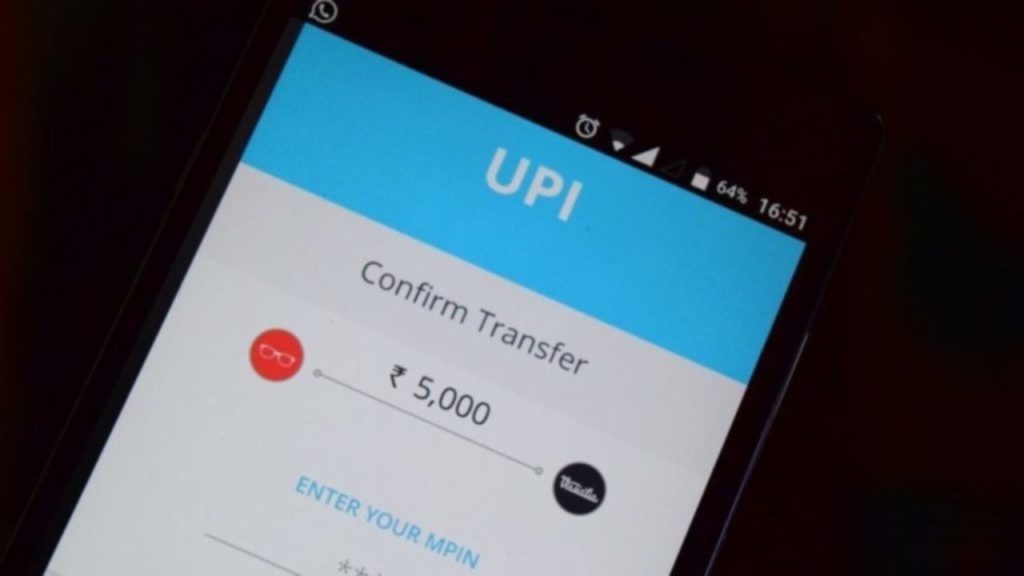

Retail Investors Can Now Buy Rs 5 Lakh Shares Via UPI Payment! How Will It Work?

Markets regulator SEBI has allowed individual investors applying in IPOs to use Unified Payment Interface (UPI) for application amounts up to Rs 5 lakh.

Put simply, individual investors can use UPI for up to Rs 5 lakh payment in public issues.

How It Will Work

They will have to provide their UPI ID in the bid-cum-application form submitted with any of these entities — syndicate member, stock broker, depository participant and registrar to an issue and share transfer agent.

The new guidelines will be effective for public issues opening on or after May 1, 2022.

The decision was taken after National Payments Corporation of India (NPCI) assessed the readiness of systems required at various intermediaries to facilitate the processing of applications with increased UPI limit.

Gap In Implementation

It found that a hike in the limit was required, SEBI said.

It had decided on the hike back on December 9, 2021.

The mechanism was implemented after a gap because banks, other payment aggregators, stock exchanges and other stakeholders had to test the new system and payment software.

NPCI confirmed that as on March 30, 2022, more than 80% of SCSBs, sponsor banks, UPI apps have conducted the system changes and have complied with its provisions.

Hiked Limit

Accordingly, SEBI decided all individual investors applying in IPOs can use UPI for up to Rs 5 lakhs.

The limit earlier was Rs 2 lakh.

In December 2021, NPCI increased the per transaction limit in UPI from Rs 2 lakh to Rs 5 lakh for UPI-based Application Supported by Blocked Amount (ASBA) in Initial Public Offers (IPOs).

Comments are closed, but trackbacks and pingbacks are open.