChat as a “rehash of ideas from 2003”.

For the uninitiated, Snapchat is a photo messaging application developed by four Stanford students. Using the app, users can take photos, record videos, add text and drawings, and send them to a controlled list of recipients.

Users set a time limit for how long recipients can view their photos, up to 10 seconds, after which it will be deleted from the recipient’s device and the company’s servers. Snapchat raised $475,000 in its seed round and an undisclosed amount of bridge funding from Lightspeed Ventures.

Pahilapitiya on the other hand wanted people (entrepreneurs and VCs) to focus on building technologies that would have trillions of dollars of ramifications. He gave Silicon chips and PCs etc as examples of these life-changing technologies.

While I do agree with Chamath’s words about the lost focus in the startup world, I think he’s reminiscing a long-lost golden past.

[box type=”shadow” ]VC funding has, mostly, never been about revolutionary products, but always about incremental gains on a certain product which has already gained some kind of traction.[/box]

And, there is of course a big market for copy products that do better things (or more things), than their predecessors.

Having been a Facebook (essentially not a new idea, but a better Social network) executive himself, he should give the benefit of doubt to the founders in the current generation.

There are many examples for such companies. Google, now worth billions of dollars was essentially, again, a better search engine.

Not to mention, the inherent risk in funding any venture; a VC is basically throwing against a wall and seeing what sticks, even while assuming that the wall is not imaginary.

On the flip side, Chamath’s statement has also been taken too much out of context, with people vilifying him for his hyperbole and hypocrisy. See the video of the conversation yourself, and you’ll see that he has his heart at the right place; not his babbling mouth though.

The problem, in my opinion, is that technology has become too synonymous with Web and Internet and the un-sexy, but real problems like Energy, Healthcare and Education etc have taken a beating by being termed as Product companies.

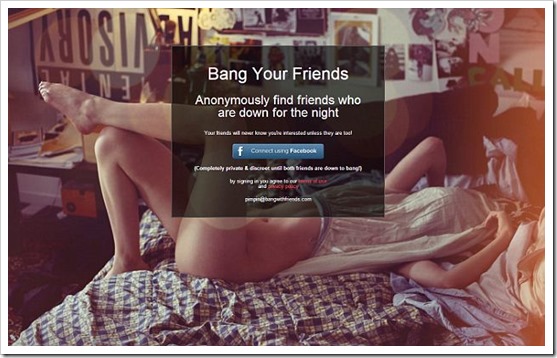

As an entrepreneur, it really hurts when you see apps like ‘Bang With Friends’ (Anonymously find friends who are down for the night!! Yes, that’s what they help you do. A ‘sex’y problem indeed) , launching $1 million rounds and getting all the VC firms swarming like bees to get it on the action (pun intended).

All this while VCs shy away from Clean tech, quoting that they are under performing. But this set of performance statistics on investment into private cleantech companies, published by Cambridge Associates shows that the deals produced a gross IRR of 6.6% through the end of Q3 2012, and a gross total value to paid in capital multiple of 1.2x. That’s not remarkable in VC terms, but it is definitely not as murky as it is made out to be.

I think that a balance in portfolio of the VC firms will do good to the society in general, and the world at large.

What do you guys think?

Well said, and agree with most of your points. Commercial viability of the idea and the venture is critical for the investors and for the industry as a whole. Most “life changing” technologies emerge as a result of some commercial venture or sometime even as a side effect.

Also, there are a number of VCs who are investing specifically in CleanTech or Education sectors, but that number being small is expected.