HDFC Existing Home Loan Customers Will Pay Increased EMIs Because Of This Reason

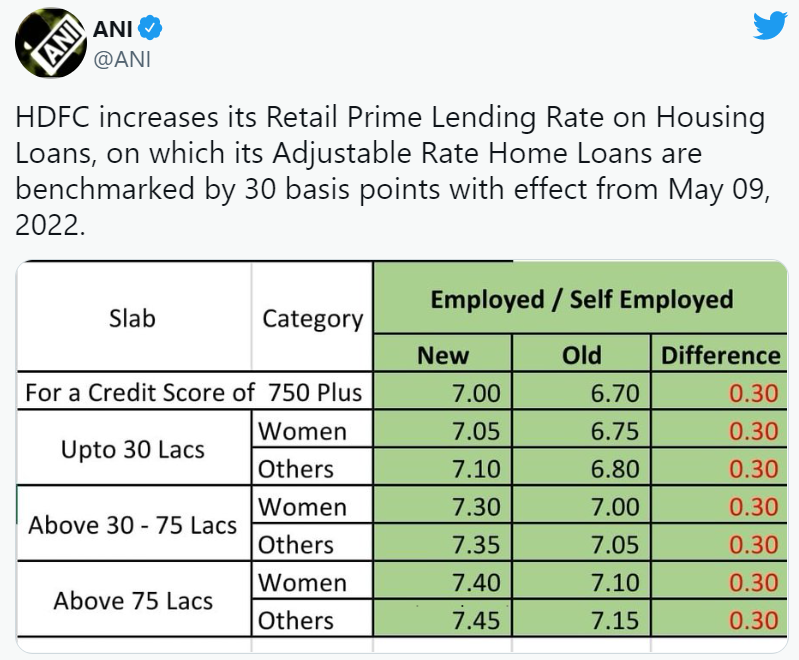

On Saturday, HDFC announced a raising its Retail Prime Lending Rate (RPLR) by 30 basis points. This comes just after three days of Reserve Bank India (RBI) announced a 40 basis point hike in its repo rate. The move by HDFC led to an identical hike in home loan rates for exiting customers. The hike comes into effect from May 9.

An Upward Revision

There will be an upward revision in its rates by 30 basis points for all the existing customers. Because of this change, rates for new customers will also go up.

After the lender had increased its benchmark lending rate by 5 basis points, this has resulted in an increase in the equated monthly instalments for existing borrowers.

With RBI now hinting at withdrawing the accommodative monetary policy to rein in inflation, interest rates are all set to go up.

What is MCLR? How Much It Raised?

MCLR was instituted by RBI with effect from April 1, 2016.

MCLR is the lowest interest rate that a bank or lender can offer. It is applicable to fresh corporate loans and floating rate loans taken before October 2019.

In the coming days, the public sector and private banks are set to raise MCLRs.

Last month itself, SBI had raised the MCLR by 10 basis points (bps) across tenures to 7.1 per cent (from 7 per cent earlier).

The same is 7.25 per cent for HDFC Bank, Punjab National Bank (PNB), and ICICI Bank.

Across tenures Bank of Baroda, Axis Bank, and Kotak Mahindra Bank raised their MCLRs by 5 bps each.

Comments are closed, but trackbacks and pingbacks are open.