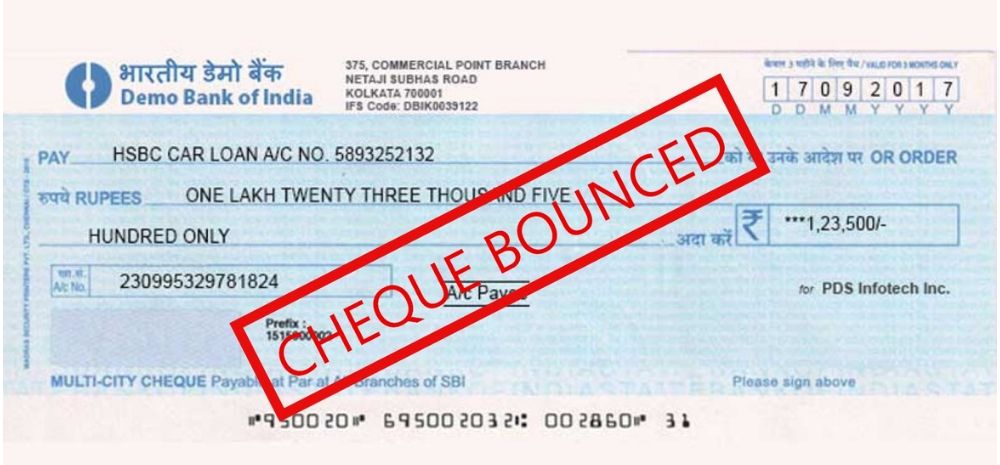

Bounced Cheque Will No Longer Invite Jail Term: Govt Wants To Decriminalise Bounced Cheques

As per the reports, the Union government has initiated the process for decriminalising economic offences that are currently punishable with a jail term, fine or both.

Why Would This Happen?

Basically, the government has sought opinions from stakeholders like state governments and the public on proposals to amend 19 acts that criminalise economic offences like a bounced cheque.

Centres this move is aimed at speeding up the economic revival process and encouraging businesses.

As there is a growing concern in the government that due to the Covid-19 pandemic and economic distress there might be a surge in financial failures, which under current rules can get treated as frauds.

Further, these proposals include amending the Negotiable Instrument Act which covers the dishonouring of a cheque or in simple terms cheque bouncing.

Additionally, the state of reason released the Finance Ministry on Monday also discusses required changes in various sections of Banning of Unregulated Deposit Schemes Act, RBI Act, NABARD Act, SARFAESI Act, Insurance Act, PFRDA Act and Payments and Settlements Systems Act.

How Does It Work?

Moreover, to get the opinion of all stakeholders, the Finance Ministry’s department of financial services has asked the state governments and UT administrations, civil society/non-government organisations, academicians, public and private sector organisations, multilateral institutions and members of the public to send their views and comments latest by June 23.

After getting the opinion, the central government will study them and finalise the rules.

According to the current law, anyone accused of issuing a cheque that’s dishonoured or runs an unregulated deposit scheme that goes insolvent has to face imprisonment or fine or both.

While, the government proposes to decriminalise such offences.

In place of that, the government proposes to bring in a method of compounding in which an accused person would have to pay a penalty and matter will end there.

Further, the suggestion supports, the element of criminality needs to be decided by a court while a compounding penalty can be determined by an adjudicating office with quasi-judicial powers.

Decriminalisation Of Minor Offences

“Decriminalisation of minor offences is one of the thrust areas of the government. The risk of imprisonment for actions or omissions that aren’t necessarily fraudulent or the outcome of malafide intent is a big hurdle in attracting investments. The ensuing uncertainty in legal processes and the time taken for resolution in the courts hurts the ease of doing business,” said the Ministry of Finance, in the statement of reason.

“Criminal penalties, including imprisonment for minor offences act as a deterrent. This is perceived as one of the major reasons impacting business sentiment and hindering investments both from domestic and foreign investors. This becomes even more pertinent in the post-COVID-19 response strategy to help revive the economic growth and improve the justice system,” said a senior finance ministry official.

According to the government assessment, such offences travel a long legal journey, choking up the various tiers of the judicial system with little financial gains.

Although, the government doesn’t want to make things easier for those with malafide intent.

Hence the ministry proposal, that pushes for a balance under which malafide intent may face punishment and less serious offences would be merely compounded.

Basically, the government plans to create a legal framework that involves sufficient penalties that may act as a deterrent.

Further, the statement of reason says that the key aims of reclassification of criminal offences to compoundable offences are to decrease the burden on businesses, inspire confidence among investors and evaluate nature of non-compliance ie, fraud as compared to negligence or inadvertent omission and the habitual nature of non-compliance before fixing of criminal liability.

Comments are closed, but trackbacks and pingbacks are open.