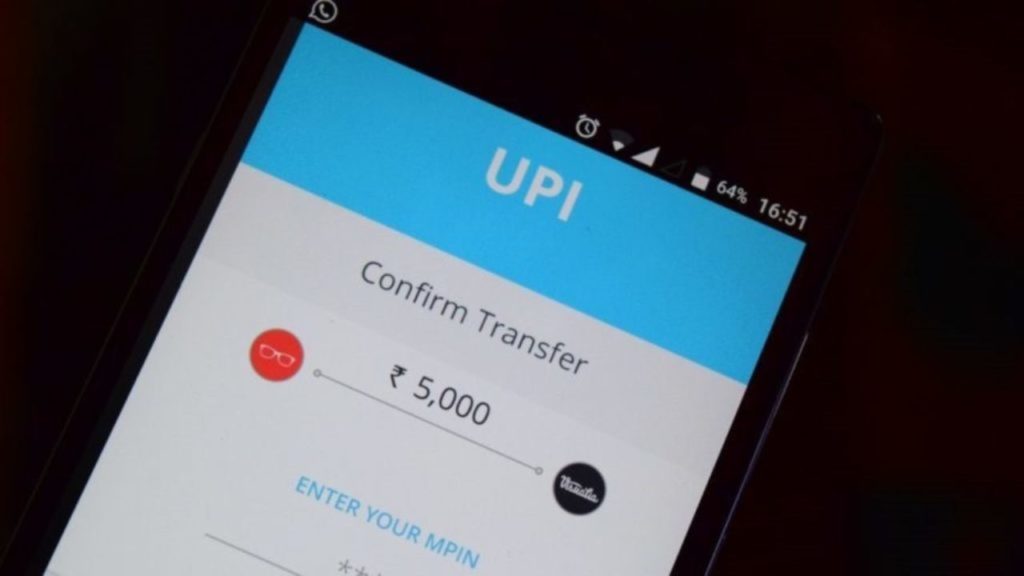

Voice Based Payments Using UPI, Without Using Internet! NPCI’s Latest Innovation For Feature Phones

After developing key digital payments railroads such as the Unified Payments Interface, Fastag and Aadhaar Enabled Payment System ,the National Payments Corporation of India (NPCI) has now commenced the testing of a voice-based payment service for the users of feature phones in low connectivity zones.

Contents

No Need For Stable Connection

Most probably the new service will be implemented using the interoperable UPI protocol as per the reports.

So, the feature phone users will not need a third-party app or a stable internet connection to complete the transactions.

The project is named as the “Interactive Voice Response” or IVR payments project.

Ongoing Beta Testing

Presently, it is going through beta testing and under the provisions of the Reserve Bank of India’s Regulatory Sandbox, the pilot program is being monitored by the bank.

But sources say that following the completion of the first phase of testing, a larger rollout would be subject to RBI approval.

Also this system was developed by Bengaluru-based fintech Ubona Technologies, with a private sector bank now facilitating transactions on the backend according to the sources.

Reportedly, the NPCI and the RBI are exploring several feature phone-based payment options.

The research is to eliminate the need for an internet connection or costly authentication hardware such as a biometric scanner or a point of sale device.

How Does It Work?

With this implementation, the feature phone users would be able to conduct merchant payments as well as peer-to-peer transactions by simply generating an authentication PIN connected to their bank accounts, debit card and registered mobile phone number.

Ths is similar to the method used to generate the UPI PINs, as per the latest report claimed by NPCI.

Further, the feature phone users will be able to produce authentication PINs through a common dial-in service, which may be operated by NPCI.

Moving ahead, this PIN can be used in merchant points, and the account holder.

They can then use their feature phones to select the payment size and merchant details through a Dual Tone Multi-Frequency (DTMF) system.

This would further assist the user through the two-factor authentication (2FA) flow in local languages.

The DTMF system is a technology that allows callers to utilise keypads that correspond to the number of the menu choice to choose preferred selections on touch-tone phones.

The other part of this service involves acquirer banks providing a proxy identity number to their merchants.

Basically, it can be used to validate the transaction’s acceptance.

With the existing UPI network’s, interoperable standards allow two or more banks to communicate and vet small-ticket payments in real-time.

Work To Be Done

So far “There are several legs of this payment system which need to be solved for mass adoption, such as strengthening security and access, as well as enabling banks with concurrent calling infrastructure that can handle thousands of calls at a time. However, these considerations are for the future when NPCI and RBI allows a larger rollout of this service. The initial results are promising,” sources said.

Comments are closed, but trackbacks and pingbacks are open.