EMI Moratorium Of 6 Months On Rs 30 Lakh Loan Is Rs 11 Lakh Extra Interest! (Compare The Difference)

EMI Moratorium Of 6 Months On Rs 30 Lakh Loan Is Rs 11 Lakh Extra Interest! (Compare The Difference)

The Reserve Bank of India (RBI) in a press conference dated March 27, 2020 announced an EMI moratorium of 3 months on repayment of term loans outstanding on March 1, 2020. The moratorium has been further extended by 3 months more i.e. till August 31, 2020.

According to industry experts, the extension of EMI moratorium may provide relief to those facing liquidity issues but may increase the overall interest cost.

The Supreme Court on May 26 issued notices to the Centre and RBI on a plea against charging of interest on loans during the moratorium announced citing the COVD-19 resultant lockdown.

Read to find out more…

If You Opt For An EMI Moratorium, You Will be Paying More!

The Central bank had announced an EMI moratorium period to relieve many individuals, especially the self-employed, as they would have found it difficult to service their loans such as car loans, home loans etc. due to loss of income during the lockdown period.

Also the defferng the loan repayment during the moratorium period neither incurs penal charges nor impacts the credit score of borrowers and their accounts won’t be tagged as Non Performing Assets (NPAs).

Naveen Kukreja, CEO and Co-founder, Paisabazaar, explained, “The accrued interest on availing the loan moratorium can be significantly higher in case of big ticket loans like home loans and loan against property with long residual tenure and sizeable outstanding loan amount.”

The borrowers can make one-time payment of the interest accrued during the EMI deferred period or the interest can be added to the outstanding loan and increase the EMI for remaining months.

On the other hand, borrowers can keep the EMI unchanged but the loan tenure can be extended. The number of additional EMIs or tenure will nevertheless also depend on the tenure of the loan left and the rate of interest (ROI).

How Much Extra Will You Pay If You Opt For Moratorium?

Rachit Chawla, founder and CEO Finway explained with an example, “For instance, a borrower has taken a loan of Rs 30 lakh for 20 years at 9.5% , the EMI would be around Rs 28,000. Let’s say he takes the benefit of the moratorium and does not pay for 6 months. That way he may save around Rs 1,68,000 but at the same time, the tenure period will go up by 4 years (in case he avails the option of increasing the tenure) and will have to pay back a staggering amount of Rs 11.4 lakh as additional interest.”

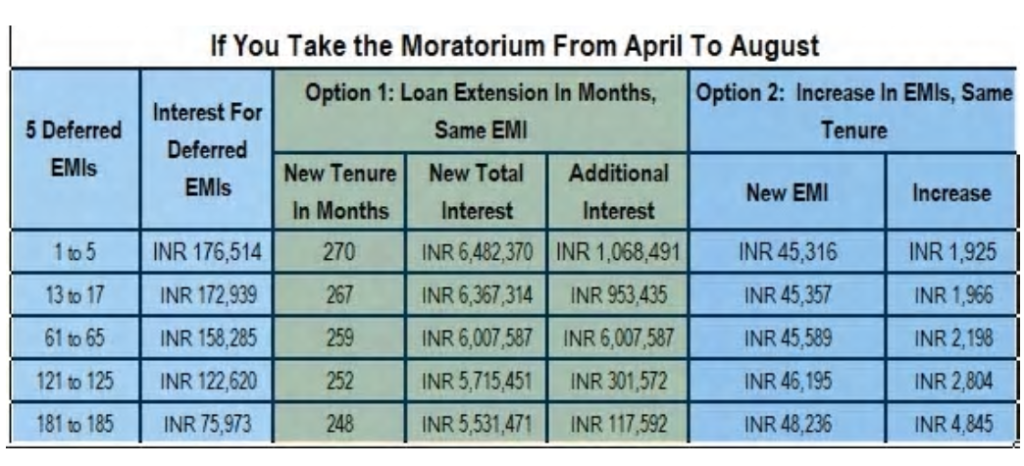

BankBazaar shared a table that shows the increase of tenure and EMIs on availing 5-month moratorium i.e. from April to August.

Image Source: BankBazaar

“In this case, it is supposed that the borrower has taken a home loan of Rs 50 lakh for 20 years and ROI is constant at 8.5%, he is required to pay 240 EMIs, where the EMI amount is Rs 43,391 per month and the total interest is Rs 5,413,879. Now, say he avails the moratorium from April to August and has two options to pay the amount. In case these are the first 5 EMIs that are deferred (he being a beginner in EMIs), the tenure will increase by 30 months to 270 months (if he opts for increasing the tenure). The new total interest will be Rs 6,482,470 and the additional interest will be Rs 1,068,491. In case he opts to increase EMIs and keep the tenure same, the new EMI he will have to pay is Rs 45,316 per month. This is an increase of Rs 1,925 per month” BankBazaar added.

The other examples given by BankBazaar take into consideration wherein the deferred EMIs are 13-17, 61-65, 121-125 and 181-185 and accordingly are the increase in tenure and EMI.

Comments are closed, but trackbacks and pingbacks are open.