UPI, RuPay Transactions Still Being Charged By Payment Gateways; Govt Asks Tough Questions

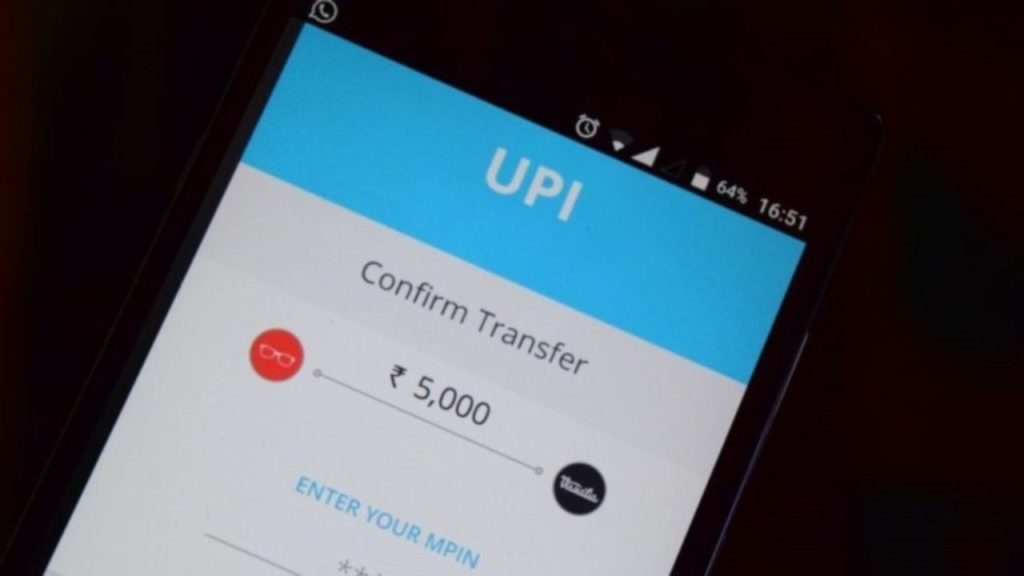

A recent report from Economic Times reveals that payment gateway service providers are defying a government notification by charging merchants a fee for enabling and using the Unified Payments Interface (UPI) and RuPay cards.

Payment Gateways Charging Merchants Fee

Despite the government’s notification, most of the payment gateway service providers are continuing to charge merchants a fee for enabling and using the Unified Payments Interface.

In the same regard, the Central Board of Direct Taxes (CBDT) has queried the service providers on their stance with respect to charges for UPI and RuPay card transactions.

During August 2020, the CBDT has also ordered the banks to refund any fees they have collected for payments using RuPay or UPI.

Further, the government had designated UPI and RuPay as prescribed modes of payments against which charges cannot be imposed by banks and service providers, in the December 2019 notification.

In response, bankers have mostly opposed this prohibition on charges due to the lack of compensation for those who provide the payment infrastructure.

RBI Announced Funds For Development

In hopes of the development of payments of infrastructure, last week, the Reserve Bank of India (RBI) had also announced the formation of a fund for the development of payments infrastructure.

According to the RBI, this fund will be utilized to compensate those who rope in retail shopkeepers and other essential services in the north-eastern states and other small towns.

What About Payment Gateway Service Providers

So far, Payment gateway service providers believe that they can offer free services to small merchants.

They strongly believe that a big cost goes into processing payments made to large online merchants.

According to them, zero fees can slow down merchant acquisition but PayTM capitalized on this situation by incentivizing merchants to onboard them on its network.

So far, the e-commerce company does not charge merchants for facilitating UPI and RuPay debit card payments online.

Currently, banks are actively advocating for the removal of the ban on these charges as the Union Budget is set to be rolled out on 1 February.

Comments are closed, but trackbacks and pingbacks are open.