Automation in Banking: HDFC Deploying A Robot For Automating Banking Services!

After making a dent in IT industry, food sector & manufacturing, automation and robotics have now ventured into the banking industry; and there can some serious side-effects to this disruption.

HDFC Bank is all set to deploy a robot inside one of their branches, thereby introducing automation via robotics into the banking industry. No other Indian bank has ventured into this new technological realm, thereby making HDFC Bank the first one to adapt this new innovation.

Under HDFC Bank’s ‘Project AI’ (Artificial Intelligence), this would be their first product.

Contents

What Will A Robot Do Inside HDFC Branch?

As per initial reports, this robot would be deployed at one of the Mumbai branches, a location where personalized services like consulting senior citizens and wealth management is not the prime action.

This robot would work more or less like a receptionist, or a counter which states, ‘May I Help You’ to customers just entering the branch.

We are assuming that the robot would be having a touch screen displayed on it’s chest, wherein options like cash withdrawal, demat account enquiry, locker facility, fixed deposit etc would be displayed. The customer would be prompted to select one of the options, and a map of the branch would be displayed, showing ‘Take Me There’ option.

Hence, this new robot inside the HDFC branch would act more like a helpful bank employee, who can guide the customer to the exact location where he or she wants to go.

The Future Of Robots In Banking Industry

In future, HDFC has some stellar plans related with automation and robotics, embedded into the banking system.

Technologies such as facial recognition, voice recognition would be gradually included into the robot, thereby making automation more prominent and most probably, replacing humans in the process.

A good example can be lead nurturing. Say a customer has filled details related to home loan on HDFC’s website. Now, when he or she arrives at the branch, the robot would quickly recognize the customer and provide the required information instantly, without wasting anyone’s time.

Robots Inspired From Japanese Banks?

HDFC’s latest salvo at robotics is clearly inspired from Japanese banks, which had introduced robots last year.

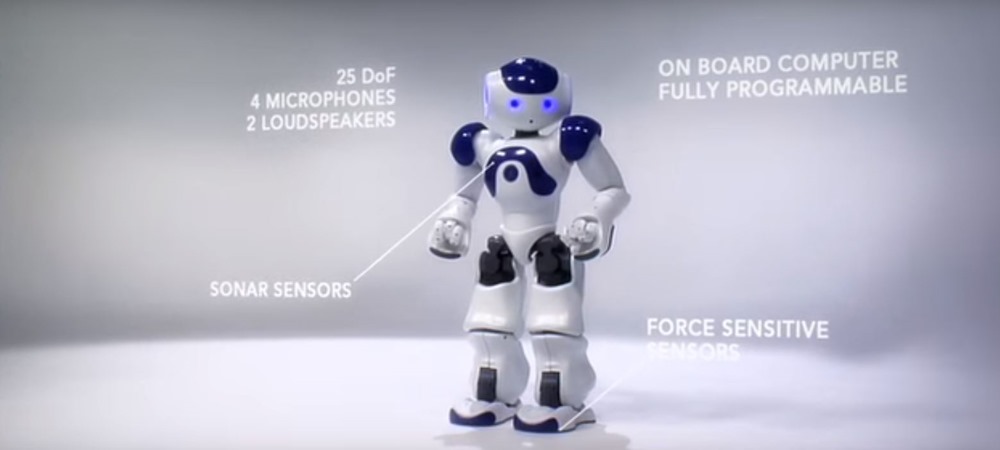

Mitsubishi UFJ Financial Group, which is one of the largest banks in Japan deployed robots inside their two branches in April last year. This robot, named Nao, was a 1.11 feet humanoid, developed by French company Aldebaran Robotics, which is a subsidiary of Japanese telecom and Internet firm SoftBank.

Powered with a camera fitted on forehead, Nao can recognize facial expressions and the tone of the voice to deliver precise service.

As per The Guardian, this is the way Nao greets when a customer enters the branch: “Hello and welcome. I can tell you about money exchange, ATMs, opening a bank account, or overseas remittance. Which one would you like?”

Later in July, Mizuho Financial Group Inc., another major bank in Japan, introduced a 121 cms tall humanoid called Pepper in their branches, to serve their customers. Pepper was also built by one of the subsidiaries of Soft Bank.

Will Automation In Banking Lead To Job Loss?

Yes, and the job loss would be massive.

As per a Citi Bank report, around 30% of all jobs inside banks would be terminated due to increased automation in various banking services.

The report said, “Fintech is forcing banking to a tipping point,”, as they proved that between 2015 and 2025, one third of all banking jobs would disappear.

Former Barclays CEO Antony Jenkins has termed this as ‘banking industry’s Uber moment.’

Automation for conducting highly sophisticated operations like financial consulting and loan approvals etc would have to be handled by humans; however monotonous and repeated tasks like customer service and form checks can be very soon handed over to robots, thereby killing more jobs than it can create.

Do you think that robotics and automation can disrupt banking industry? Do let us know by commenting right here!