India Venture Capital & Private Equity Report

If you are a Early Stage Startup, your chances are of getting VC or Private Equity funding is very slim and numbers prove it – Only 9% of all the VC / PE deals have been for early stage companies between 2004 to 2008. This is especially true during the times of recession. Venture Capitalists play it safe and hardly venture in funding a early stage startups.

These are the findings of “India Venture Capital & Private Equity Report 2009”, created by Thillai Rajan & Ashish Deshmukh of IIT, Madras. The report analysis in detail the venture capital and Private Equity funding in India between 2004 to 2008.

India had seen tremendous growth in overall Private Equity funding (2008 was exception due to downturn) – In 2004, the total value of PE deals was $1.8 billion which grew tremendously to $22 billion in 2007 and then falling down to $8.1 billion in 2008.

Contents

Here are some of the highlights of the report:

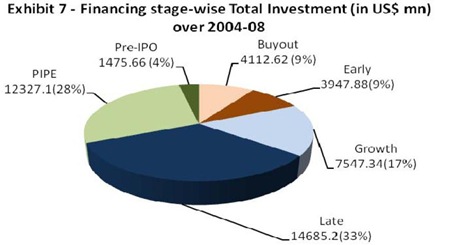

Stage wise Private Equity Investment between 2004 to 2008

Out of the total PE VC Investments, around 50% went to Growth and Late stage companies.

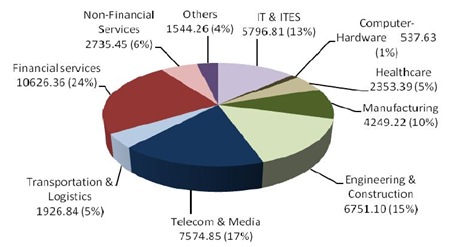

Industry-wise Private Equity Investment breakup by amount

Financial Services Sector (24%) got the biggest share of Investment, followed by Telecom & Media (17%), Engineering & Construction (15%) and IT & ITES (13%).

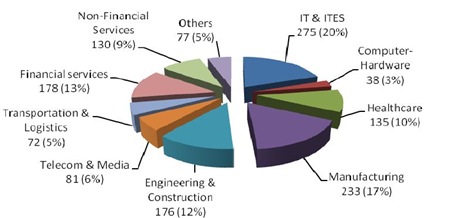

Industry-wise Private Equity Investment breakup by Deal numbers

While the Financial Services sector lead in the total PE Investment amount, IT & ITES sector (20%) generated maximum number of deals followed by Manufacturing (17%) and Financial Services (13%).

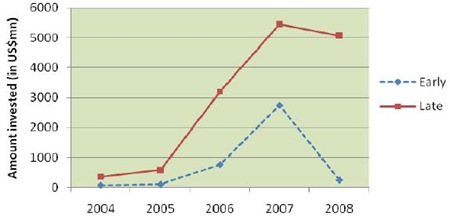

Early Stage Vs Late Stage Private Equity Investments

Like mentioned earlier, the Early stage Investment saw biggest drop (90%) in 2008 due to downturn, while the Late stage investment was relatively unaffected.

If you need the complete report giving in-depth analysis of all the Private Equity deals executed between 2004 to 2008, please drop in a comment.

Report via: @vijayanands

“IIT Guwahati – Techniche. the annual techno-management fest:

The deadlines for Events of Management Module in Techniche’11 have been extended. The new deadlines are.

1. Product Launch – 5th Aug.

2. BrainChild (B-Plan Event with Rs. 50 Lakh incubation) – 5th Aug.

3. Stratagem -10th Aug.

4. Blue Chips – 20th Aug, and can be registered on the spot.

5. VSM – The online stock market Simulation, can be played right now.

For more information, visit the website.

http://www.techniche.org/techn iche11/competitions/management.html

Or the Module Managers :

Shruti Soni

07896173026

[email protected]

****************************** ***

Total Prize money for the 5 events : Rs. 5 Lakhs

Incubation Amount for B-Plan : Rs. 50 Lakhs

****************************** ***

Also do not forget to check out the mind blowing Lecture Series at Techniche.”

http://www.techniche.org/t

http://www.techniche.org

“IIT Guwahati – Techniche. the annual techno-management fest:

The deadlines for Events of Management Module in Techniche’11 have been extended. The new deadlines are.

