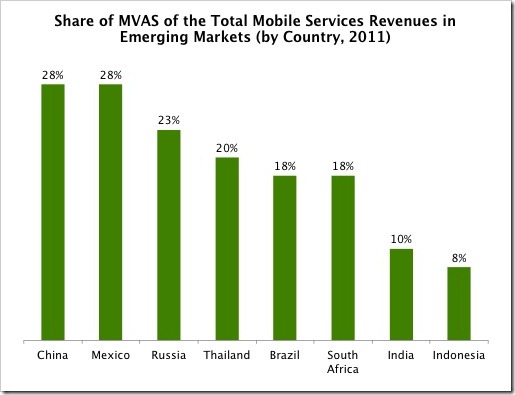

The contribution of Mobile Value Added Services (MVAS) in India to total revenues of telecom operators is 10%, according to a report. As a percentage, the revenues from value added services for operators in India are lower than most other emerging markets of the world. Increased sales of smartphones globally is seen by the study as a common factor driving growth in the MVAS domain.

According to Convergence Catalyst Research and Estimates, 28% of total revenues of Chinese and Mexican telecom operators are driven by value added services. In Russia, this figure is 20% while it is 18% in Brazil and South Africa. MVAS make up for 10% and 8% of revenues of telecom operators in India and Indonesia.

In-house app development, efficient sourcing of mobile content and a spike in mobile data and WLAN data traffic are some of the factors due to which Chinese operators are seeing more than a fourth of their revenues coming from MVAS. In Mexico, the push in revenues from this segment comes primarily from messaging services including SMSes and MMSes.

Increase in smartphone sales and SMS volumes are driving MVAS revenues in Russia while growth in mobile data consumption is working for Thai telecom operators. The report adds that nearly 35% of the online population in Thailand accesses internet through mobile devices.

Higher sales of 3G mobile devices like tablets are contributing to increased usage across all MVAS segments including messaging and mobile data in Brazil. In South Africa, MVAS contribution to total revenue has grown 125% in FY 2011 alone. The spike is said to have been fuelled by mobile money services.

Indonesian telecom operators are in the process of leveraging current trends and tapping into mobile users’ habits of accessing multimedia rich content from their handsets. Contribution of MVAS to total revenues of Indonesian operators is 8%, nearly 72% lower than China and Mexico.

The comparison of percentage contribution of value added services in total revenues and the factors driving it are a solid insight into the performance, trends and future of the non-voice domain in worldwide markets. However it should not be mistaken as a benchmark to compare the actual markets themselves.

A classic example is India, where MVAS contribution to total revenues is 10%, according to the Convergence Catalyst report. However apart from China, the Indian market is virtually unrivalled on a volume based comparison. Telecom operators in India are host to 91.3 crore mobile subscriptions, nearly two and a half times larger than North America and 35% larger than all of Africa. Commentators are looking at a spike in smartphone adoption in India as a catalyst in growth of MVAS in a market that has the second largest mobile subscriptions in the world.