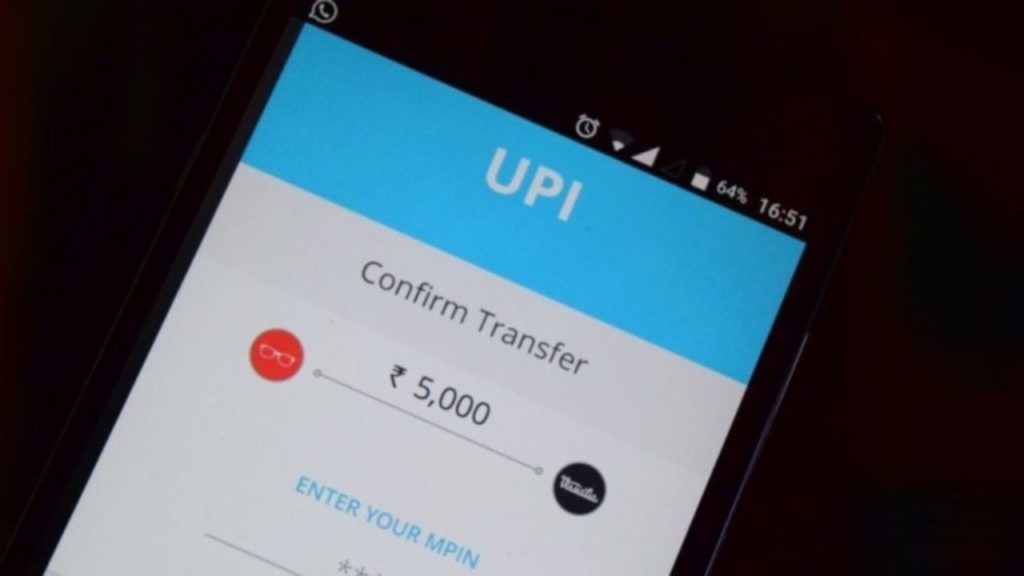

UPI Payments Won’t Work After Midnight Between These Hours: Here’s The Reason Why?

The UPI platform of National Payment Corporation of India (NPCI) will go under the upgradation process

Recently, NPCI announced on its Twitter account that over the course of next few days, The UPI platform of National Payment Corporation of India (NPCI) will go under the upgradation process. Read the story to know more.

Better Payment Experience:-

The National Payments Corporation of India (NPCI) is an umbrella organisation for operating retail payments and settlement systems in India.

Recently, NPCI announced on its Twitter account that over the course of next few days, The UPI platform of National Payment Corporation of India (NPCI) will go under the upgradation process. According to the digital payment platform the upgradation process may cause inconvenience to users as it will take place during 1AM to 3AM. However, there has been no clarity provided on the exact number of days as NPCI said that it might take “a few days”. NPCI has recommended users to avoid making payments during the time period.

The official twitter account of NPCI read that they are upgrading their UPI platform in order to provide its users with better and safer payment experience. Also they added that UPI users may have to face some inconvenience from midnight 1am to 3am.

For real-time payments between peers or at merchants’ end while making purchases, the Unified Payments Interface run by NPCI is used.

NPCI also clarified how its Information Security Team is managing as well as mitigating cyber threats by leveraging technologies in a way that its deployment is appropriate for use and using procedures that are adopted from various practices as well as guidelines which are best in industry and is implemented by professionals who are constantly trained. Also in order to combat the ever evolving cyber threats various technologies have been deployed in order to upgrade its security posture leveraging a multi layered defence approach.

Surge In Digital Payments:-

On the BHIM UPI platform, there are currently 165 banks which are listed. A record 2.94 million users on iOS as well as 155.14 million users on Android as of October 2020 are recorded on NPCI. As digital payments are contactless, they are considered safer and hence the pandemic season has seen a surge in digital payments.On top of that, increasingly more users are drawn due to discount coupons as well as cashback offers.

For the third consecutive month, Phonepe beat Google Pay and dominated the UPI market. In the last month of 2020, PhonePe processed 902.3 million transactions, which accounted for Rs 182,126.88 crores.

Comments are closed, but trackbacks and pingbacks are open.