1. Product Launch – 5th Aug.

2. BrainChild (B-Plan Event with Rs. 50 Lakh incubation) – 5th Aug.

3. Stratagem -10th Aug.

4. Blue Chips – 20th Aug, and can be registered on the spot.

5. VSM – The online stock market Simulation, can be played right now.

For more information, visit the website.

http://www.techniche.org/techn iche11/competitions/management.html

Or the Module Managers :

Shruti Soni

07896173026

[email protected]

****************************** ***

Total Prize money for the 5 events : Rs. 5 Lakhs

Incubation Amount for B-Plan : Rs. 50 Lakhs

****************************** ***

Also do not forget to check out the mind blowing Lecture Series at Techniche.”

http://www.techniche.org/t

http://www.techniche.org

The report sounds interesting read. May I request you for a copy of the same via email? many thanks and best wishes Ranjana

Hey,

I really like ur work on private equity and venture capital and i would like to refer ur complete report. Can u plz mail me a copy of this on [email protected]

Please send me a copy

great information thanks for sharing this…

"IIT Guwahati – Techniche. the annual techno-management fest:

The deadlines for Events of Management Module in Techniche'11 have been extended. The new deadlines are.

1. Product Launch – 5th Aug.

2. BrainChild (B-Plan Event with Rs. 50 Lakh incubation) – 5th Aug.

3. Stratagem -10th Aug.

4. Blue Chips – 20th Aug, and can be registered on the spot.

5. VSM – The online stock market Simulation, can be played right now.

For more information, visit the website.

http://www.techniche.org/techn iche11/competitions/management.html

Or the Module Managers :

Shruti Soni

07896173026

[email protected]

****************************** ***

Total Prize money for the 5 events : Rs. 5 Lakhs

Incubation Amount for B-Plan : Rs. 50 Lakhs

****************************** ***

Also do not forget to check out the mind blowing Lecture Series at Techniche."

http://www.techniche.org/t

http://www.techniche.org

"IIT Guwahati – Techniche. the annual techno-management fest:

The deadlines for Events of Management Module in Techniche'11 have been extended. The new deadlines are.

1. Product Launch – 5th Aug.

2. BrainChild (B-Plan Event with Rs. 50 Lakh incubation) – 5th Aug.

3. Stratagem -10th Aug.

4. Blue Chips – 20th Aug, and can be registered on the spot.

5. VSM – The online stock market Simulation, can be played right now.

For more information, visit the website.

http://www.techniche.org/techn iche11/competitions/management.html

Or the Module Managers :

Shruti Soni

07896173026

[email protected]

****************************** ***

Total Prize money for the 5 events : Rs. 5 Lakhs

Incubation Amount for B-Plan : Rs. 50 Lakhs

****************************** ***

Also do not forget to check out the mind blowing Lecture Series at Techniche."

http://www.techniche.org/t

http://www.techniche.org

Looks like a great report. I would like to get the full report at the id mentioned here. Thank you!

This web is great make money shortening your links!! http://adf.ly/X8Wd

i’m in mba last sem sir …i would be very thankful to you if you can mail it on m id ……my topic is performanace analysis of equity captial exit via ipo

could you pls mail report at [email protected]

could you pls mail report at [email protected]

thnks in advance.

from the graph can seen that early adopter is less. Follower a lot.

this seem like followers success more than early adopter because follower can learn mistake from the early adopter and improve it. That why higher chance to stay longer in market.

Interesting report. Can I ve a copy of it?

kindly mail it at [email protected]

Thanks

Great report. Would like to read the entire report.

Thanks in advance

Tanu

Great report ! Would like to have a copy of the report.

Wonderful report. Can I get a full copy of it? Thank you.

hi..

going through the graphs and analysis you have completed in your report

“India Venture Capital & Private Equity Report 2009.Great work..

