Exponential Increase in UPI Based Transactions; eWallet Transactions Are Now Decreasing: RBI Data

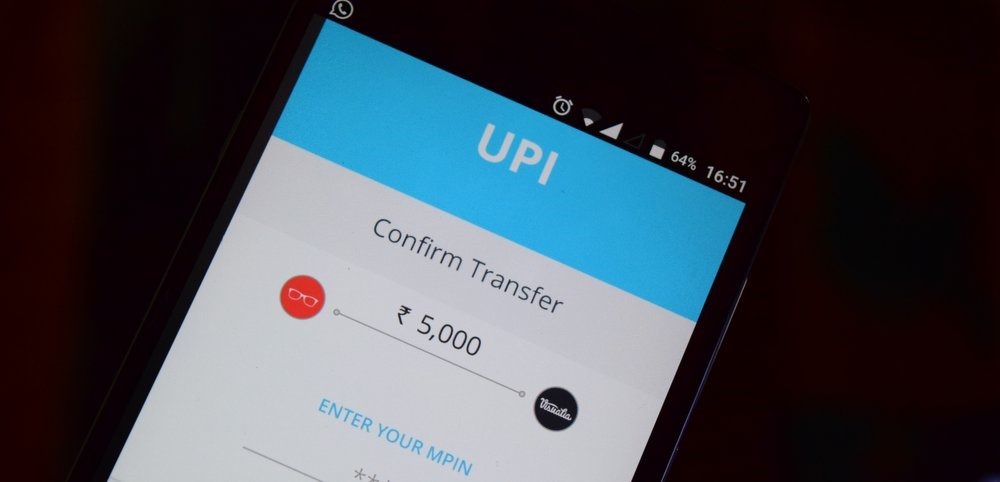

Unified Payment Interface or UPI, which was launched in April last year, is slowly but gradually becoming the most preferred platform for conducting a digital transaction.

In fact, such is the momentum, that within a year of its launch, UPI has actually overtaken digital wallets in terms of growth and expansion. And if we believe the reports, then very soon, more digital transactions would be happening via UPI apps, compared to digital wallets.

These facts and derivations have been analysed from RBI’s latest data pertaining to digital transactions.

UPI Transactions Witness Massive Growth

As per the latest numbers revealed, around 2 lakh transactions are now happening daily on UPI platform. In the month of March 2017, Rs 2000 crore worth of digital transactions were successfully processed, compared to Rs 1660 crore in January 2017. This is a massive increase of 20%, within 90 days.

Supporting UPI’s incredible expansion is BHIM App, wherein 80,000 transactions are now taking place daily; and 44 banks which have launched their own UPI app for their customers.

Confirming these details, AP Hota, managing director at National Payments Corporation of India said, “We already have 44 banks on UPI, of which 35 have their own applications available on the (Google) Play Store; BHIM is seeing around 80,000 transactions per day, and we are registering almost 2 lakh transactions on the entire UPI railroad,”

Which Transactions Are Happening On UPI?

Peer to peer modes of payments and remittances command 90% share of UPI transactions as of now, and this is not the only bad news for eWallets.

Once the BharatQR mode of digital transactions gains more popularity, then merchant transactions too will adapt UPI, and the percentage of transactions will only increase, even threatening debit/credit cards share.

And the most interesting aspect: Average value of transaction on UPI is Rs 4000, which is way more than an average transaction on eWallets.

Is This The Demise of eWallets?

The biggest market which eWallets are losing right now is merchant transactions. As per the RBI data, Rs 1800 crore worth of merchant transactions happened on eWallets in the month of March, down from Rs 2100 crore in January.

Hence, transactions from eWallets are now directly transferring to UPI platform.

Although overall eWallets accounted for Rs 4000 crore worth of transactions, compared to Rs 2000 crore on UPI in the same period. But the fact that this achievement was accomplished by UPI in a span of 12 months questions the future of eWallets in India.

While an average transaction on eWallet is Rs 250, it is Rs 4000 on UPI platform.

Experts are stating that mobile wallets are now mainly being used for online recharges, movie tickets and in some cases, offline retail outlets which adapted digital currency during demonetization phase.

Now, as PoS terminals for debit/credit cards is increasing, and as cash is coming back into the system, the usage of digital wallets has fallen considerably.

Do you think digital wallets can fight against UPI, which is independent of any platform, and supported by Govt. of India? Do let us know by commenting right here!

UPI is not advertised aggressively, even when govt. can take it to dizzy heights. There are many E – wallets advertisements compared to UPI.