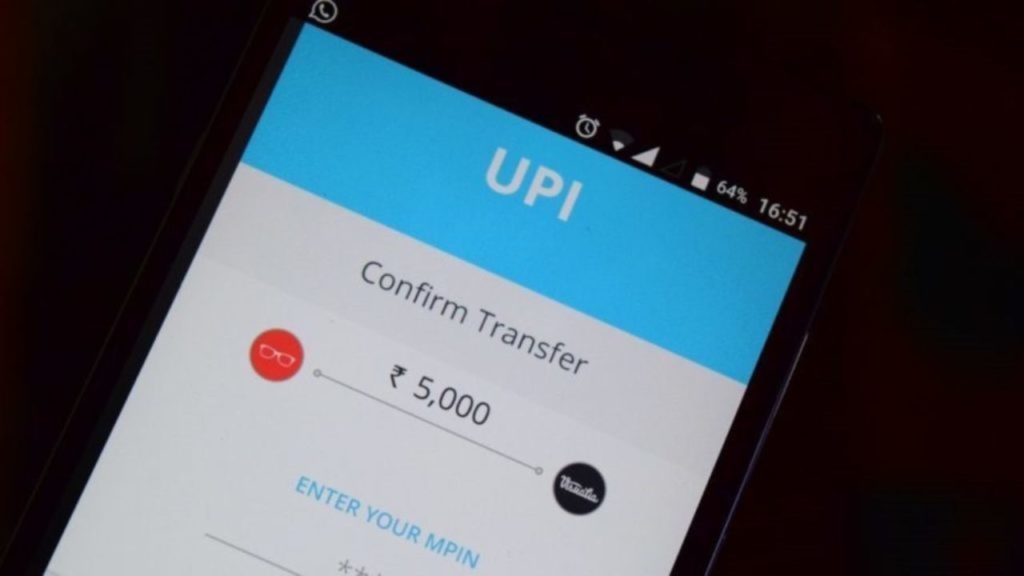

Use Your UPI To Withdraw Cash Across All ATMs, No Need For Card! RBI Issues Rules For Interoperable Cash Withdrawal From ATMs

On May 19, guidelines have been issued to all the banks for the interoperable card-less cash withdrawal as well as ATMs using the Unified Payments Interface (UPI) facility by Reserve Bank of India (RBI).

The central bank in its release said that soon the option of card-less cash withdrawals shall be provided by all banks, ATM networks as well as White Label ATM Operators (WLAO).

NPCI Advised To Facilitate UPI Integration

The RBI said that the National Payments Corporation of India (NPCI) has been advised to facilitate UPI integration with all the bank as well as ATM networks.

While UPI would be used for customer authorisation in such transactions, when it comes to the settlement, it would be done through the National Financial Switch (NFS) or ATM networks.

The RBI said that such transactions shall be processed without levy of any charges other than those prescribed under the circular on Interchange Fee and Customer Charges.

The central bank said in the release that withdrawal limits for such transactions shall be in-line with the limits for regular ATM withdrawals.

Interoperability To Be Allowed: RBI

In its April monetary policy meeting, the central bank said proposed to allow interoperability in cardless cash withdrawal transactions at all banks and ATMs using the UPI facility.

The central bank said that the frauds such as skimming, card cloning and device tampering can be prevented if the card is not needed for the cash withdrawal transactions.

Comments are closed, but trackbacks and pingbacks are open.