UPI Breaks All Record: Annual Transactions Cross $1 Trillion Mark With 102% Growth In 1 Year!

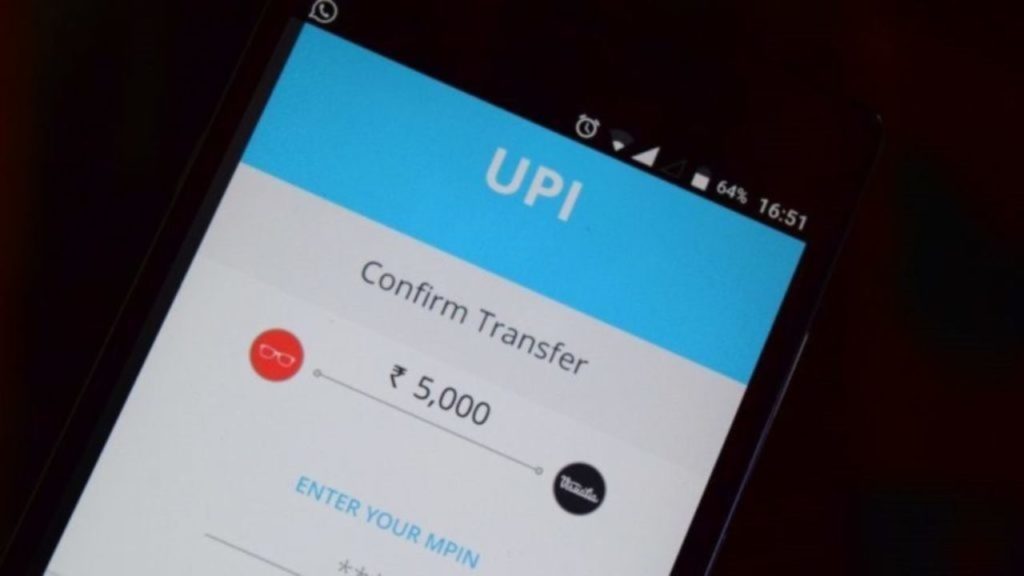

Unified Payments Interface (UPI) has achieved a major milestone, having crossed the $1-trillion mark in transaction values for the financial year 2021-22.

Contents

The Figures

This is a huge leap from the Rs 41 lakh crore reported in the previous year.

As on March 29, the value of UPI transactions added up to Rs 83.45 trillion or roughly $1 trillion.

The number of transactions stood at 45.6 million.

Further Growth Expected

Usage of the payments system has grown exponentially over the last few years and will continue to grow once payments for feature phone users gets enabled.

The NPCI is getting ready to do a pilot launch of wallet-based UPI payments named UPI Lite.

Offline Payments

This on-device wallet service will be in line with the RBI’s framework for offline digital payments.

It will enable transactions of up to Rs 200 at a time and users can only load up these on-device, offline wallets with up to Rs 2,000.

NPCI data noted that over half of all transactions on UPI were less than Rs 200.

Aadhaar OTP-Based Onboarding

UPI Lite is among a series of initiatives towards making UPI accessible to a larger set of users.

Apart from the launch of the service for feature phone users, an Aadhaar OTP-based UPI on-boarding without requiring a debit card is also in the works.

Banks and other payment system players are expected to prepare their systems for launch by June 30.

Other Countries Also Adopt UPI

The NPCI is also working with several countries to help them implement UPI in their countries, notably Bhutan and Nepal.

Its ultimate goal is to achieve a run rate of a billion transactions a day in three to five years.

One of the initiatives it is taking to get to that is UPI’s AutoPay feature which experts say will be crucial to increasing daily transactions on the platform.

Shortcomings

However, the system is not flawless.

Despite a significant rise in monthly transactions, UPI has been beset by glitches and instances of failed transactions.

NPCI data showed that in February alone, State Bank of India, the biggest in terms of UPI volumes, saw 31.68 million failed transactions due to technical reasons like unavailability of systems and network issues.

Of the total 4.83 billion transactions processed on UPI in February, 69.96 million were declined due to issues at the banks’ or NPCI’s end.

This January, UPI saw an unscheduled downtime of 187 minutes, its highest ever.

[…] It Works? Retail Investors Can Now Buy Rs 5 Lakh Shares Via UPI Payment! How Will It Work? UPI Breaks All Record: Annual Transactions Cross $1 Trillion Mark With 102% Growth In… After Bhutan, This Country Adopts UPI Payment For All Citizens! Big Win For UPI? Comments are […]