Google Pay, PhonePe Are India’s Biggest UPI Apps; Paytm Ranks #3 In UPI Race

If there’s anything that is changing frantically and on a very grand scale during this pandemic-led lockdown phase, it has to be the way everyone is flocking towards digital transactions.

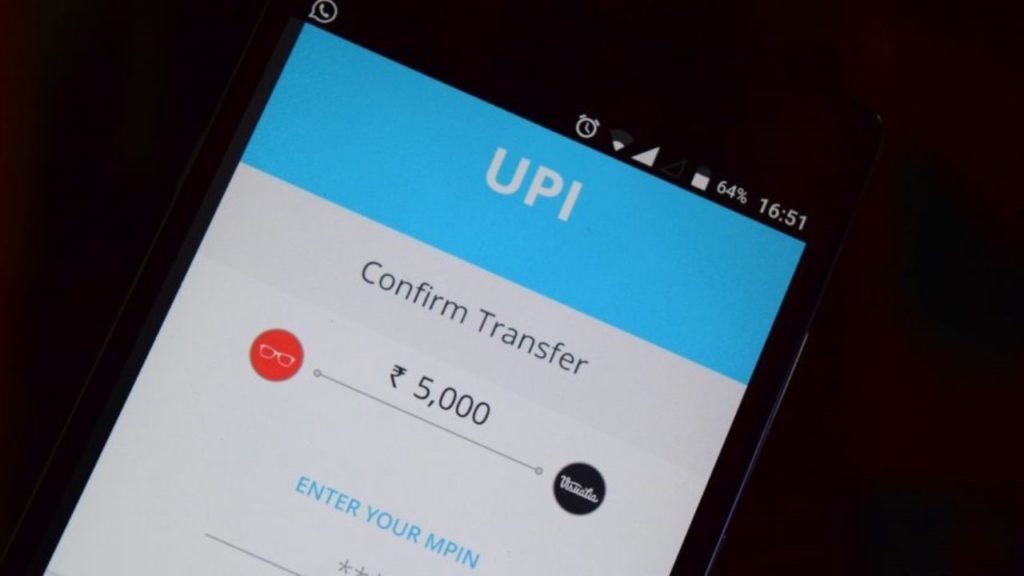

In fact, right since demonetisation in Nov 2016, UPI or Unified Payments Interface transactions have seen a boost. Safe to say, pandemic has added on to its user base.

UPI transactions have nearly doubled, not just in value but also in the number of people using it, in just one year.

With Google Pay and Phone Pay leading the UPI market (Google Pay a little more ahead than Phone Pe), Paytm and Mobikwik follow the trend with a considerate share of users, in the same.

Contents

Let’s Compare Numbers

To help you understand the vast plunge that UPI transactions India has taken, please have a look at this year’s and last year’s numbers, depicted below.

Monthly Value of UPI transactions has crossed twice its count as compared to previous year.

- July 2019: Rs 1.46 lakh crore.

- July 2020: Rs 2.91 lakh crore.

Number of Transactions

- July 2019: 82,230 crore

- July 2020: 1.49 lakh crore

Google Pay and Phone Pe: Market Leaders

If we look closely, Google Pay is slightly ahead of Phone Pay, as its share is a little over 40%, while Phone Pe’s share almost reaches the mark.

With the two giants, occupying over half of the UPI market, Mobikwik and Paytm share a combined share of the remaining market share of 20%.

Sameer Nigam, Founder & CEO of Phone says that while entering Covid-19, Phone Pe had 11 million merchants enrolled on it, spanning over 500,000 cities.

The company plans to get onboard about 15-16 million merchants by the end of 2020.

According to market researchers and industrial analysts, such digital platforms have managed to whirl everyone in, due to the massive cashbacks they shred to benefit their users.

Phone Pe Speaks

As per Phone Pe, all the cashbacks offered by the company since the last 7 months have been lesser than their average cash back spend.

It says despite this fact, customers have a repeat rate of over 97-98% onto the platform and that is only because of Phone Pe’s security and success rate.

As of now, the company has a user-base of over 23 crore, while the monthly active users are 9 crore.

Comments are closed, but trackbacks and pingbacks are open.