These 15 IPOs Gave 300% Return To Investors In 2021: Check Full List

The year 2021 was very tumultuous for all of us. It saw the economy open up after the first wave of the pandemic, close down because of the disastrous second wave, and somehow is trying to get back on its feet amid the onslaught of various variants like delta and omicron. But there is again a bright silver lining to this cathartic story as well.

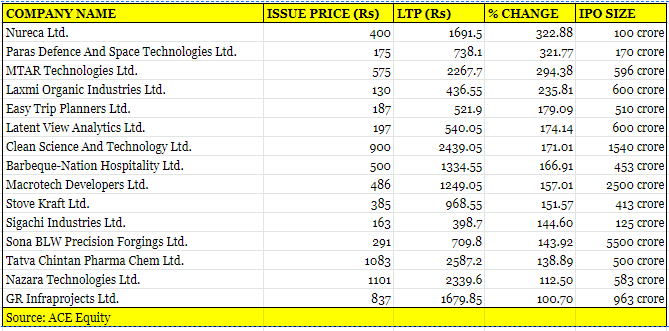

This was the year where investors witnessed a frenzy in the Indian stock market. This was the year marked by many big-ticket IPOs like Paytm, Nykaa, and Zomato. Among 63 companies listed on exchanges so far in 2021, 15 have offered multi-bagger returns of up to 300 percent to investors.

It was a roller costar ride for Indian investors in 2021

In 2021, the Rs 100 crore IPO by Nureca gave a return of up to 323 percent over the issue price of Rs 400. The company’s share sale offer was subscribed 40 times and it had listed at a premium of 59 percent. The Rs 170 crore issue of Paras Defence is a close second with a return of 321 percent. Shares of MTAR Tech are at third rank. It was up 295 percent over the IPO price of Rs 575. The Rs 596 crore issue was subscribed 200 times.

Laxmi Organics, (up 205 percent) Easy Trips Planners and Latent View are among the top five debutants that have nearly quadrupled investors’ wealth.

Paytm parent One97 Communications has been a disappointment for a lot of investors. CarTrade Tech (Rs 3,000 crore IPO), Fino Payments Bank (Rs 1,200 crore IPO), and Krssna Diagnostics (Rs 1,213 crore IPO) have also eroded investor wealth.

At the same time, Sona BLW, Macrotech Developers, and Clean Science made it to the list of multi-bagger debutants of 2021, offering investors between 171-139 percent returns.

The Outlook remains strong for IPO in 2022 as well

According to G Chokkalingam, Founder & MD, Equinomics Research & Advisory, “The low retail float is helping these companies sustain prices. In bigger issues, even if in percentage terms, the share float is small, in absolute terms it is still big. And when valuation comfort is not there, big issues are not able to sustain in the market.”

It should be noted that the IPO pipeline for 2022 continues to remain strong, with the behemoth IPO of LIC likely to open in the first quarter of 2022. Oyo, Adani Wilmar, Go Airline, Emcure Pharma, Gemini Edibles, India1 Payments, Pradeep Phosphates, Arohan Financial Services, and Northern Arc Capital are also gearing for public IPO as they have already received SEBI approval for public issues.

According to EY, strong domestic and global demand is expected to continue to contribute to positive IPO activity. However, there could be headwinds resulting from the lingering pandemic in Europe, together with the impact from higher inflation and interest.

Comments are closed, but trackbacks and pingbacks are open.