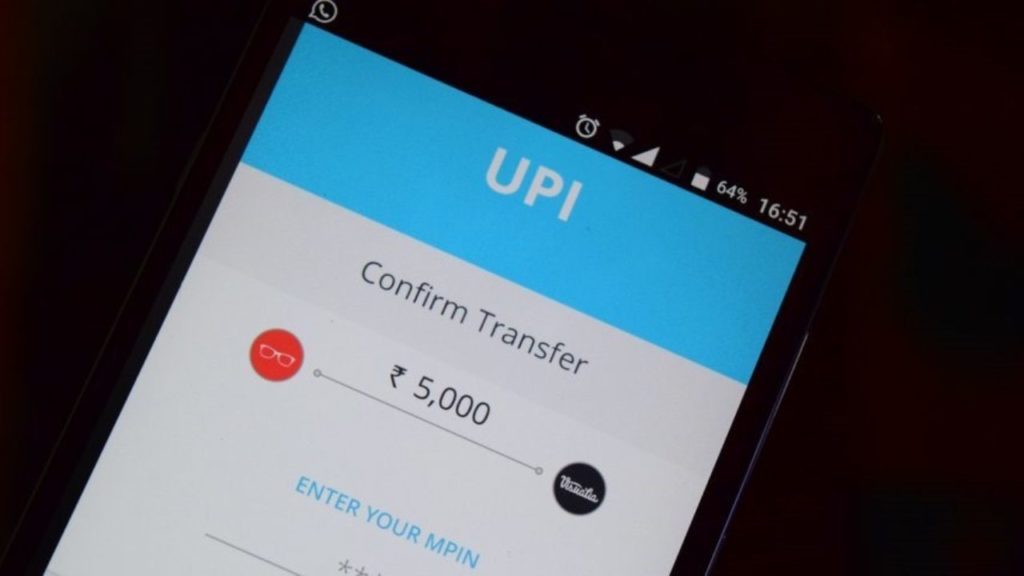

30% Cap On UPI Apps: Google Pay, PhonePe Transactions Won’t Fail, Here’s The Reason Why

Ever since NPCI announced a 30% cap on all digital payment apps for UPI, there is a bit of concern, regarding the UPI transactions being done by users at merchant outlets.

Will the transactions fail?

As per the notifications issued, it’s safe to say that the UPI transactions won’t fail as of now, even if the 30% cap has been received by the app.

Here is the reason why..

30% Cap On UPI Apps: Transactions Won’t Fail

As per the notifications on 30% cap issued by NPCI, it’s clear that the transactions done on existing UPI apps such as PhonePe, Google Pay, Paytm and others wont fail.

The reason is that, this rule has to imposed starting 2023, which is 2 years from now.

NPCI has provided time till 2023 for all UPI payment apps, to redesign and reform their systems, in order to comply with this new rule.

Hence, UPI transactions will go on as usual till that time.

Confirming this, Sameer Nigam, Founder and CEO, PhonePe said, “We have reviewed the recent NPCI circular and want to assure all our customers and merchants that there is absolutely no risk of any UPI transactions on PhonePe failing. In fact, NPCI’s circular categorically says that the 30% market share cap does not apply to existing TPAPs like PhonePe until Jan 2023,”

TPAs are Third Party App Providers, and this include all existing UPI payment apps such as Paytm, PhonePe, Google Pay and others.

With this explanation, it’s clear that PhonePe, Google Pay,Paytm, MobiKwik, BHIM App users won’t face any inconvenience till 2023.

30% Cap On UPI Apps: How Will It Work?

As per the NPCI and Govt rules, no UPI payment app can have more than 30% market share of the overall UPI transactions in the country.

This means that be it Google Pay, PhonePe, Whatsapp Pay or Paytm, they can only process within 30% of the overall UPI transactions.

NPCI has stated that the 30% number will be taken out based on last 3 months average, on a rolling basis.

We are still awaiting details, as to how will UPI apps implement this rule.

We will keep you updated, as more details come in.

Comments are closed, but trackbacks and pingbacks are open.