New Income Tax Calculations [Union Budget 2011]

Pranab Mukherjee is done with his job of presenting the Union Budget 2011 in the Lok Sabha. The budget seems to have succeeded in fighting all populist forces – be it fiscal housekeeping, a much-needed push to the reforms initiative or an aam-aadmi’s expectations on the front of tax relief.

The Finance Minister kept the common man waiting for almost 1 and half hours before he announced his formulations for direct tax proposals before the Parliament. The Bengali babu was clear in his speech that the personal tax slabs for the fiscal 2011-12 will be more of a transitionary step closer to DTC rates to be effective from FY 2012-13.

Contents

Current Tax Slabs (FY 2010-11):

- Income upto an annual sum of Rs.1,60,000 is tax free.

- Income in the range of Rs.1,60,001 to Rs.5,00,000 is taxable at a rate of 10%

- Income in the range of Rs.5,00,001 to Rs.8,00,000 is taxable at a rate of 20%

- Income above Rs.8,00,001 is taxable at a rate of 30%

Tax Slab Raised

For the fiscal 2011-12, the FM has tweaked only the threshold income tax limit at the lowest levels of the slab which affects the commonest of the aam-aadmi. The new proposal has enhanced the exemption limit for the general category of individual tax-payers from Rs.1,60,000 to Rs.1,80,000; which will be uniform for both men and women. This will provide a uniform tax relief of Rs.2000 to every tax payer of this category.

Incremental Sops for Senior Citizens

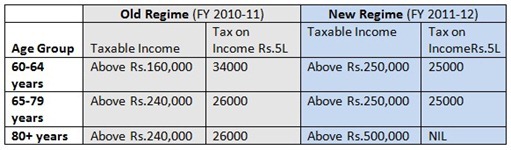

The Union Budget 2011 has been generous for the citizens of the age group from 60 years and above. Pranab’da announced special category of tax-paying senior citizens. The biggest beneficiaries are those aged 80 years or more.

Income Tax Calculations

The most pleasant news for the higher-aged tax-payers being FM’s reducing the qualifying age, from 65 years to 60 years, to be termed as Senior citizens under the Income Tax Act. Moreover, Pranab Mukherjee has also raised the exemption limit from Rs. 2,40,000 to Rs. 2,50,000 for this age-group people.

The buck doesn’t stop here! He also introduces a special category of ‘Very Senior Citizens’ – for 80 years and above – who will be eligible for a bountiful higher tax exemption of Rs.5 lakh. Its party time for them… and they do deserve it!

What’s your say on the FM’s Union Budget 2011 tax proposals?

[…] fervent calls to chartered accountants and tax planners are bound to me made. If you want to avoid calling your accountant for knowing a few quick answers, put your Android smartphone to good use and download some of these […]

this should be more clarify.

This income tax information is out of date……………..

Have you any idea about that from 2011-12 onwards, the premium pays under ulip plans, will be the part of tax saving of 1,00,000 or not?

give me budget2011

Hello according to me For the fiscal 2011-12, the FM has tweaked only the threshold income tax limit at the lowest levels of the slab which affects the commonest of the aam-aadmi. The new proposal has enhanced the exemption limit for the general category of individual tax-payers from Rs.1,60,000 to Rs.1,80,000; which will be uniform for both men and women. This will provide a uniform tax relief of Rs.2000 to every tax payer of this category

Mortgage Calculator How Much Can I borrow

My Tax for the year is 9300/- Still How much I should Invest for Tax Saving. I pay LIC premium of Rs 3175/- & PPF Rs 2000/-

@ Viral,

OK WE all know about tax slabs, tax rates now.

What about 80C tax deductibles. We all know and you have recently posted an article about the planning required to invest in 80C instruments.

I dont read much into 80C in this budget?? Some where I read that it is not tinkered with. Is it true?

I dont understand this new catagory of Super Sr. Citizens.

Average life of an Indian is some where around 60. From logic, I dont see more than 1 in a thousand living beyond 80 yrs age. Also out of those lucky ones, I dont think 1 in a thousand have earnings of more than 5 lakh.

As the author says the budget is a populist one, I strongly feel that Pranab is trying to please Mr. Karunanidhi. He is the only person I can remember of more than 80 yrs age and more than 5 lakh income. I also can think of Mr. Vajpayee as a person of more than 80 years age but that poor guy may not have income of more than 5 lakhs.

Altaf,

Haha! I quite agree that it might not sound much of a populist move, afterall. My grand-father is just about to turn 80, I hope he might be glad with this news.

But, I really doubt whether he must be even hearing the Budget at this age. This is the age when old people are least interested about their income and taxes.

You can say that the FM has simply manipulated with figures by giving large bounties in least expected areas, and taking away with the other hand from mid-income group where it matters the most.