I am in the pipeline of completing my thesis work on ‘private equity and health care sector’.It would be of great help if you can provide depth analysis off the Private Equity deals executed between 2004 to 2008 in India and majorly realted to Health care sector….

Thanks.

would love to know more. Thanks !!

Hi,

I am an MBA student currently researching the PE industry in India. It would be great if you could mail me the report at the given email id.

Thanks in advance.

Karn

Can you please send me a copy of the report, thanks

Ashwin

It seems to be a really interesting report. Would definitely like to resd the complete report

Dear All

Kindly send me the copy of report at my Email ID : [email protected]

Best regards

Ashish

I am looking at enetering the VC investment space in India post MBA and hence would like to learn more about the market. It would really help to read the report in detail.

Regards.

sir,

i request you a copy of VC report as i am dealing with the project titled “Growth of venture capital and its impacts on global recession”…hence a copy of this report would help me a lot…..

wud appreciate a feed back,

thank you

jijith

I studying and learning about VC Investments in India. Can you please mail me the report at [email protected]

would be nice to get a copy of the report at [email protected]

dear sir i m doing research on vc plz mail me the complete report of it . i m highly oblige to u

thanks

[email protected]

I am a graduate student in Cambridge, MA and I am working with my team on venture capital in India. Can you please email me the report at [email protected], it would be very helpful to review the work on VC from IIT.

Best Regards

Hi,

Congrats on a great effort! I have been tracking the PE scene in Power sector closely but would love to understand the overall scenario in India. Request a copy of this fantastic report. Thanks.

My email id is [email protected].

Hi,

Congrats on a great effort! I have been tracking the PE scene in Power sector closely but would love to understand the overall scenario in India. Request a copy of this fantastic report. Thanks.

Hi,

Trak.in is really good and very helpful.I would like to have a copy of the complete report as I am doing a study of penetration of VC fundin in India.

Regards.

I would like to understand the investment and trrends in Indian Energy sector

I would like to have a copy of the report to understand the investment in the Indian energy sector

We are interested in this activity ,will be mor than happy to receive a copy of the report’Thanks- Dhiren

Would like a copy of the report.

Hi,

Kindly send a soft copy of the report to [email protected]

Best regards

Can you please send me the soft copy of the report. It will be highly appreciated.

Hi,

I’d appreciate it if you could email an electronic copy of the report to the email address listed in my profile.

Thanks,

MT

Can you please send me the report. Appreciate your cooperation.

I am a PG student with a little work experience in US PE research. Can you please mail me the report as i would love to know more about the scenerio in India. [email protected]

Quite interested in the role of private equity in India. Would very much like to have a copy of your report which is the source for the above information.

Thanks

please note my email id is: [email protected]

I would love to have a copy of the report… Thanks

This blog does not specify your mail ID so better mail us [email protected] so that we can send you the report.

Iam studying the early stage vc investmnets in India. It will be very useful if you could mail a copy of the report to me.

Regards,

Vijaya

If any of you still not received the report please mail us at [email protected]

Would be glad if you could please mail a copy to [email protected].

Thank you,

Arun

Please mail me copy of India Venture Capital & Private Equity Report 2009. This seems very interesting..

Yesterday I requested a copy of this report and since then browsing my emails

eagerly for the same. If you are unable to send individual copies, could you please

let us know the link we can download this report from?

Appreciate a reply.

Thank you,

Satendra

It would be very interesting to read this report. Could you please email it to me?

trak.in is an excellent attempt to help indian entrepreuners. Appreciate it.

Could you please send a copy of this report to [email protected]

Thanks,

Satendra

I am interested in finding out the Seed Stage and late stage VC funding in India. It would be great if I could get a copy of the report. would appreciate if you can e-mail the electronic version to [email protected]

thanks

Srini

Hi,

This is a really useful report as I am currently studying the penetration of VC fundin in India. It would be great if I could get a copy of the complete report.

Regards,

Pooja

A copy of the report would be nice to read.