This Is How Groww Is Incubating The Habit Of Investment Among India’s Millennials

India has a population of 126 crore people, and out of them, 20 crore Indians have enough income and savings which makes them eligible to become investors in financial products such as mutual funds, stocks etc.

But the reality is different: Only 2 crore Indians are invested in mutual funds or stocks. Considering that SIP-based Mutual Funds are one of the safest, and low-risk form of investment, this reality is indeed baffling.

And Groww wants to change this.

Contents

Groww Wants Indian Millennials To Invest In Mutual Funds

In 2016, ex-Flipkart employees Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal acknowledged this gap and launched a simple, easy-to-use investment platform called Groww.

Within just 2.5 years, Groww has amassed more than a million users across India. Right now, Groww provides a platform for investing in mutual funds only but plans to launch stock market investments very soon.

Recently, they secured Series A funding of $6.2 million led by Sequoia India. Earlier, they had raised $1.6 million funding from Insignia Ventures Partners, Lightbridge Partners, Kairos and others, along with previous investors Mukesh Bansal and Ankit Nagori. Y Combinator is also an investor in the company.

Groww’s focus is on tapping Indian millennials, who are moving away from traditional investments such as real estate and gold and looking for newer investment opportunities.

Highlighting this fact, Lalit Keshre, Co-founder & CEO, Groww said, “Our goal is to offer the easiest and simplest investment app to the younger generation.”

BSE has recognized the company for the “highest transaction in mutual funds” on a platform. Groww has partnered with more than 37 mutual funds and created one of the robust platforms for investment.

Investing In Mutual Funds Becomes Easy With Groww

We checked out Groww, with the intention of making a mutual fund investment, and we were pleasantly surprised: a clean UI welcomes you, and your login process is seamless. In fact, users who are logged in with their Gmail account can register and start investing in literally 3 seconds.

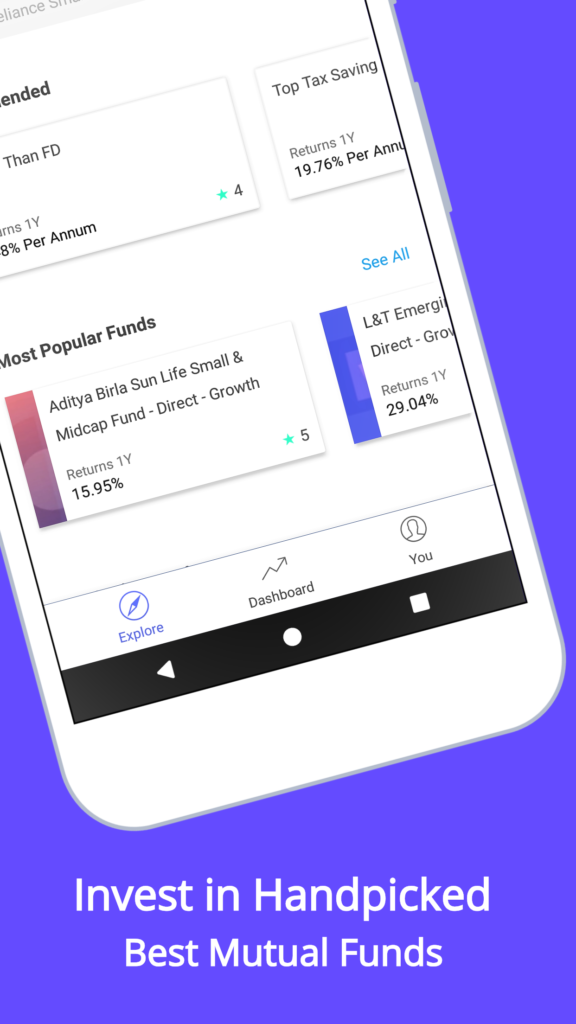

The app, which opens up for the user offers three main features: Most popular mutual funds, Handpicked Collections and Assistant, to help select the best funds for you.

We decided to go with the research work done by Groww, and clicked on Axis Bluechip Fund, which was listed under their Popular Mutual Fund category. This fund has given a 3 year return of 16.9%, and the minimum SIP investment required is Rs 1000, and the minimum lump sum investment amount required in Rs 5000.

After verifying the phone number, the system quickly processes KYC, and within a few moments, you are ready to start investing in mutual funds. The best part was, you can do payments via UPI as well as net banking. Within UPI, you can choose to pay via Google Pay, BHIM, Whatsapp, Payzapp. This makes investing literally in a click.

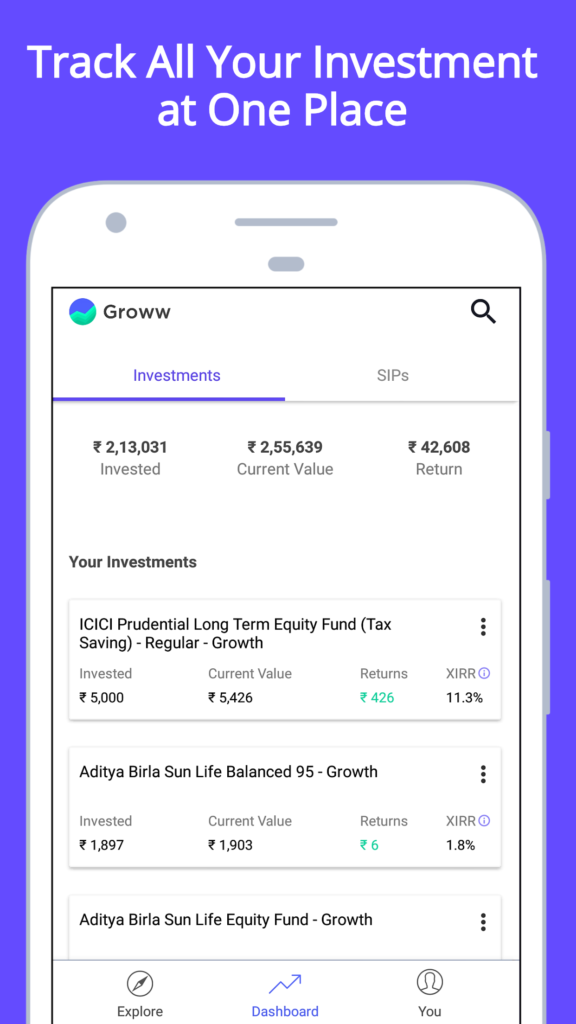

You can choose the duration of the SIP as well, which makes it completely transparent to operate. Groww Android app has more than a million downloads and is one of the fastest-growing apps on the Android ecosystem.

Common Questions Answered: Investment, Data Safety, and More

Groww has a dedicated Q&A section on the website, which answers some of the most common questions asked.

The section answers queries on data security, safety of investments done via Groww, whether NRIs can invest in mutual funds in India, process to discontinue SIP, how to track the investments, how to perform quick KYC online and more.

Here is the list of all the top mutual funds, based on performance.

Disclaimer About Investment

Investment of any form, whether in stocks or commodities, gold or real estate, mutual funds or debentures, carry some sort of risk.

But then, taking no risk is the biggest risk of all.

Mutual funds are considered relatively safer than directly investing in stocks because everyone does not have enough research experience/knowledge regarding which stocks to invest in, Investors will be able to make good returns on their investments in mutual funds since experienced fund managers manage them for millions of people.

Groww is a platform, which is backed by a strong team which understands the market, and provides you with the best options to invest.

But at the end of the day, investments are subject to market risk.

Association of Mutual Funds in India has created a website to educate investors about mutual funds, which we will recommend for all.

Comments are closed, but trackbacks and pingbacks are open.