Chinese Phone Brands Are Unstoppable In India; Xiaomi Rises To #2 Position, No Indian Brand In Top 5

International Data Corporation (IDC) has just released their research for Indian mobile phone market, and the biggest news is that for the first time in history, no Indian brand was able to make it in the top 5 position (both for last quarter of 2016)

Chinese phone brands have literally conquered the Indian phone and smartphone market as they accounted for whopping 46% market share for the last quarter of 2016. And the direct result of this Chinese rise was the decrease in market share of Indian brands, as they sold 19% lesser units compared to last year.

In January, we had reported that Chinese brands have conquered 40% share in smartphone market.

It is quite interesting that this growth in Chinese Smartphones has coincided with huge backlash across the country, especially on Social Media, for banning Chinese good!

Top 5 Highlights from this report

1) Xiaomi has risen to become 2nd biggest smartphone brand in India with 10.2% market share during Q4 of 2016. Last year for the same period, Xiaomi managed only 3.3% market share. This clearly showcases the good work done by Hugo Barra, who quit Xiaomi last month as their Global VP. We have already documented the meteoric rise of Xiaomi in India during his tenure.

2) If we talk about only online sales of smartphones, then Xiaomi along with Lenovo (along with Motorola) accounted for more than 50% market share. Overall, online sales accounted for 31.2% share for Q4 of 2016, and overall, the segment witnessed an impressive 10% growth compared to last year.

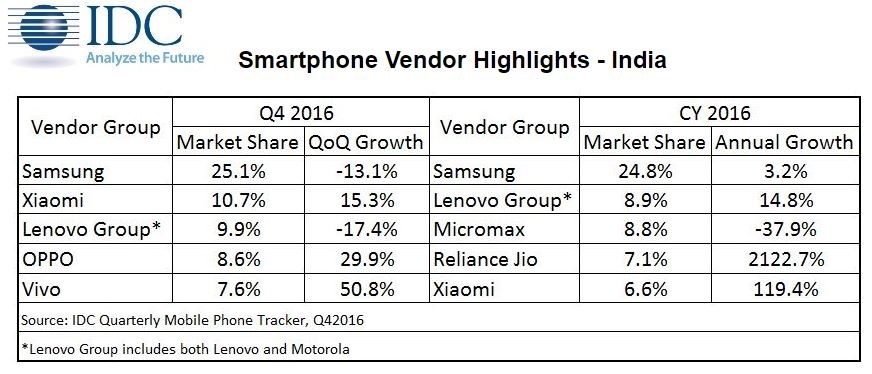

3) Overall, 10.9 crore smartphones were sold in India in 2016, and Samsung was #1 company with massive 24.8% market share. For Q4 2016, Samsung garnered 25.1% share, which is although 13.1% lesser than last quarter, but still big enough to keep them at #1 position.

4) For the first time in the history, no Indian brand was able to make it in the top 5 position for a quarter. For the last quarter of 2016, Samsung was ranked #1 with 25.1% share, Xiaomi was #2 with 10.7% share, Lenovo was #3 with 9.9% share, Oppo was #4 with 8.6% and Vivo was #5 with 7.6% share.

5) For the entire year (2016), Samsung was #1 with 24.8%, Lenovo was #2 with 8.9% share, Micromax was #3 with 8.8% share (and massive reduction of 37.9%share compared to 2015), Reliance Jio made an entry with 7.1% share and Xiaomi was at #5 with 6.6% share (and massive increase in share with 119.4% growth compared to 2015)

6) Feature phone remain the top selling mobile units with 13.6 crore units shipped, and their sales are increasing due to the high cost of smartphones. While feature phone sales reduced by 16.2% in 2015, their sales decreased by only 9.4% in 2016, which means that feature phones are here to stay for some time.

7) China’s Transsion Group, which introduced their feature phones under the brand ‘itel’, have quickly risen to #2 position in this niche for the last quarter.

For the forecast for 2017, IDC has said migration of feature phone users to smartphones may slow down, as costs of smartphones remain high, and after-effects of demonetization will hold some effect in the market. Besides, they are pretty optimistic for the rise in online sales, as the cashless mode of payments become more wide-spread.

You can access the full report here.

Xiaomi Sold 30 Lakh Redmi Series mobile phone in India till launch which very huge.