India Doubles its Millionaires!

It is quite surprising to see the wealth of High Networth Individuals soaring drastically even though we are just coming out of a global recession. Last couple of years have been tough economically through-out the world – but the wealthier seem to have gone even more wealthier, while the middle class & lower class seem to struggling even more.

According to the World Wealth Report recently released by Capgemini and Merrill Lynch Wealth Management, most countries in the world have increased their HNI (High Net-Worth Individuals) count. While, India has more than doubled it – maximum compared to any other country in the world.

|

Indian HNI growth (past 5 years) |

|||

| Year of report | India | Asia-Pacific | World |

| 2005 | 70,000 | 2.3 mn | 8.3 mn |

| 2006 | 83,000 | 2.4 mn | 8.7 mn |

| 2007 | 1,00,015 | 2.6 mn | 9.5 mn |

| 2008 | 1,23,000 | 2.8 mn | 10.1 mn |

| 2009 | 84,000 | 2.4 mn | 8.6 mn |

| 2010 | 1,26,700 | 3 mn | 10 mn |

| Source: Capgemini, Merrill Lynch Wealth Management | |||

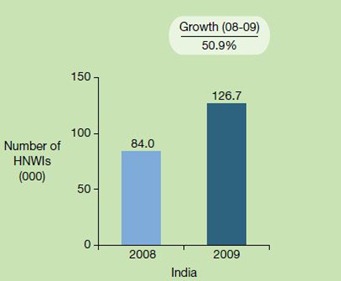

In 08-09, India had 84,000 HNI’s which grew by 50.9% to take to the number to 1,26,700 HNI Indians !

In Asia Pacific region, Hong Kong saw the maximum rise with 105% growth in number of HNIs followed by India (50.9%) and China (31%).

I think one of the main reasons for such kind of growth in India is appreciation of stock market in India. The market capitalization increased 103 per cent in 2009, compared to a dip of 64 per cent in 2008.

Here are some of the highlights of the Report

- The world’s population of high net worth individuals (HNWIs) grew 17.1% to 10.0 million in 2009.

- The world’s population of high net worth individuals (HNWIs) returned to 10 million in 2009, increasing by 17.1% over 2008.

- HNWI financial wealth increased 18.9% from 2008 levels to $39 trillion. After losing 24.0% in 2008, Ultra-HNWIs saw wealth rebound 21.5% in 2009.Ultra-HNWIs increased their wealth by 21.5% in 2009.

- In terms of the total Global HNWI population remains highly concentrated with the U.S, Japan and Germany accounting for 53.5% of the world’s HNWI population, down slightly from 2008.

- The Asia-Pacific HNWI population rose 25.8% overall to 3.0 million, catching up with Europe for the first time.

- The Asia-Pacific region was home to eight of the world’s ten fastest-growing HNWI populations, led by Hong Kong (104.4%) and India (50.9%).

- Asia-Pacific HNWI wealth surged 30.9% to $9.7 trillion, more than erasing 2008 losses and surpassing the $9.5 trillion in wealth held by Europe’s HNWIs in 2009.

- In India, real GDP growth increased to 6.8% in 2009 from 6.1% in 2008.

- Market capitalization in India and China almost doubled

[…] of India’s growth potential in terms of disposable income as well as spending power. India’s millionaires are increasing at crazy pace and Harley wants to be a part of this […]

Good but by black money

Good but by black money

Good but by black money

Good but by black money

A good sign for Developing Country like ours. Alas it would have accompanied with similar trends in other areas like literacy, Sex ratio, forest area and finally decrease in BPL numbers.

Good but by black money

To say that India has about 126700 HNIs who have assets worth USD one million (excluding residence and household assets/cars etc) and more, is indeed a very inaccurate/unconvincing information. The way property prices are quoted since last one year, I believe alone Mumbai will have more than that many HNIs.If the entire country has to included the figure will very easily turn out to have more than 100 times this figure. I think the people who do these estimations go by the data picked up from income/sales tax offices and not even property registrar’s office. I will just give one illustration. The shop from where I pick up my monthly provisions is located in the wholesale market in Navi Mumbai. The owner tells me that his stock at any time is worth Rs 100 crores and his monthly sale is about Rs 8 crores @ 2% margin. There are about 5000 such shops in one complex.Mumbai Metropolitan Region may have 50 such complexes.This is only one example. My Jeweller stocks Gold worth Rs 20 Crores and there may be 50000 jewellery shops in Mumbai. So whosoever takes the onus of giving such figures has to be living on ground and not just peek into official datalogs.

Hello Altaf,

All 3 points are valid and especially the 1st one. Although, it is good to have good number of people HNIs, I think the actual wealth can be gauged from average per capita, which is dismally low…

Rich & Poor divide is just getting wider…because if recession did not affect these guys, whom did it really affect…the middle & lower class..

Richer got more rich…while poorer got more poor !

Could any one say, If in India all the Black money is just kept under floor/ hidden some where, [*OR*], Majority of Black money is being used in some kind of profit making business. (many do business with out paying tax earning some profit, in the last they will buy some property either in the form of Gold or land), making the black money – white/legal.

The disaster thing to the economy is the Hiding the Money (especially the Black money) with out doing any use of it.

And if the Rich are having a lot of Wealth in the Form of Property/non-cash (which will not be considered as an Improving factor – if distributed to the poor).

It is an Unequal distribution of wealth of the Rich are having their property in Liquidity form (in cash) and kept it in a corner for no use, just spending it day by day.

Most of the Rich in this world are based on the Value of their Property/holdings/non-cash items. With these kind fo people there is no problem to the world.

The main problem occurs when a Rich person is hiding his wealth in the form of real Cash.

From the above figures I had done some interesting calculations.

1) Proportion of HNWIs to population :

Out of the world population of 6 billion (is it 6?) 10 million are HNWIs, a ratio of 1 HNWI among 600 people.

Out of Indian polulation of 1.2 billion 0.12 million are HNWIs, a ratio of 1 HNWI among 10,000.

Even if we grow at 50% in this area, it will take some 20 years just to catch up with world average itself and many more years (May be 100) to catch up with US, Japan and Germany.

2) Also the figures 100% may not be accurate. There are so many black money HNWIs who do not want to be identified and counted. If such people are same in all cultures, then the above figures can be taken as indicative of a country’s rich. But the poorer the country, the greater the corruption and greater the number of Black money HNWIs. I mean in many developed countries, the count of Black money HNWIs is less per thousand population compared to poorer countries.

3) Also the ratio of HNWIs to population indicates wealth distribution in a country. The lesser the ratio of HNWIs/1000 it means the wealth (and power) are concentrated in fewer hands reflecting the rich – poor divide in a country.

From this view if you look at Point 1, you will know that in Inida wealth is concentrated in fewer hands compared to the whole world and by greater margin if you compare with US, Germany, Japan.

Really a good working

i have up dated my knowledge about HNWIs

now can you provide me the list of first twenty rich persons of India.

thanks