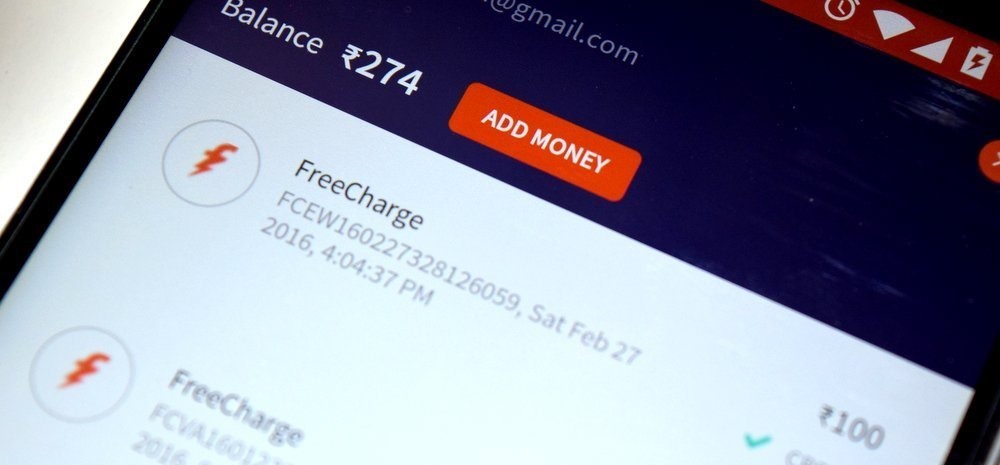

FreeCharge Wallet Now Lets You Pay Your Traffic Challans In Mumbai

While there are many sides to demonetisation, for the good or the worse of the Indian economy in the short-term, digital wallets providers have emerged out as the winners.

At a time when the common man is struggling to get cash from banks or ATMs, FreeCharge, the leading mobile wallet provider has tied up with Mumbai Traffic Police for collecting challans digitally.

How e-Challans Work?

When a person is caught violating traffic rules, an e-challan is generated against the vehicle number which is then forwarded to the owner’s phone number.

The owner can then logon to the Mumbai Police website, enter his/her vehicle registration number or challan number and pay the fine by selecting FreeCharge wallet from the payment options.

Digital Challans Will Increase The Collection of Traffic Police

Issuing challans digitally will not only help keep a check on repeat traffic offenders, but will also increase the collections of traffic police while making the roads safer to travel.

Mumbai Traffic Police expects an increase of 8 lakh challans over the existing 22 lakh traffic challans/annum.

On an average, Delhi pays Rs. 140 Cr worth of traffic challans whereas Mumbai shells out Rs. 100 Cr to traffic violations. Bangalore collects Rs. 70 Cr from traffic violations and Ahmedabad pays Rs. 17 crore as traffic fines. All of these figure are about to get a big boost as FreeCharge is already in talks with traffic police of other cities to enable e-payment of traffic challans.

About 500 e-challan devices have been setup at various check posts across Mumbai. Beware! Traffic offenders.

“We are pleased to partner with Mumbai Traffic Police in their pursuit of making the process of collecting fines cashless. Digital payments make the process faster and more efficient. Such partnerships are in line with our objective to make FreeCharge an everyday, everywhere option for our users,” said Govind Rajan, CEO, FreeCharge.

The government is encouraging mobile wallets companies to integrate their services deeply into the everyday life of a common man. Recently, Ola Money partnered with 25 utility providers (including gas and electricity) across the country.

Ola has also partnered with SBI and PNB banks to ease the cash crunch and now allows users to withdraw cash (up to Rs. 2000/card) by swiping their debit cards at select Ola Cabs.

The recent Paytm-NHAI partnership enables electronic toll collections for vehicles fitted with RFID-based e-toll tags. This will make travel even more swift and trouble free as you won’t have to stop to pay toll tax.

The mobile wallet companies are changing the facing of Indian economy and will act as strong pillars for helping the country transform into a cashless economy.