This Bank Offers International UPI Payments: India’s 1st Ever Bank To Do So! (How It Works?)

Indian diaspora is spread all across the globe. From those foreign lands, people often send money back home for their financial commitments. Even though India is going digital at a higher rate than ever and the rate of digital payments is increasing (courtesy, UPI), transferring money from other countries to India is still not an easy task.

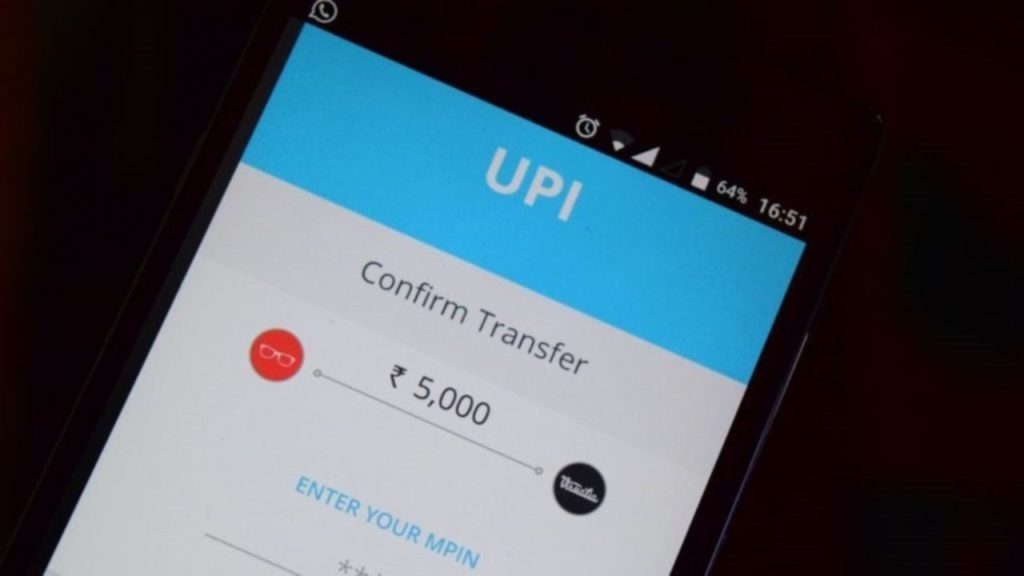

Till now, you had to follow the age-old cumbersome process of adding all bank account details. But soon this scenario will change. At least up to some extent and you will be able to transfer money across borders as easily as you transfer within the country using UPI.

IndusInd Bank partners with NPCI for easy cross-border remittances to India

Recently, IndusInd Bank announced that it has partnered with the National Payments Corporation of India (NPCI) for offering real-time cross-border remittances to India using UPI IDs, for its Money Transfer Operator (MTO) partners.

“With this initiative, IndusInd Bank has become the first Indian bank to go live on UPI for Cross Border Payments/NRI Remittances. Under this arrangement, the MTOs will be using the IndusInd Bank channel to connect with NPCI’s UPI payment systems for validation and cross-border payment settlement into beneficiary accounts,” the bank said in a statement.

At first, IndusInd Bank has started off with Thailand for Foreign Inward Remittance (FIR) through UPI. For this, IndusInd bank has also partnered with DeeMoney, a Thailand-based financial solutions provider offering money transfers and foreign currency exchange services. Customers using the DeeMoney website can easily transfer funds just by adding the beneficiary’s UPI ID.

At the same time, IndusInd Bank is also planning to add more partners in various other countries for cross border-payments via UPI in the near future.

Leadership at the bank and NPCI is confident about this step

“It’s a significant step towards simplifying remittances as functionality, as individuals residing overseas will now be able to conveniently transfer money to a beneficiary by simply adding their UPI ids, without having to remember their bank account details. We believe, enabling foreign remittance through UPI is a major milestone towards strengthening its usage as a platform, and will go a long way in enhancing its adoption by NRIs across geographies,” said, Mr. Soumitra Sen, Head – Consumer Banking & Marketing, IndusIndBank while speaking about the partnership.

Ms. Praveena Rai, COO, NPCI was also happy about this new partnership. He said, “We believe this initiative will offer a much simpler and more efficient remittance experience for international travelers using UPI. We are confident that our association would act as one of the major contributing factors towards the evolution of cross-border payments through UPI. With UPI venturing into cross-border remittances, we are looking forward to witnessing significant growth in UPI’s transaction volumes in the years to come.”

Comments are closed, but trackbacks and pingbacks are open.