SEBI Bans DLF From Stock Markets For 3yrs, Stocks Down 25%. Real Estate Sector Stunned!

68 year old real estate company DLF Ltd., having market capital of more than $190 billion (Rs 11, 40,000 crore) has been banned by SEBI from entering into stock markets for three years.

DLF Ltd, along with its Chairman KP Singh and top 5 executives, including Singh’s son Rajiv Singh (Vice Chairman) and daughter Pia Singh (Whole Time Director) are included in this ban declared by SEBI.

Stock market has reacted strongly to this decision, as at the time of writing, DLF shares were down 25%, compared to yesterday’s trading price. Stock market analysts have already declared this move as devastating and disastrous for the company, which is already facing several challenges.

DLF is likely to challenge the order before the Securities Appellate Tribunal, a quasi-judicial body.

This decision by SEBI to ban DLF is regarding non-disclosure violations conducted by the organization in 2007, when they came up with their maiden IPO (Initial Public Offering). That IPO was valued at Rs 9187 crore, which was India’s highest rated IPO during that time.

Few days before the IPO in 2007, Kimsuk Krishna Sinha alleged that DLF group entity Sudipti Estates and other persons from the management had duped him of Rs 34 crore in a land deal. DLF denied any wrongdoing, and went ahead with the IPO, without mentioning Sinha’s case in the information material supplied to the potential investors (IPO Prospectus). Sinha had also filed a petition with Delhi High court, which instructed SEBI to act on the complaint and do further investigation.

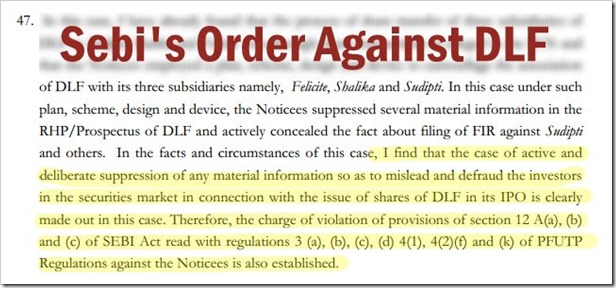

In a 43 page order released by Securities and Exchange Board of India’s (SEBI’s) whole-time member Rajeev Agarwal, it is mentioned, “I find that a case of active and deliberate suppression of information to mislead and defraud the investors in the securities market in connection with the issue of shares of DLF in its IPO is clearly made out,”

SEBI uploaded this order of banning DLF after the trading hours on Monday.

This news is very likely to impact the whole real estate industry, as investor gurus are recommending investors to stay away from real estate companies for the next few days. Panicked investors may suddenly dump their DLF shares, and choose other real estate companies, which may confuse the market even more.

Vivek Gupta,CMT – Director Research, CapitalVia Global Research Limited said, “This is big news and it will impact entire Realty sector and stock negatively. Big giants like HDIL, Indiabulls Real Estate and Unitech may continue southward journey. Investors should to stay away from these sectors as of now,”

DLF has reassured it’s investors that they have not acted against law; and all their actions are in accordance with the law. In a statement released by them, they said, “DLF and its board were guided by and acted on the advise of eminent legal advisors, merchant bankers and audit firms while formulating its Offer documents,”

[…] company DLF Ltd., having market capital of more than $190 billion (Rs 11, 40,000 crore) has been banned by SEBI from entering into stock markets for three […]