RBI Wants You To Pay Fees For UPI Money Transfer, Based On ‘Tiers’; Seeks Public Opinion

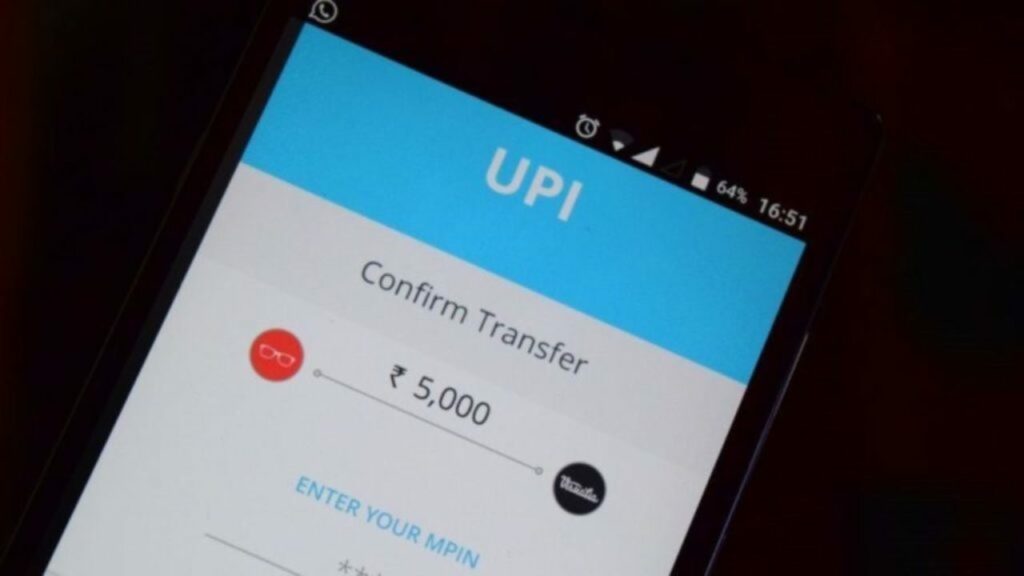

The RBI has invited feedback from stakeholders on the possibility of imposing a “tiered” charge on payments made through UPI based on different amount bands.

Back in 2020, the Union government had mandated a zero-charge framework for UPI transactions with effect from January 1, 2020.

Contents

Charges for different payment services

Feedback and suggestions will be open till October 3.

It wants to structure its policies and streamline the framework of charges for different payment services or activities, such as UPI, IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and payment instruments including debit cards, credit cards, and prepaid payment instruments (PPIs).

Transaction fees

The central bank likened UPI to IMPS which incurs charges for fund transfer transactions.

With this it could be argued that the charges in UPI need to be similar and that a tiered charge could be imposed based on the different amount bands.

At present there are no costs incurred by users or merchants for payments made through UPI.

Merchant discount rate

Going a step ahead, if UPI transactions are charged, then merchant discount rate (MDR) should also be imposed based on the transaction value.

Either this or fixed amount be charged as MDR irrespective of the transaction value.

Further, it has sought feedback on whether it should decide on the charges or the market be allowed to determine if charges are introduced at all.

MDR for debit cards

For debit cards, RBI has sought feedback on whether MDR for debit cards be uniform across merchants, irrespective of turnover.

Further, the RBI has asked whether RuPay cards can be treated differently from other debit cards affiliated to international card networks in terms of MDR.

Cost of enabling payment

The government had made the MDR for RuPay debit cards (and UPI) zero, effective January 1, 2020.

The RBI has argued that merchants could be charged only for the cost of enabling payment which is similar to that for a debit card.

The other element of cost could be recovered by the issuer from the credit cardholder separately.

Comments are closed, but trackbacks and pingbacks are open.