Reliance Earnings & Share Buyback Plan – Falls Short of Investor Expectations !

What an oxymoron! Reliance Industries (RIL), the largest Indian conglomerate, is going through a stagnation phase in terms of its earnings performance, yet being the country’s most valued firm.

For almost a year now, RIL has been a dragger on the benchmark indices – with its share price dipping by almost 35% in 2011; adversely hit by depressing refining margins, fall in KG basin gas production, lack of new project pipeline and lower income from overseas investments in unconventional sources of energy.

In addition, the petrochemical and refining major reported a sharp drop in net profit by 13.5% to Rs.4440 crore for the quarter ended December 2011. This beaten down earnings has come on the back of 40% improvement in turnover at Rs.87840 crore, which indicates benign growth in demand for the company’s products, whilst contracting refining margins.

RIL’s gross refining margins have dipped even below the Singapore benchmark of about $8/bbl, at $6.80 per barrel, dismally down from $9/bbl during a year-ago period. The group honcho has blamed the global nature of its business and weakness in economic conditions for reduced earnings in the quarter.

In order to overcome the clouds of pessimism from weak results and beaten down stock price, RIL’s management has announced a buyback program of an aggregate amount which shall not exceed Rs.10440 crore. Here’s more clarity on the buyback plan:

- Maximum Buyback spending: Rs.10440 crore

- Maximum number of shares planned to be bought: 12 crore

- Maximum Shares of Free float to be bought: 6.7%

- Maximum Shares of Total equity capital to be bought: 3.7%

- Maximum Price per share: Rs.870/-

This means that the management will be happy to buyback shares of the company at a price NOT exceeding Rs.870/- per share, which is determined as a fair value price point to deploy company’s cash reserves to reduce free float from the open market. Indirectly, it also means that the share price will find it difficult to rise beyond Rs.870/- in the near future, as a discovered value zone.

However, the company is not obliged to buyback all the 12 crore shares at a stretch, even if the stock continues to linger below the threshold price for long. The guideline is to put in place the upside limitations in terms of price and quantum of shares planned to be bought back.

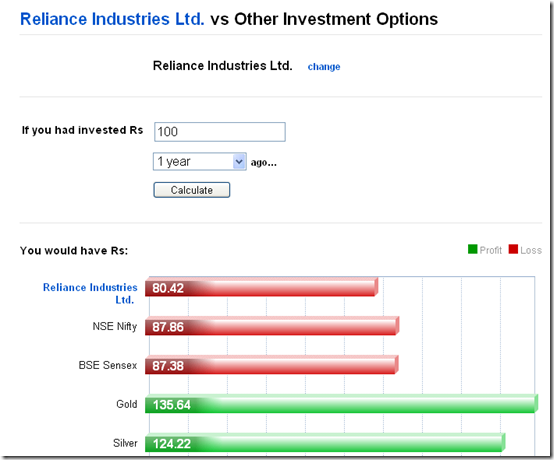

Reality Check on Your Investments in RIL [1 Year Performance]

For long, there exists a great disparity in the corporate world to announce lucrative buyback plans to enthuse investors and the real intention to execute the same. Is SEBI hearing it?

It must be pointed out that RIL had cash reserves of Rs.74539 crore at the end of the December quarter – including funds shored-up from the country’s biggest energy deal for sale of 30% stake in its 23 blocks to BP for $7.2 billion. In fact, RIL’s surplus cash reserves is likely to hit $25 billion by March 2012, if reports are to be believed.

Not surprisingly, Reliance’s ‘other income’ has surged to a high of Rs.1717 crore in its Q3-FY12 performance. Almost a third of the company’s profit before tax is constituted of non-core income rather than being topped up by the operating income.

In the near term, the share buyback will prove to be EPS accretive as the company mops-up its free float from the open market, thus improving the earnings per share for the existing shareholders. Moreover, a chunk of its non-core assets are also taken care of, while company betting its cash reserves on its own growth plans.

However, disappointing Q3 results meant that markets expected a mega-buyback plans to keep them contended – say to the tune of Rs.15-20 thousand crores. But, the markets didn’t get it. The Resultant: RIL stock dipped by 3% on the bourses today.

The point that is striking investors like an arrow is the fact that, all the new refiners compare their GRMs to that of Singapore. New Indian refiners (all of them, RIL, Essar and others) boast of better GRMs than Singapore.

I could not understand how RIL GRM can fall below that of Singapore. Its a brand new refinary and RIL has all the logistics fixed up with purchases around the world of the crude at lowest costs. Then how can its GRMs go below that of Singapore.

This is a major issue for RIL. If RIL falls behind Singapore continuously, it will fail its investors.

Even Essar is upgrading its refinary to process more complex crudes. RIL can not fall behind.

Just my two paisa :)