FreeCharge ‘Chat and Pay’ Allows Secure P2P Payments Over Chat in 5 Seconds

2015 was all about digital payments and 2016 seems to be about innovating further in this ever-growing industry. With Government stepping in the ensure digital payments come to the forefront, the future of cashless payments seems to be very bright.

FreeCharge, one of the leading digital payments solution provider in India, has introduced a spectacular new payment solution which authorizes payments through chats. A first-of-its-kind technology in India, ‘Chat and Pay’ will allow social payments from Person-to-Person(P2P) and between Customers and Merchants through a secure network.

Talking about the innovative solution, Govind Rajan, Chief Operating Officer at FreeCharge said, “Our ambition at Freecharge is to create a Payment OS for a Digital India. Today, we have taken a bold step in achieving this goal. Payments are often social; they are in fact a very human interaction. Chat N Pay brings this human emotion to payments, making them deeply engaging. We are confident Chat N Pay will accelerate the adoption of digital payments.”

Features of Chat and Pay

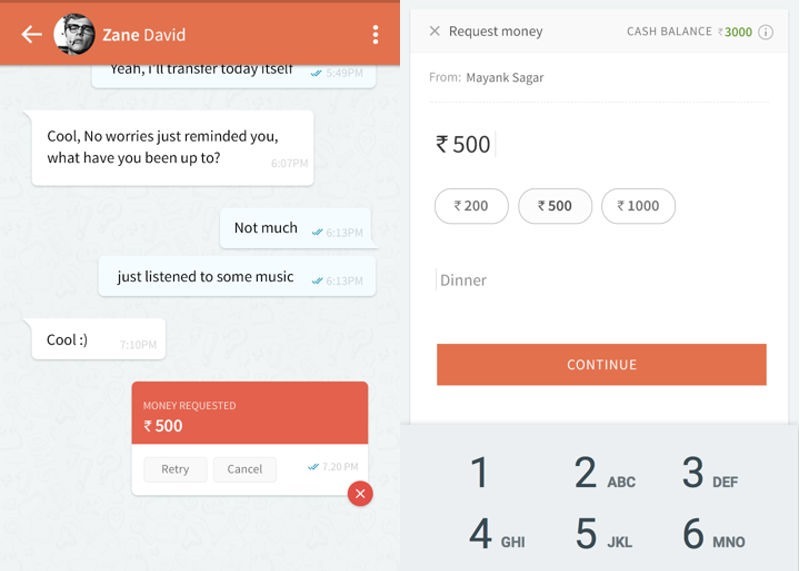

As the name itself suggests, Chat and Pay will allow you to transfer money to your friends, family and social circle through chat service from FreeCharge in under 5 seconds. It will also allow customer-merchant interface to allow transactions at merchants and direct money transfer.

The merchants will have to register for FreeCharge’s service to accept payments through Chat and Pay, which will reduce the overall transaction time to less than 1 minute. Merchants will also be able to increase the payments limit to Rs 1,00,000 after KYC verification.

All the merchants have to do is register their bank account number, geographic location and choose a customized identifier for customers to identify their service area through the app. A small interchange of messages between the customers and merchants will allow payments and acceptance of orders.

Is it going to revolutionize the payment industry?

If you look at FreeCharge’s biggest competitor, Paytm, they’re partnering with more and more offline merchants to allow digital payments offline as well. FreeCharge, on the other hand, is focusing on introducing more convenient payment solutions which also take as much time as a normal physical cash payment.

The digital wallet industry is growing at an exponential rate and the demand for innovative solutions is never-ending. A simple chat and pay service will firstly allow easier and secure transfer of digital money, and secondly will not need any capital investment to implement across big or small merchants.

Needless to say, FreeCharge will have a wide ecosystem of merchants, old and new, and create a seamless integrated service between consumers and merchants at the same time. Chat and Pay is available for Android starting today, with subsequent launch for iOS and Windows in the coming weeks.

[…] is enabling P2P payments using their app in 5 seconds; while MobiKwik is transforming rural India with cashless initiatives. […]