Finance Friday: Midcap MF+ SIP = A Great Investment

Is there a safe way to invest in Market? – There is none – Some are safer and some are riskier, depends on your appetite for Risk.

This Finance Friday post is directed at people who are just getting into Stock markets and want to start with a relatively safer option.

A SIP (Systematic Investment Plan) is considered one of the safest Investment vehicles available in the markets today. The basics of an SIP are basically an extension to the MF (Mutual Funds) where regular purchase of units is done every month for a pre-decided amount.

In Simple terms, it helps you average out your buying price which fluctuates based on the market volatility. But, is any SIP good enough to be termed ‘The’ Investment .

It sure ain’t. There are umpteen factors which decide the profitability of an SIP similar to what holds for any equity based investment. With a plethora of choices available in mutual fund SIP’s one can be spoilt for choices and making the right choice can be often difficult.

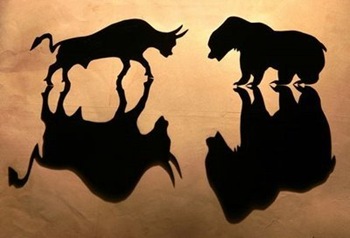

The answer in my humble opinion, as is clear from the title is a Mid-Cap focussed fund. Now, the rationale here is pretty straight forward. Mid Cap funds are among the most volatile lot. They are the wild bulls at times and turn bears just as wildly. Basically, mid cap funds come with a potential risk in lieu of equally high profits.

So, how could you cut down on the risks when dealing with a mid-cap mutual fund. An SIP in a good mid cap fund is what will make the investment much more fruitful.

What better way to prove it than some real stats. Luckily, I happened to chance upon an article on BT with stats on some mid-cap mutual funds. The stats below will help understand the investment rationale behind the ‘Mid Cap Fund+SIP’ combination

|

(Source: Business Today)

All the mutual funds are midcap funds from one of the better AMC’ s in India. Did you notice anything common between the returns spanning various tenures.

- All have stupendous 3 and 6 monthly returns

- All have poor or marginal 1 year returns.

But, then why should this data suggest going for an SIP. First, the 3 month and 6 month returns are courtesy of the recent bull market we witnessed. Moreover, Mutual Funds in my opinion are comparatively long term plays(2-3 years).

Moreover, most of the Mutual Funds have a exit load if sold before 1 year. So, people generally buy and hold mutual funds for at least more than a year.

Now, given that the performance of mutual funds fluctuates like the data suggests, would you prefer doing a bulk purchase in a mutual fund. My answer is NO. Simply, because if i invest in a midcap MF at the peak of bull run, there is every chance that my investment can go for a toss should the bears run rampant.

But, with an SIP i am accounting for the volatility since my investment is going to be in a phased manner and the purchases are going to be made irrespective of a bull or bear market.

- Bull market – I get less funds but the NAV goes higher.

- Bear Market- Even though the NAV is falling, the number of units I get is more.

So, with a SIP investment one can ensure that the volatility of a mid cap fund is factored in and my investment is protected.

What are your thoughts on this? Do you think the combination makes for a healthy investment or there is a better option available. I would love to know and learn of other profitable options available.

[This Finance Friday post has been written by Ankit Agarwal, an ERP Consultant by profession, a wannabe entrepreneur and stock market stalker by passion]

I want to know top five SIP